Invest

High-profile business leader talks through ‘unusually tough’ market conditions

Invest

High-profile business leader talks through ‘unusually tough’ market conditions

Sentiment and access to credit in the post-royal commission environment are proving tough on even the most experienced leaders in finance.

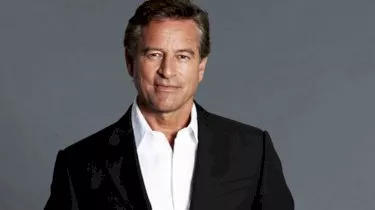

High-profile business leader talks through ‘unusually tough’ market conditions

Sentiment and access to credit in the post-royal commission environment are proving tough on even the most experienced leaders in finance.

Executive chairman for Yellow Brick Road, Mark Bouris, said he had never experienced such tough borrowing conditions in the Australian market.

This is consistent with the experience of Australian investors, who particularly felt the squeeze last year, when the banking regulator had a cap on interest-only lending.

“It has been an unusually tough six months,” Mr Bouris said, after the release of Yellow Brick Road’s results.

“Sentiment surrounding the royal commission, changes in credit approval processes, more intense regulatory oversight and greater compliance requirements and costs have created significant uncertainty.

“It is now particularly hard for mortgage originators and brokers to assist borrowers to obtain an approved home loan. In all the years of being involved in the home loan business, I have never seen such difficult borrowing conditions. These factors have caused an adverse impact to our new lending, particularly in the December quarter,” Mr Bouris said.

Investors looking for new lines of credit, or to refinance, should be aware of the more stringent conditions lenders are imposing. To read more about how to give yourself the best shot at securing a loan this year, click here.

Stock market

6K Additive secures A$48 million through initial public offering on the Australian Stock Exchange

6K Additive, a prominent player in the advanced metal powders and alloy additions market, has made a significant stride by successfully completing its Initial Public Offering (IPO) on the Australian ...Read more

Stock market

Institutional investors increase stock allocations to 18-year high amid cautious market shifts

In a recent development, State Street Markets unveiled the findings of its latest State Street Institutional Investor Indicators, revealing intriguing shifts in institutional investor behaviourRead more

Stock market

FOREX.com launches in Australia to empower self-directed traders

StoneX Group Inc. (NASDAQ: SNEX) has announced the Australian launch of FOREX.com, expanding access for self-directed traders to a global suite of Contracts for Difference (CFD) products across ...Read more

Stock market

Westpac and CMC Markets strengthen partnership to enhance online trading services

In a significant move that underscores the evolving landscape of online trading in Australia, CMC Markets Stockbroking has been chosen as the preferred vendor by Westpac Banking Corporation to extend ...Read more

Stock market

Portfolio reviews as an operating discipline: turning volatility into a competitive edge

In a higher-rate, higher-volatility world, portfolio reviews are no longer an annual hygiene task; they’re a core operating rhythm that protects cash flow, unlocks tax alpha, and sharpens risk ...Read more

Stock market

Fee war on the ASX: Global X’s A300 turns up the heat on core Aussie equity ETFs

Global X has lobbed a 0.04% management fee into Australia’s core equity sandbox, launching the Australia 300 ETF (A300) to take on entrenched giants. Read more

Stock market

Challenger IM shakes up the ASX with private credit note and a side of risk

Challenger Investment Management has taken private credit mainstream with an ASX-listed note structure—LiFTs—that secured roughly $100 million in cornerstone commitments within a day of launch. Read more

Stock market

International stocks: Diversifying your portfolio beyond Australia

In an increasingly globalized market, Australian investors have the opportunity to enhance their investment portfolio by incorporating international stocks. Diversifying your investments globally can ...Read more

Stock market

6K Additive secures A$48 million through initial public offering on the Australian Stock Exchange

6K Additive, a prominent player in the advanced metal powders and alloy additions market, has made a significant stride by successfully completing its Initial Public Offering (IPO) on the Australian ...Read more

Stock market

Institutional investors increase stock allocations to 18-year high amid cautious market shifts

In a recent development, State Street Markets unveiled the findings of its latest State Street Institutional Investor Indicators, revealing intriguing shifts in institutional investor behaviourRead more

Stock market

FOREX.com launches in Australia to empower self-directed traders

StoneX Group Inc. (NASDAQ: SNEX) has announced the Australian launch of FOREX.com, expanding access for self-directed traders to a global suite of Contracts for Difference (CFD) products across ...Read more

Stock market

Westpac and CMC Markets strengthen partnership to enhance online trading services

In a significant move that underscores the evolving landscape of online trading in Australia, CMC Markets Stockbroking has been chosen as the preferred vendor by Westpac Banking Corporation to extend ...Read more

Stock market

Portfolio reviews as an operating discipline: turning volatility into a competitive edge

In a higher-rate, higher-volatility world, portfolio reviews are no longer an annual hygiene task; they’re a core operating rhythm that protects cash flow, unlocks tax alpha, and sharpens risk ...Read more

Stock market

Fee war on the ASX: Global X’s A300 turns up the heat on core Aussie equity ETFs

Global X has lobbed a 0.04% management fee into Australia’s core equity sandbox, launching the Australia 300 ETF (A300) to take on entrenched giants. Read more

Stock market

Challenger IM shakes up the ASX with private credit note and a side of risk

Challenger Investment Management has taken private credit mainstream with an ASX-listed note structure—LiFTs—that secured roughly $100 million in cornerstone commitments within a day of launch. Read more

Stock market

International stocks: Diversifying your portfolio beyond Australia

In an increasingly globalized market, Australian investors have the opportunity to enhance their investment portfolio by incorporating international stocks. Diversifying your investments globally can ...Read more