Invest

How super funds play the ratings game

It’s that time of the year again when super funds release their annual performance. This blog looks at how the funds twist their performance relative to other funds and indexing.

How super funds play the ratings game

It’s that time of the year again when super funds release their annual performance. This blog looks at how the funds twist their performance relative to other funds and indexing.

The funds’ PR is parroted by the ratings agencies whose tables and good news story are accepted at face value by the media.

Firstly, we look at how funds manipulate their inclusion into the categories set by the ratings agencies.

Defensive assets

ASIC defines defensive assets as cash or government bonds.

Cash is defensive because when market fall it holds its value.

High-grade bonds can do one better and rise when share markets fall. History backs this up too; in each of the six times Australian shares had a down year in the past 20, bonds rose to cushion the impact.

Can other assets be defensive?

This very much depends on the opinion of the fund manager and there is strong history to demonstrate why their opinions might not end up as fact.

High income stream and low growth assets

Just because an asset delivers a big income stream does not make it defensive. Take Telstra. Most of Telstra’s returns come from regular fully franked dividend income, but its share price has dropped 60 per cent since 2015.

Infrastructure and property assets

Much infrastructure and property is held in unlisted vehicles, which raises three concerns:

- The value of the investment is the opinion of the fund manager and there is no way of knowing whether that value is credible given that there is no open market for the asset;

- The financial structure may see a return of capital reported as an income distribution; and

- The investment is very illiquid and a sale is often extremely constrained by agreements with co-investors, including first right of refusal and so-called ‘tag-and-drag’ conditions. One critical characteristic of a defensive asset is to be able to sell it in a deep and open market.

The inherently risky nature of these investments is usually exposed towards the end of each market cycle when too much debt is loaded in to beef up returns. In 2008, the real estate investment trust (REIT) sector fell by a whopping 75 per cent globally because these funds had created income that couldn’t be sustained under high debts and falling prices.

During the financial crisis, some super funds stopped members from transferring money out because they were unable to sell illiquid unlisted assets. One fund, MTAA super, lost $1.6 billion due to poor hedging of unlisted assets. MTAA super lost its spot as one of the best performing funds in 2008 to become the second worst according to SuperRatings.

Creative definitions of defensive assets

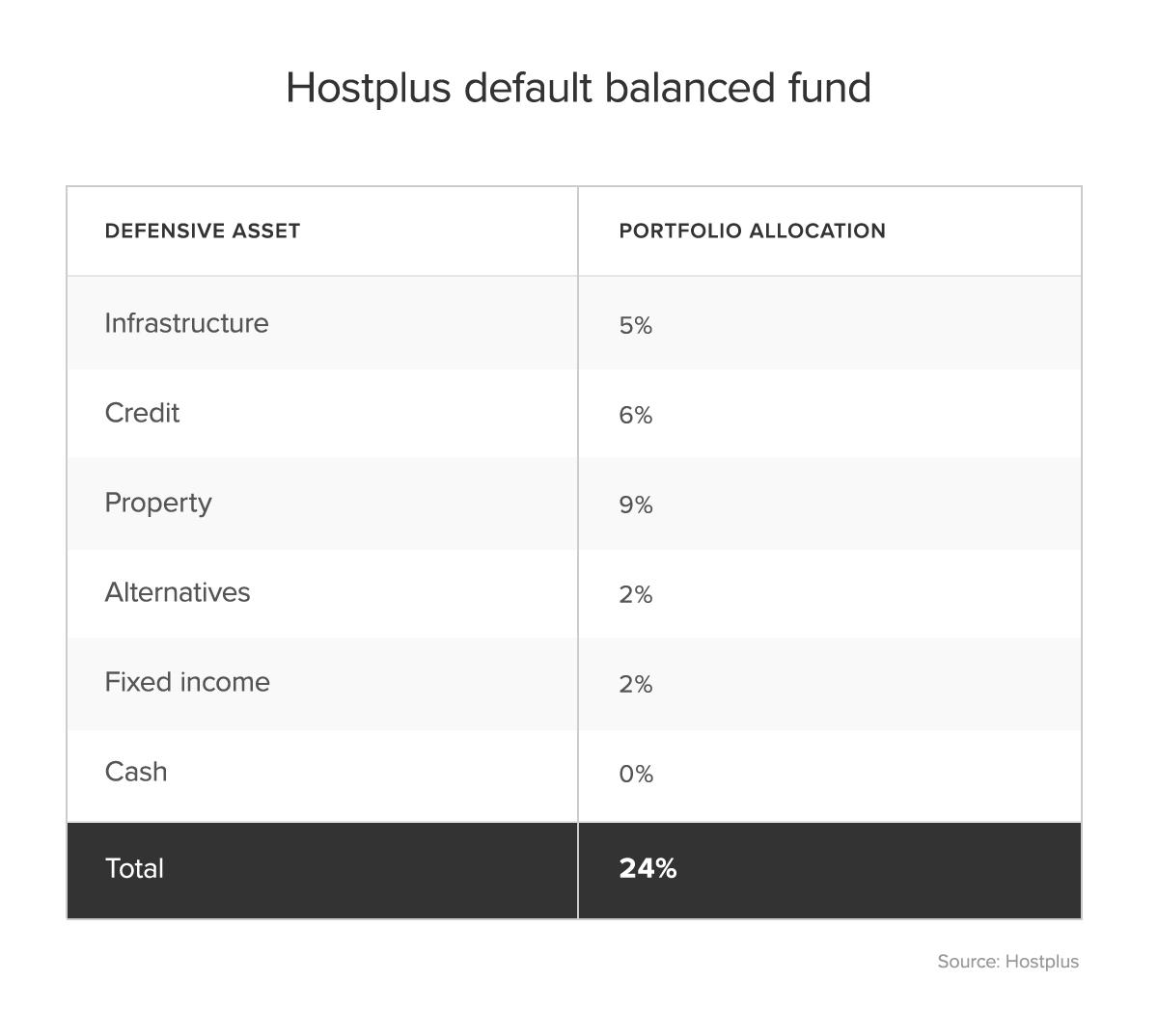

In recent times, many super funds have invented their own definition of a defensive asset, which has helped to push them up the ratings. Let’s look at this year’s top performing fund, the Hostplus default balanced fund, which claims a 24 per cent allocation to defensive assets.

The Hostplus website explains that in addition to cash and fixed income “some asset classes, such as infrastructure, property and alternatives may have growth and defensive characteristics”.

Their self-defined defensive assets include infrastructure, credit, property and alternatives. These makes up 22 per cent of the 24 per cent portfolio allocation to defensive assets. Government bonds make up just 2 per cent and there is zero cash!

This has enabled Hostplus to claim top gong in its chosen category.

Hostplus isn’t the only one. Many of the top funds on this list have counted some other assets as defensive to make the balanced fund weigh-in.

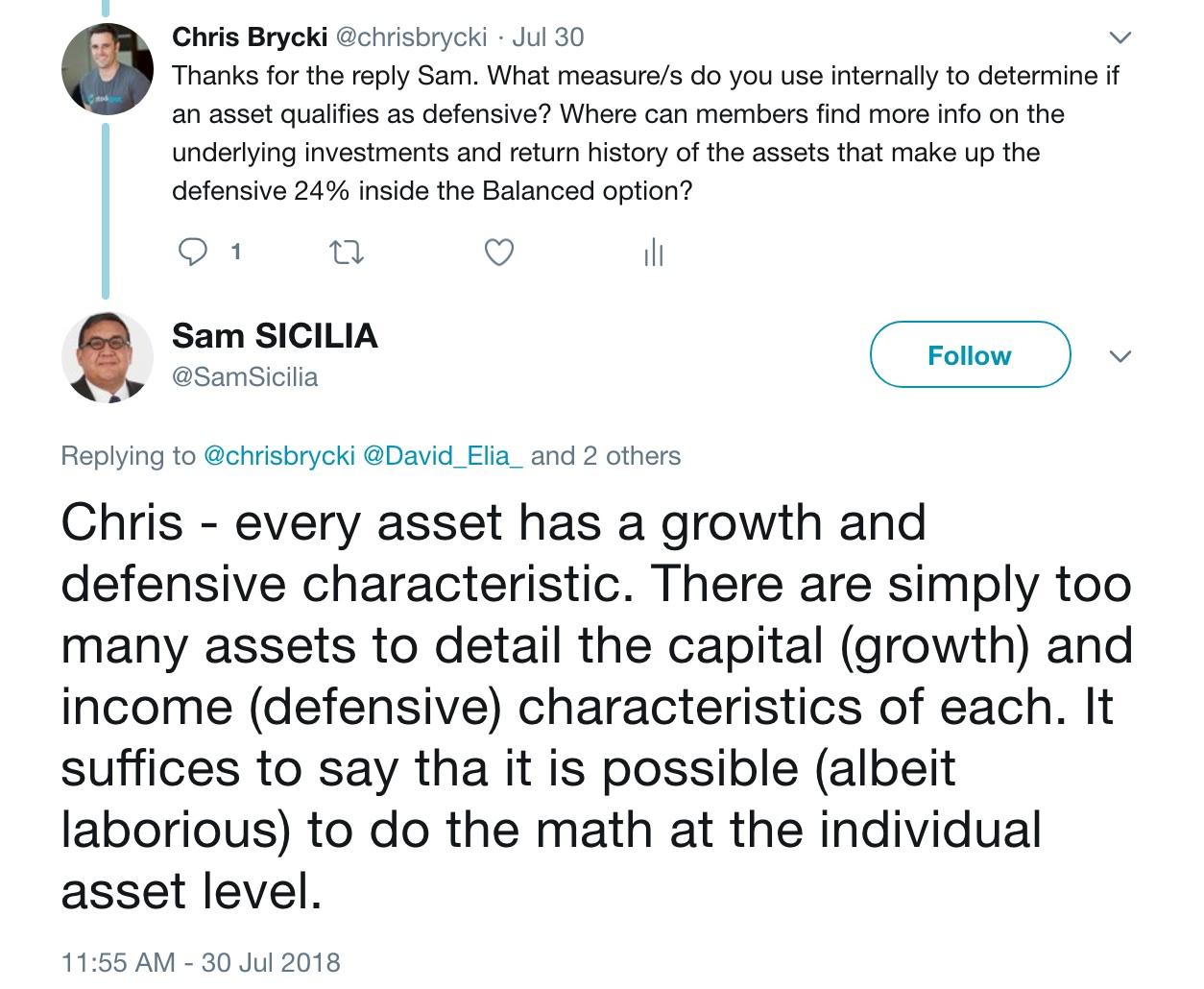

This prompted me to ask Hostplus chief investment officer Sam Sicilia the following question:

The Productivity Commission got a similar response from many super funds when asking about returns for individual assets. Only five of 208 funds were prepared to disclose them.

Unfortunately, super funds aren’t required to disclose how they classify their investments on their website or to anyone. Not to members, to the Australian Prudential Regulation Authority (APRA) or ASIC! They also aren’t required to share how each asset has performed or even what it is. This allows funds to play the ratings game without anyone holding them to account.

By all means Hostplus and other funds should be free to invest in illiquid unlisted infrastructure, alternatives and property assets.

Just don’t call them defensive!

How Hostplus sells the ‘success’ of its balanced default fund

Hostplus chief executive David Elia put the performance down to active management:

“Over the past three years our balanced option did 10.16 per cent, while the index balanced option did 7.29 per cent, so that’s almost a 3 percentage point differential. The [active] balanced option has outperformed across every time horizon,” he said.

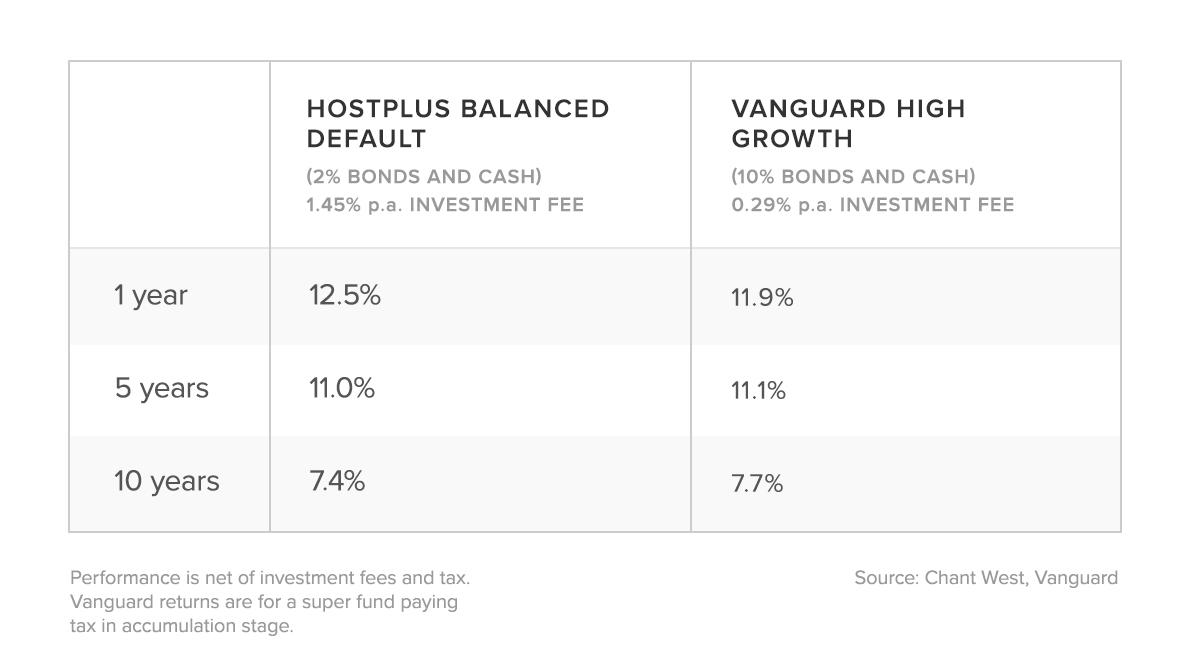

It’s absurd that Hostplus compares its indexed balanced option, which has 25 per cent cash and bonds, to its default balanced option with just 2 per cent.

It would be fairer to compare it to an index fund with a similar amount of risk. For example, the Vanguard High Growth Fund has a 10 per cent allocation to cash and bonds and generated the following returns over one, five and 10 years after fees and taxes.

When comparing much more similar funds, Hostplus performed just below an index fund over 10 years. That’s not bad, most funds did a lot worse!

How ratings agencies support the misleading self-reporting

The ratings agencies don’t properly query the allocations reported by the funds. This provides no check as to the real risk of the self-reported defensive assets.

In addition, the ratings agencies have a few additional problems of integrity, which we discussed in what fund ratings won’t tell you. To recap:

- Most ratings businesses only publicly announce the top performers and not the worst. This is because they are typically paid by the funds who they rate. Anyone who has seen The Big Short would understand how problematic this conflict of interest is. It’s why we publish the Fat Cat Funds Report to shed a light on the best and worst fund; and

- Performance over one- and three-year periods is meaningless yet it becomes the major focus each year. You need to see how a fund has performed over a full market cycle (around 10 years) to have any idea how it performs in good and bad times.

Active or indexed super?

By our analysis (which we’ll share in Part 2 of this series), over 90 per cent of active super funds underperformed an index fund of similar risk over five and 10 years after fees and taxes.

Expensive fees for active management is precisely what causes most super funds to underperform. For every active winner there has to be an active loser and management fees drag down net returns.

There are always going to be a small number of funds who beat the index but that group is always changing. Many funds in the top lists this year have also spent time near the bottom when markets weren’t as kind to them.

Winners always change. Fees are with you every year.

How to pick the right super fund

For those looking for a super fund with a low allocation to defensive assets, Hostplus might be one to consider. Let’s be clear, Hostplus and other industry funds are making some good investments, including into venture capital and infrastructure projects that will benefit Australia.

However, what shouldn’t be making headlines and driving members to switch is how the fund performed compared with lower risk options in a rising market.

Chasing the latest returns harms investors

Over the last 10 years, Hostplus has been one of the very few funds to almost generate enough extra returns to match an index fund of similar risk. Vanguard’s high growth fund still beat it by 0.3 per cent per year after fees and taxes over 10 years.

Compared with the disastrous bank owned retail super products, industry funds consistently come out ahead. However, that doesn’t mean some stakeholders aren’t massaging the truth about what drives returns and therefore what’s in the best interest of members.

Will Hostplus be able to keep up with an index fund over the next 10 years? Maybe, maybe not. Based on history, the odds of a fund that charges 1.45 per cent per year beating a low cost index fund across the market cycle is not high. Warren Buffett proved this when he recently won a 10-year bet that a Vanguard index fund would beat five expert-selected active fund managers.

Buffett backed the index fund, which won by a massive 77 per cent.

Chris Brycki is CEO and founder of online investment adviser, Stockspot.

Investment insights

APAC deal activity down by 3% in 2025 as China and India offset broader decline

The Asia-Pacific (APAC) region witnessed a moderation in deal activity in 2025, with a 3% decline in the total number of deals announced compared to the previous year. This downturn, encompassing ...Read more

Investment insights

Risk seeking among the noise: institutional investors shift strategies amid market fluctuations

In a landscape marked by evolving market dynamics, institutional investors are demonstrating a cautious yet strategic shift in their investment patterns. The latest State Street Institutional Investor ...Read more

Investment insights

2026 Portfolio Growth: Why Australia’s Savviest Investors Are Pausing Deals and Doubling Down on Operations

After a two-year sugar hit for property returns, multiple signals suggest 2026 is a danger year for buying sprees. Australian investors are being urged to slow acquisitions, protect balance sheets, ...Read more

Investment insights

Investors warn: AI hype is fuelling a bubble in humanoid robotics

The burgeoning field of humanoid robotics, powered by artificial intelligence (AI), is drawing significant investor interest, but experts warn that the hype might be creating a bubble. A recent report ...Read more

Investment insights

Australia emerges as key player in 2025 APAC private equity market

Australia has solidified its position as a significant player in the Asia-Pacific (APAC) private equity market, according to a new analysis by global private markets firm HarbourVest PartnersRead more

Investment insights

Global deal activity declines by 6% amid challenging market conditions, reports GlobalData

In a year marked by economic uncertainty and geopolitical tensions, global deal activity has experienced a notable decline, according to recent findings by GlobalData, a prominent data and analytics ...Read more

Investment insights

Furious five trends set to reshape the investment landscape in 2026

The investment landscape of 2026 is poised for transformation as five key trends, dubbed the "Furious Five" by CMC Markets, are set to dominate and disrupt markets. These trends encompass artificial ...Read more

Investment insights

Investors maintain cautious stance amid data uncertainty

Amidst the backdrop of a US government shutdown and lingering economic uncertainties, investors have adopted a neutral stance, as revealed by the latest State Street Institutional Investor IndicatorsRead more

Investment insights

APAC deal activity down by 3% in 2025 as China and India offset broader decline

The Asia-Pacific (APAC) region witnessed a moderation in deal activity in 2025, with a 3% decline in the total number of deals announced compared to the previous year. This downturn, encompassing ...Read more

Investment insights

Risk seeking among the noise: institutional investors shift strategies amid market fluctuations

In a landscape marked by evolving market dynamics, institutional investors are demonstrating a cautious yet strategic shift in their investment patterns. The latest State Street Institutional Investor ...Read more

Investment insights

2026 Portfolio Growth: Why Australia’s Savviest Investors Are Pausing Deals and Doubling Down on Operations

After a two-year sugar hit for property returns, multiple signals suggest 2026 is a danger year for buying sprees. Australian investors are being urged to slow acquisitions, protect balance sheets, ...Read more

Investment insights

Investors warn: AI hype is fuelling a bubble in humanoid robotics

The burgeoning field of humanoid robotics, powered by artificial intelligence (AI), is drawing significant investor interest, but experts warn that the hype might be creating a bubble. A recent report ...Read more

Investment insights

Australia emerges as key player in 2025 APAC private equity market

Australia has solidified its position as a significant player in the Asia-Pacific (APAC) private equity market, according to a new analysis by global private markets firm HarbourVest PartnersRead more

Investment insights

Global deal activity declines by 6% amid challenging market conditions, reports GlobalData

In a year marked by economic uncertainty and geopolitical tensions, global deal activity has experienced a notable decline, according to recent findings by GlobalData, a prominent data and analytics ...Read more

Investment insights

Furious five trends set to reshape the investment landscape in 2026

The investment landscape of 2026 is poised for transformation as five key trends, dubbed the "Furious Five" by CMC Markets, are set to dominate and disrupt markets. These trends encompass artificial ...Read more

Investment insights

Investors maintain cautious stance amid data uncertainty

Amidst the backdrop of a US government shutdown and lingering economic uncertainties, investors have adopted a neutral stance, as revealed by the latest State Street Institutional Investor IndicatorsRead more