What’s the difference between Australian and foreign tax residents?

The standards used by the Australian Taxation Office to determine tax residency are not the same as those used by the Department of Immigration and Border Protection, therefore, it’s important to understand the difference between Australian citizen and permanent resident.

Someone could be an Australian resident for tax purposes even if they are not an Australian citizen or permanent resident.

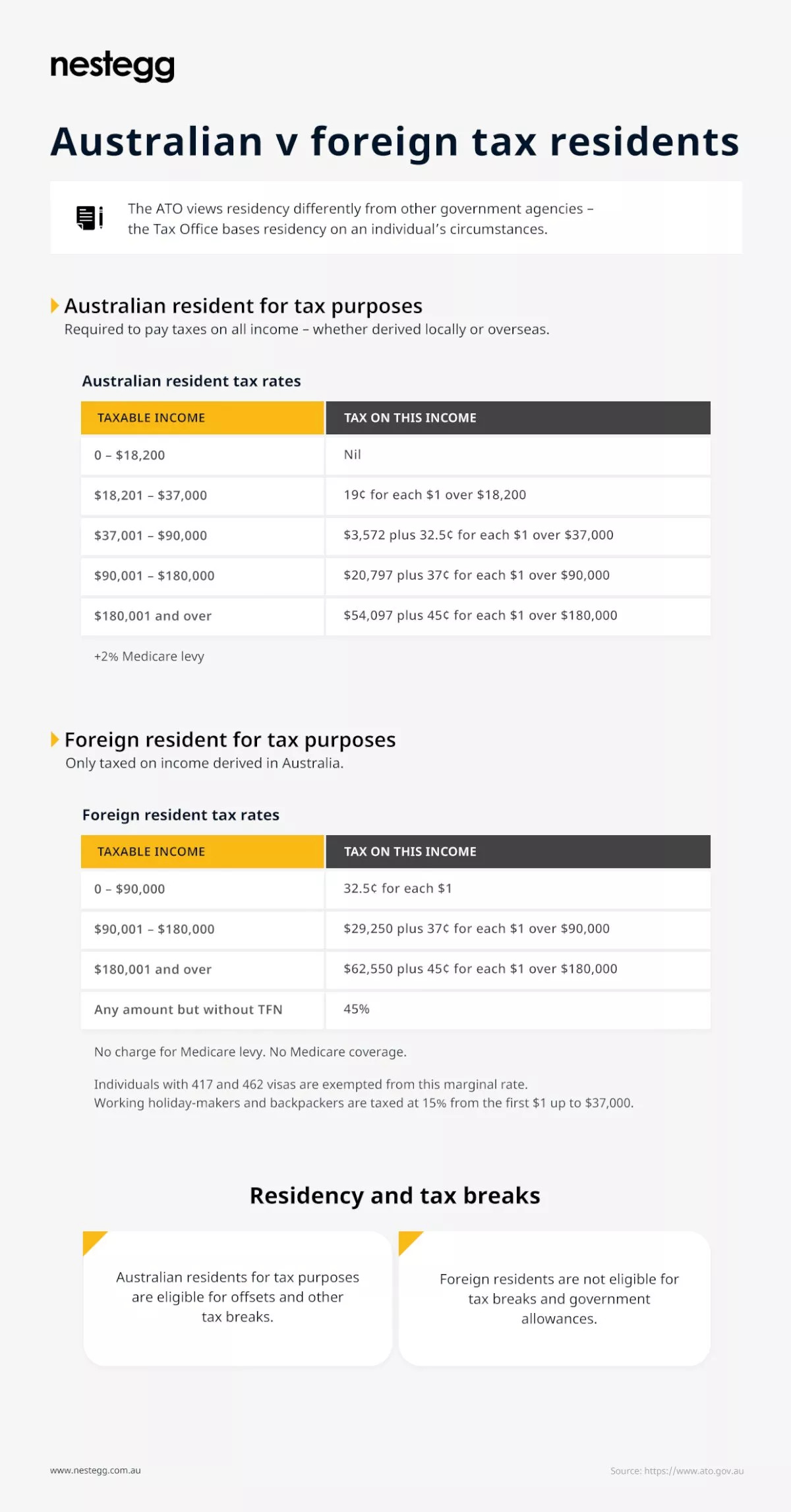

Australian tax residents will be taxed on worldwide income while non-tax residents will only be taxed on Australian-sourced income and Australia taxable property.

Foreign tax resident

A foreign resident (or ‘non-resident’) is usually someone who lives outside Australia during the year or spends fewer than 183 days in that tax year in Australia.

These residents:

- Are only taxed on Australian-sourced income and Australian taxable property;

- Have a tax rate of 47 per cent (including the temporary budget repair levy of 2 per cent); and

- Pay no capital gains tax (CGT) on the disposal of shares in an Australian company unless the company owns Australian taxable property.

Australian tax resident

An individual will be an Australian tax resident if they reside in Australia or in Australia for over 183 days in the year of income.

Even though Australian tax residents will be taxed on worldwide income and the individual top marginal tax rate is relatively higher, there are still benefits of being tax residents, including:

- Access to the 50 per cent CGT discount if the CGT asset is held for greater than 12 months;

- Their main residence will be exempt from CGT upon sale (this would generally not apply to non-residents); and

- There is no foreign stamp duty surcharge.

Temporary resident

Those who hold a temporary visa and do not have a permanent resident visa are considered to be temporary residents of Australia for tax purposes.

Temporary residents are exempt from Australian tax on certain foreign source income and capital gains as well as interest withholding tax and have certain concessions in relation to employee share schemes.

People on working holidays will be subject to a tax rate of 19 per cent from 1 January 2017 under current government proposal.

In certain circumstances, an individual may be exempt from paying the Medicare levy if they are a temporary resident and they are not from a country where Australia has a Reciprocal Health Care Agreement.

Australia has such agreements with New Zealand, the United Kingdom, the Republic of Ireland, Sweden, the Netherlands, Finland, Italy, Belgium, Malta, Slovenia and Norway.

Gloria Liang, senior tax consultant, HLB Mann Judd Melbourne

Tax saving

$20,000 instant asset write-off extension welcomed, but calls for broader support grow

The Australian government's decision to extend the $20,000 instant asset write-off into the next financial year has been met with approval from business leaders. However, there are growing calls for m...Read more

Tax saving

The downsizer dividend: How targeted tax levers could unlock housing supply in Australia

A call by Raine & Horne to incentivise seniors to move to smaller homes has kicked off a wider policy conversation that reaches well beyond real estate. If designed well, a targeted package could ...Read more

Tax saving

Raine & Horne's bold move could unlock housing supply but what are the hidden risks

Raine & Horne’s call for targeted tax incentives to encourage empty nesters to ‘rightsize’ isn’t just another sector wish list; it’s a potential lever to free up family homes, ease renta...Read more

Tax saving

From annual check-ups to always‑on: how modern portfolio reviews unlock after‑tax alpha

The era of once‑a‑year portfolio check‑ins is over. Continuous, tech‑enabled reviews now drive returns through tax efficiency, risk control and behavioural discipline—especially in a high‑...Read more

Tax saving

Navigating tax laws for capital gains in 2023

The landscape of Australian tax laws surrounding capital gains is ever-changing, with 2023 being no exception. ...Read more

Tax saving

What you need to know about the tax implications of crypto

One million Aussies are now invested in crypto, but many have not thought about how these investments will affect them at tax time. ...Read more

Tax saving

Welfare overhaul could give recipients a leg-up

Australia’s Centrelink recipients who’ve been doing it tough are in for a potentially easier time if the federal government pursues ambitious reforms that could provide sturdier safety nets. ...Read more

Tax saving

Students should think twice before tapping into their super

Former students might want to think carefully before they look to take advantage of the federal government’s biggest first home buyer incentive. ...Read more

Tax saving

$20,000 instant asset write-off extension welcomed, but calls for broader support grow

The Australian government's decision to extend the $20,000 instant asset write-off into the next financial year has been met with approval from business leaders. However, there are growing calls for m...Read more

Tax saving

The downsizer dividend: How targeted tax levers could unlock housing supply in Australia

A call by Raine & Horne to incentivise seniors to move to smaller homes has kicked off a wider policy conversation that reaches well beyond real estate. If designed well, a targeted package could ...Read more

Tax saving

Raine & Horne's bold move could unlock housing supply but what are the hidden risks

Raine & Horne’s call for targeted tax incentives to encourage empty nesters to ‘rightsize’ isn’t just another sector wish list; it’s a potential lever to free up family homes, ease renta...Read more

Tax saving

From annual check-ups to always‑on: how modern portfolio reviews unlock after‑tax alpha

The era of once‑a‑year portfolio check‑ins is over. Continuous, tech‑enabled reviews now drive returns through tax efficiency, risk control and behavioural discipline—especially in a high‑...Read more

Tax saving

Navigating tax laws for capital gains in 2023

The landscape of Australian tax laws surrounding capital gains is ever-changing, with 2023 being no exception. ...Read more

Tax saving

What you need to know about the tax implications of crypto

One million Aussies are now invested in crypto, but many have not thought about how these investments will affect them at tax time. ...Read more

Tax saving

Welfare overhaul could give recipients a leg-up

Australia’s Centrelink recipients who’ve been doing it tough are in for a potentially easier time if the federal government pursues ambitious reforms that could provide sturdier safety nets. ...Read more

Tax saving

Students should think twice before tapping into their super

Former students might want to think carefully before they look to take advantage of the federal government’s biggest first home buyer incentive. ...Read more