Invest

Looking outside the Australian banking sector

Investing outside of Australia's banking sector can be a great way for investors to diversify their portfolio, writes Janus Henderson's Jane Shoemake.

Looking outside the Australian banking sector

Investing outside of Australia's banking sector can be a great way for investors to diversify their portfolio, writes Janus Henderson's Jane Shoemake.

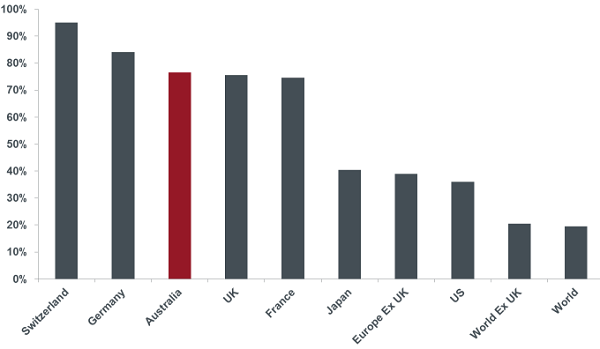

Dividends paid by the Australian market are concentrated to a small number of companies, with the 20 largest dividend-paying companies accounting for approximately 80 per cent of the dividends paid by the entire market.

Chart 1: Top 20 dividend paying companies and their contribution to their market’s income

Source: Datastream, MSCI, Factset, Société Générale, as at 30 June 2017.

The financial sector is the largest contributor, with the big four banks (Commonwealth Bank, ANZ, NAB, and Westpac) dominating payments, accounting for 45 per cent of all dividends paid.

Table 1: Top 10 ASX dividend paying companies

Source: Datastream, MSCI, Factset, Société Générale, as at 30 June 2017.

There is significant reliance on the banks to continue paying dividends at current levels for the dividend yield of the wider market to be sustained.

Whilst we don’t believe there is an imminent threat to the outlook for Australian bank dividends, we do believe that it is prudent as an investor to diversify risk and ensure there is not an over-reliance on any one stock or sector to provide income.

The suspension of BP’s dividend post the 2010 Macondo disaster is a salutary reminder of the impact that unforeseen events can have on supposedly reliable dividend paying companies.

Outlook for Australian banks relative to overseas banks

Australian banks despite the high yields available, are less attractive compared to some of the US and European banks.

The recent weakness of the Australian bank sector has led to the following conclusions:

- The stocks look expensive on a price-to-book basis (trading at around 1.5 to 2.3 times) when compared to their US and European counterparts. Dividends are attractive, but dividend growth is expected to be negligible given already high payout ratios of around 80 per cent.

- Despite stringent capital requirements, dividends have been maintained, with ANZ the only bank to cut its dividend (down 12 per cent in 2016). Dividend growth however has been lacklustre,

- Capital ratios are currently around 10 per cent, up from 8-9 per cent in 2014, and on an international basis compare very favourably with their peers.

- However, capital ratios are improving elsewhere in the world and whilst the recent announcement regarding common equity tier 1 capital (at least 10.5 per cent) was less punitive than expected, Australian banks remain under regulatory scrutiny.

- This was highlighted following the announcement of the introduction of a banking tax on balance sheet liabilities. Revenue remains under pressure due to competition, lower loan growth (particularly in mortgages where there is a cap on new interest-only mortgage lending) and other macro-prudential policies.

- This is in contrast to overseas peers where growth is forecast to improve from its current low levels;

- The slowdown in Australian economic growth and the over-extended housing market remain a concern with regard to bad debt levels.

Australian banks are high quality businesses and their current return on equity is attractive relative to the majority of their international peers.

However, return on equity levels are expected to improve at European and US banks, whereas there are concerns that the returns Australian banks can achieve have peaked.

Our view is that we can find more attractively valued banks with decent dividend yields, good growth prospects and improving return on equity levels elsewhere in the world.

Investment insights

APAC deal activity down by 3% in 2025 as China and India offset broader decline

The Asia-Pacific (APAC) region witnessed a moderation in deal activity in 2025, with a 3% decline in the total number of deals announced compared to the previous year. This downturn, encompassing ...Read more

Investment insights

Risk seeking among the noise: institutional investors shift strategies amid market fluctuations

In a landscape marked by evolving market dynamics, institutional investors are demonstrating a cautious yet strategic shift in their investment patterns. The latest State Street Institutional Investor ...Read more

Investment insights

2026 Portfolio Growth: Why Australia’s Savviest Investors Are Pausing Deals and Doubling Down on Operations

After a two-year sugar hit for property returns, multiple signals suggest 2026 is a danger year for buying sprees. Australian investors are being urged to slow acquisitions, protect balance sheets, ...Read more

Investment insights

Investors warn: AI hype is fuelling a bubble in humanoid robotics

The burgeoning field of humanoid robotics, powered by artificial intelligence (AI), is drawing significant investor interest, but experts warn that the hype might be creating a bubble. A recent report ...Read more

Investment insights

Australia emerges as key player in 2025 APAC private equity market

Australia has solidified its position as a significant player in the Asia-Pacific (APAC) private equity market, according to a new analysis by global private markets firm HarbourVest PartnersRead more

Investment insights

Global deal activity declines by 6% amid challenging market conditions, reports GlobalData

In a year marked by economic uncertainty and geopolitical tensions, global deal activity has experienced a notable decline, according to recent findings by GlobalData, a prominent data and analytics ...Read more

Investment insights

Furious five trends set to reshape the investment landscape in 2026

The investment landscape of 2026 is poised for transformation as five key trends, dubbed the "Furious Five" by CMC Markets, are set to dominate and disrupt markets. These trends encompass artificial ...Read more

Investment insights

Investors maintain cautious stance amid data uncertainty

Amidst the backdrop of a US government shutdown and lingering economic uncertainties, investors have adopted a neutral stance, as revealed by the latest State Street Institutional Investor IndicatorsRead more

Investment insights

APAC deal activity down by 3% in 2025 as China and India offset broader decline

The Asia-Pacific (APAC) region witnessed a moderation in deal activity in 2025, with a 3% decline in the total number of deals announced compared to the previous year. This downturn, encompassing ...Read more

Investment insights

Risk seeking among the noise: institutional investors shift strategies amid market fluctuations

In a landscape marked by evolving market dynamics, institutional investors are demonstrating a cautious yet strategic shift in their investment patterns. The latest State Street Institutional Investor ...Read more

Investment insights

2026 Portfolio Growth: Why Australia’s Savviest Investors Are Pausing Deals and Doubling Down on Operations

After a two-year sugar hit for property returns, multiple signals suggest 2026 is a danger year for buying sprees. Australian investors are being urged to slow acquisitions, protect balance sheets, ...Read more

Investment insights

Investors warn: AI hype is fuelling a bubble in humanoid robotics

The burgeoning field of humanoid robotics, powered by artificial intelligence (AI), is drawing significant investor interest, but experts warn that the hype might be creating a bubble. A recent report ...Read more

Investment insights

Australia emerges as key player in 2025 APAC private equity market

Australia has solidified its position as a significant player in the Asia-Pacific (APAC) private equity market, according to a new analysis by global private markets firm HarbourVest PartnersRead more

Investment insights

Global deal activity declines by 6% amid challenging market conditions, reports GlobalData

In a year marked by economic uncertainty and geopolitical tensions, global deal activity has experienced a notable decline, according to recent findings by GlobalData, a prominent data and analytics ...Read more

Investment insights

Furious five trends set to reshape the investment landscape in 2026

The investment landscape of 2026 is poised for transformation as five key trends, dubbed the "Furious Five" by CMC Markets, are set to dominate and disrupt markets. These trends encompass artificial ...Read more

Investment insights

Investors maintain cautious stance amid data uncertainty

Amidst the backdrop of a US government shutdown and lingering economic uncertainties, investors have adopted a neutral stance, as revealed by the latest State Street Institutional Investor IndicatorsRead more