Invest

Wait, so it’s definitely cheaper to rent than buy?

New research has revealed that there are indeed dwellings in Australia that are cheaper to buy than rent (57 per cent to be exact), but where are these dwellings located and are they liveable?

Wait, so it’s definitely cheaper to rent than buy?

New research has revealed that there are indeed dwellings in Australia that are cheaper to buy than rent (57 per cent to be exact), but where are these dwellings located and are they liveable?

According to REA’s inaugural Insights Buy or Rent Report, it is cheaper to buy than rent more than half of properties in Australia, thanks to the Reserve Bank and its low-rate perseverance.

And while results naturally differ by property type, REA’s research – which hinges on current prices and a 10-year analysis of all the costs associated with buying and renting – concludes that just over half of houses are cheaper to buy over the next 10 years, while this rings true for as many as 75 per cent of units.

So, where are these lucky suburbs?

Naturally, REA found that buying conditions are “particularly favourable” outside of NSW and Victoria.

Additionally, (surprise, surprise) more than 80 per cent of houses, and almost all units outside of the most populous states, are estimated to be cheaper to buy than rent.

But they won’t remain “affordable” for long, realestate.com.au economist Paul Ryan believes.

“Affordability is driving demand, and as a result it is likely we will continue to see regional price growth,” Mr Ryan said.

“Interest rates can currently be fixed below 2 per cent per year, and the Reserve Bank of Australia has committed to maintaining low interest rates until at least 2024.

“This certainty that mortgage costs are not going to increase rapidly provides comfort to buyers borrowing larger amounts.”

Where, where, where?

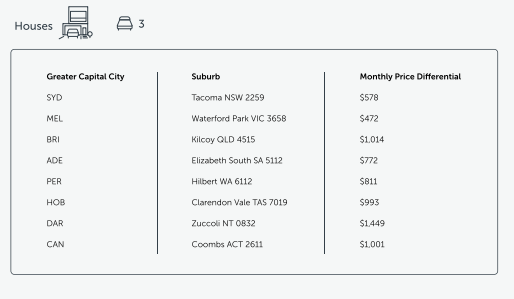

Well, if you currently live in Sydney and are eager to get out and buy a three-bedroom home, then look no further than Tacoma!

Tacoma?

Tacoma is a suburb of the Central Coast region of NSW and, according to REA, it would be $578 per month cheaper to buy rather than rent a three-bedroom house, based on the 10-year analysis.

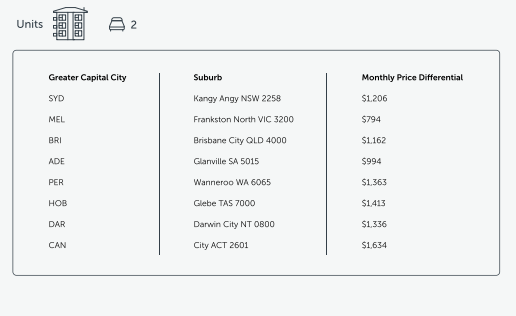

Not interested in three-bedroom homes but prefer a unit? Kangy Angy is your town!

On the Central Coast and in a semi-rural area, Kangy Angy’s monthly price difference sits at $1,206.

Still not enticed?

Well, according to Mr Ryan, for first-time buyers in Sydney, apartments in middle and outer suburban regions are generally cheaper to buy than rent.

“Families looking for more space will find it only marginally more expensive to buy a house outside of inner-city Sydney regions,” he said.

In Melbourne, Victoria’s centrally located Waterford Park is your best bet for three-bedroom homes, while Frankston North is the place REA believes you should look for a comfortable two-bedroom unit.

In Brisbane, the top suburb for its house affordability is regional Kilcoy – 75km northwest of Brisbane – and for a unit (a familiar suburb!) Brisbane City.

But REA’s analysis showed some of the biggest savings from buying instead of renting a house can be found in Western Australia’s Pilbara region, where rents in mining towns have “skyrocketed” amid a boom in iron ore exports.

Among them is Tom Price (over 1,000 km from Perth), offering the biggest monthly saving nationally at $3,341 if buying instead of renting a three-bedroom house.

Buying rather than renting a two-bedroom unit in the Karratha suburb of Pegs Creek (again, very rural!) would be $2,507 a month cheaper.

Renting still cheaper?

But despite a heap of research, REA still arrives at the conclusion that renting remains the cheapest option for many people, particularly in Sydney and Melbourne.

It shows 71.6 per cent per cent of houses in NSW and Victoria and 41.6 per cent of units are estimated to be cheaper to rent than buy over the next decade.

“While rents do not typically adjust as quickly as prices, the COVID-19 pandemic and the cessation of international travel saw significant reductions in asking rents in inner-city Sydney and Melbourne,” Mr Ryan said.

“As such, renting in these inner-city areas is currently considered cheap, relative to their very high asking prices.”

So, the choice is yours, where do you want to live?

About the author

About the author

Property

Multigenerational living is moving mainstream: how agents, developers and lenders can monetise the shift

Australia’s quiet housing revolution is no longer a niche lifestyle choice; it’s a structural shift in demand that will reward property businesses prepared to redesign product, pricing and ...Read more

Property

Prestige property, precision choice: a case study in selecting the right agent when millions are at stake

In Australia’s top-tier housing market, the wrong agent choice can quietly erase six figures from a sale. Privacy protocols, discreet buyer networks and data-savvy marketing have become the new ...Read more

Property

From ‘ugly’ to alpha: Turning outdated Australian homes into high‑yield assets

In a tight listings market, outdated properties aren’t dead weight—they’re mispriced optionality. Agencies and vendors that industrialise light‑touch refurbishment, behavioural marketing and ...Read more

Property

The 2026 Investor Playbook: Rental Tailwinds, City Divergence and the Tech-Led Operations Advantage

Rental income looks set to do the heavy lifting for investors in 2026, but not every capital city will move in lockstep. Industry veteran John McGrath tips a stronger rental year and a Melbourne ...Read more

Property

Prestige property, precision choice: Data, discretion and regulation now decide million‑dollar outcomes

In Australia’s prestige housing market, the selling agent is no longer a mere intermediary but a strategic supplier whose choices can shift outcomes by seven figures. The differentiators are no longer ...Read more

Property

The new battleground in housing: how first-home buyer policy is reshaping Australia’s entry-level market

Government-backed guarantees and stamp duty concessions have pushed fresh demand into the bottom of Australia’s price ladder, lifting values and compressing selling times in entry-level segmentsRead more

Property

Property 2026: Why measured moves will beat the market

In 2026, Australian property success will be won by investors who privilege resilience over velocity. The market is fragmenting by suburb and asset type, financing conditions remain tight, and ...Read more

Property

Entry-level property is winning: How first home buyer programs are reshaping demand, pricing power and strategy

Lower-priced homes are appreciating faster as government support channels demand into the entry tier. For developers, lenders and marketers, this is not a blip—it’s a structural reweighting of demand ...Read more

Property

Multigenerational living is moving mainstream: how agents, developers and lenders can monetise the shift

Australia’s quiet housing revolution is no longer a niche lifestyle choice; it’s a structural shift in demand that will reward property businesses prepared to redesign product, pricing and ...Read more

Property

Prestige property, precision choice: a case study in selecting the right agent when millions are at stake

In Australia’s top-tier housing market, the wrong agent choice can quietly erase six figures from a sale. Privacy protocols, discreet buyer networks and data-savvy marketing have become the new ...Read more

Property

From ‘ugly’ to alpha: Turning outdated Australian homes into high‑yield assets

In a tight listings market, outdated properties aren’t dead weight—they’re mispriced optionality. Agencies and vendors that industrialise light‑touch refurbishment, behavioural marketing and ...Read more

Property

The 2026 Investor Playbook: Rental Tailwinds, City Divergence and the Tech-Led Operations Advantage

Rental income looks set to do the heavy lifting for investors in 2026, but not every capital city will move in lockstep. Industry veteran John McGrath tips a stronger rental year and a Melbourne ...Read more

Property

Prestige property, precision choice: Data, discretion and regulation now decide million‑dollar outcomes

In Australia’s prestige housing market, the selling agent is no longer a mere intermediary but a strategic supplier whose choices can shift outcomes by seven figures. The differentiators are no longer ...Read more

Property

The new battleground in housing: how first-home buyer policy is reshaping Australia’s entry-level market

Government-backed guarantees and stamp duty concessions have pushed fresh demand into the bottom of Australia’s price ladder, lifting values and compressing selling times in entry-level segmentsRead more

Property

Property 2026: Why measured moves will beat the market

In 2026, Australian property success will be won by investors who privilege resilience over velocity. The market is fragmenting by suburb and asset type, financing conditions remain tight, and ...Read more

Property

Entry-level property is winning: How first home buyer programs are reshaping demand, pricing power and strategy

Lower-priced homes are appreciating faster as government support channels demand into the entry tier. For developers, lenders and marketers, this is not a blip—it’s a structural reweighting of demand ...Read more