Invest

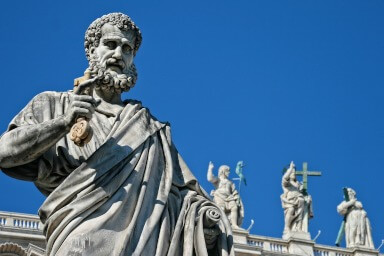

Italy tipped to bring down euro

The embattled euro may not survive much longer, with one economist predicting Italy will be the country to bring the single currency toppling down.

Italy tipped to bring down euro

The embattled euro may not survive much longer, with one economist predicting Italy will be the country to bring the single currency toppling down.

Australian economist Bill Mitchell says Italy will likely be the nation to bring down the euro ahead of a string of elections this year, if populist Five Star Movement (FSM) comes to power.

“It’ll only take one big political shift and I guess everyone’s banking now on Italy because [FSM leader] Beppe Grillo looks like he’s got a much better chance than Marine Le Pen in France,” Mr Mitchell told nestegg.com.au.

“I don’t think the French will leave, I think it’ll be the Italians.”

The prediction comes in the wake of former Italian Prime Minister Matteo Renzi’s decision to step down in December, following an unsuccessful referendum to renegotiate government powers.

Meanwhile, the world’s oldest bank, Monte dei Paschi di siena’s appeal to the Italian government for a bailout just weeks ago at the expense of Italian investors is likely to encourage support for FSM, already riding a wave of populism.

“I think the political resonances around Europe are moving in that direction [and while] I don’t think Marine Le Pen can win the presidency, she’ll rock the boat severely. There’ll be a major shift in the Italian elections, the Spanish electoral system can barely deliver a government and Greece is headed for even more instability in the next month,” Mr Mitchell said.

“In the long run, it’ll become apparent that someone will leave or get kicked out of the union,” he added.

“Economically, it’s dead in the water. It can’t possibly deliver long-term prosperity and the damage that it is causing and the intergenerational costs it’s creating are going to be massive.”

However, it remains to be seen where Europeans will draw the line.

“While I think that the majority of Italians still want the euro, they’re living in a dream world. They want the euro but they also don’t want austerity and they can’t have both under the way the union is constructed,” Mr Mitchell said.

“Their banking system is insolvent. It’s being propped up at the moment, but how long the ECB allows the banking system to remain intact is a good question. I suspect they will keep propping it up for now simply because if the Italian banks collapse, it’ll be chaos.”

Stock market

6K Additive secures A$48 million through initial public offering on the Australian Stock Exchange

6K Additive, a prominent player in the advanced metal powders and alloy additions market, has made a significant stride by successfully completing its Initial Public Offering (IPO) on the Australian ...Read more

Stock market

Institutional investors increase stock allocations to 18-year high amid cautious market shifts

In a recent development, State Street Markets unveiled the findings of its latest State Street Institutional Investor Indicators, revealing intriguing shifts in institutional investor behaviourRead more

Stock market

FOREX.com launches in Australia to empower self-directed traders

StoneX Group Inc. (NASDAQ: SNEX) has announced the Australian launch of FOREX.com, expanding access for self-directed traders to a global suite of Contracts for Difference (CFD) products across ...Read more

Stock market

Westpac and CMC Markets strengthen partnership to enhance online trading services

In a significant move that underscores the evolving landscape of online trading in Australia, CMC Markets Stockbroking has been chosen as the preferred vendor by Westpac Banking Corporation to extend ...Read more

Stock market

Portfolio reviews as an operating discipline: turning volatility into a competitive edge

In a higher-rate, higher-volatility world, portfolio reviews are no longer an annual hygiene task; they’re a core operating rhythm that protects cash flow, unlocks tax alpha, and sharpens risk ...Read more

Stock market

Fee war on the ASX: Global X’s A300 turns up the heat on core Aussie equity ETFs

Global X has lobbed a 0.04% management fee into Australia’s core equity sandbox, launching the Australia 300 ETF (A300) to take on entrenched giants. Read more

Stock market

Challenger IM shakes up the ASX with private credit note and a side of risk

Challenger Investment Management has taken private credit mainstream with an ASX-listed note structure—LiFTs—that secured roughly $100 million in cornerstone commitments within a day of launch. Read more

Stock market

International stocks: Diversifying your portfolio beyond Australia

In an increasingly globalized market, Australian investors have the opportunity to enhance their investment portfolio by incorporating international stocks. Diversifying your investments globally can ...Read more

Stock market

6K Additive secures A$48 million through initial public offering on the Australian Stock Exchange

6K Additive, a prominent player in the advanced metal powders and alloy additions market, has made a significant stride by successfully completing its Initial Public Offering (IPO) on the Australian ...Read more

Stock market

Institutional investors increase stock allocations to 18-year high amid cautious market shifts

In a recent development, State Street Markets unveiled the findings of its latest State Street Institutional Investor Indicators, revealing intriguing shifts in institutional investor behaviourRead more

Stock market

FOREX.com launches in Australia to empower self-directed traders

StoneX Group Inc. (NASDAQ: SNEX) has announced the Australian launch of FOREX.com, expanding access for self-directed traders to a global suite of Contracts for Difference (CFD) products across ...Read more

Stock market

Westpac and CMC Markets strengthen partnership to enhance online trading services

In a significant move that underscores the evolving landscape of online trading in Australia, CMC Markets Stockbroking has been chosen as the preferred vendor by Westpac Banking Corporation to extend ...Read more

Stock market

Portfolio reviews as an operating discipline: turning volatility into a competitive edge

In a higher-rate, higher-volatility world, portfolio reviews are no longer an annual hygiene task; they’re a core operating rhythm that protects cash flow, unlocks tax alpha, and sharpens risk ...Read more

Stock market

Fee war on the ASX: Global X’s A300 turns up the heat on core Aussie equity ETFs

Global X has lobbed a 0.04% management fee into Australia’s core equity sandbox, launching the Australia 300 ETF (A300) to take on entrenched giants. Read more

Stock market

Challenger IM shakes up the ASX with private credit note and a side of risk

Challenger Investment Management has taken private credit mainstream with an ASX-listed note structure—LiFTs—that secured roughly $100 million in cornerstone commitments within a day of launch. Read more

Stock market

International stocks: Diversifying your portfolio beyond Australia

In an increasingly globalized market, Australian investors have the opportunity to enhance their investment portfolio by incorporating international stocks. Diversifying your investments globally can ...Read more