Retirement

Boss of major super fund makes big calls on future of retirement savings

Retirement

Boss of major super fund makes big calls on future of retirement savings

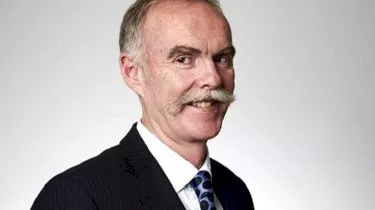

The chief executive of Australian Super has laid out his predictions for Australia’s superannuation system, and he’s tipping some parts of the industry to contract in the coming years.

Boss of major super fund makes big calls on future of retirement savings

The chief executive of Australian Super has laid out his predictions for Australia’s superannuation system, and he’s tipping some parts of the industry to contract in the coming years.

Australian Super boss Ian Silk said factors like the royal commission, volatile markets and ongoing legislative tinkering combine to create a “challenging environment” into the future for superannuation.

In a recent address, he predicted the self-managed super fund sector would take a hit, driven by performance concerns and regulatory tightening.

He added: “There should not be any consistently underperforming funds – this is the most important change that will benefit members. You shouldn’t be able to be in a consistently poor fund – because they simply shouldn’t exist. If those running consistently underperforming funds don’t do the right thing, APRA must.”

Mr Silk also called on the industry to remedy the “unacceptable” situation that women currently retire with less superannuation than men.

“Many other groups don’t get their fair share of benefits from that system. The system is meant to be universal and needs to distributes those benefits more fairly,” he said.

For Mr Silk, any fund or offering that is not wholly member-centric will struggle in the long term.

“That future will be harder to deliver than the past – more competitive and with even greater scrutiny of our performance. We should welcome the extra scrutiny that comes with our current position of industry leadership,” he said.

“Each of us and our funds should make a genuine commitment to take our funds from their current position to elite performance for members,” he said.

“It’s easy to rely on formulaic words and say we’re committed to members’ best interests, and say that we’ll make that commitment,” he said.

“The real test will be whether we act in members’ interests every single time, not some or most of the time, but each and every time we make a decision, including when that might not be in the best interests of our fund, or even ourselves,” he said.

Superannuation

Rest posts healthy returns following a positive end to 2025

Rest, one of Australia's largest profit-to-member superannuation funds, has reported impressive returns in its flagship MySuper Growth investment option for the year 2025. The fund is optimistic about ...Read more

Superannuation

Rest marks milestone with first private equity co-investment exit

In a significant development for Rest, one of Australia’s largest profit-to-member superannuation funds, the organisation has announced the successful completion of its first private equity ...Read more

Superannuation

Expanding super for under-18s could help close the gender super gap, says Rest

In a push to address the gender disparity in superannuation savings, Rest, one of Australia's largest profit-to-member superannuation funds, has called for a significant policy change that would allow ...Read more

Superannuation

Employment Hero pioneers real-time super payments with HeroClear integration

In a significant leap forward for Australia's payroll and superannuation systems, Employment Hero, in collaboration with Zepto and OZEDI, has successfully processed the country's first ...Read more

Superannuation

Rest launches Rest Pay to streamline superannuation payments and boost member outcomes

In a significant move aimed at enhancing compliance with upcoming superannuation regulations, Rest, one of Australia’s largest profit-to-member superannuation funds, has unveiled an innovative ...Read more

Superannuation

Rest appoints experienced governance expert to bolster superannuation fund

Rest, one of Australia's largest profit-to-member superannuation funds, has announced the appointment of Ed Waters as the new Company Secretary. Waters, who brings with him over 15 years of extensive ...Read more

Superannuation

Small businesses brace for cash flow challenges as Payday Super becomes law

With the new Payday Super legislation now enacted, small businesses across Australia are preparing for a significant shift in how they manage superannuation contributions. The law, which mandates a ...Read more

Superannuation

Rest launches Innovate RAP to support fairer super outcomes for First Nations members

In a significant move towards reconciliation and inclusivity, Rest, one of Australia's largest profit-to-member superannuation funds, has unveiled its Innovate Reconciliation Action Plan (RAP)Read more

Superannuation

Rest posts healthy returns following a positive end to 2025

Rest, one of Australia's largest profit-to-member superannuation funds, has reported impressive returns in its flagship MySuper Growth investment option for the year 2025. The fund is optimistic about ...Read more

Superannuation

Rest marks milestone with first private equity co-investment exit

In a significant development for Rest, one of Australia’s largest profit-to-member superannuation funds, the organisation has announced the successful completion of its first private equity ...Read more

Superannuation

Expanding super for under-18s could help close the gender super gap, says Rest

In a push to address the gender disparity in superannuation savings, Rest, one of Australia's largest profit-to-member superannuation funds, has called for a significant policy change that would allow ...Read more

Superannuation

Employment Hero pioneers real-time super payments with HeroClear integration

In a significant leap forward for Australia's payroll and superannuation systems, Employment Hero, in collaboration with Zepto and OZEDI, has successfully processed the country's first ...Read more

Superannuation

Rest launches Rest Pay to streamline superannuation payments and boost member outcomes

In a significant move aimed at enhancing compliance with upcoming superannuation regulations, Rest, one of Australia’s largest profit-to-member superannuation funds, has unveiled an innovative ...Read more

Superannuation

Rest appoints experienced governance expert to bolster superannuation fund

Rest, one of Australia's largest profit-to-member superannuation funds, has announced the appointment of Ed Waters as the new Company Secretary. Waters, who brings with him over 15 years of extensive ...Read more

Superannuation

Small businesses brace for cash flow challenges as Payday Super becomes law

With the new Payday Super legislation now enacted, small businesses across Australia are preparing for a significant shift in how they manage superannuation contributions. The law, which mandates a ...Read more

Superannuation

Rest launches Innovate RAP to support fairer super outcomes for First Nations members

In a significant move towards reconciliation and inclusivity, Rest, one of Australia's largest profit-to-member superannuation funds, has unveiled its Innovate Reconciliation Action Plan (RAP)Read more