Invest

Rents grow at fastest pace since 2007

Housing rents are rising at the fastest pace since 2007, but experts are warning that rental conditions around the country are extremely diverse.

Rents grow at fastest pace since 2007

Housing rents are rising at the fastest pace since 2007, but experts are warning that rental conditions around the country are extremely diverse.

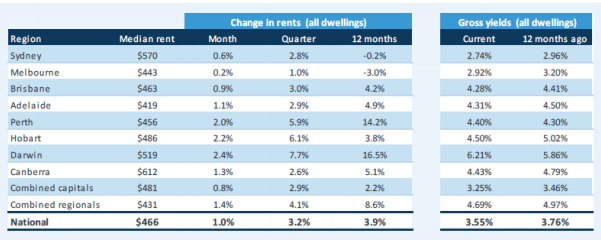

National rental rates have surged 3.2 per cent in the March quarter, representing the largest quarterly increase since May 2007, with the regions, Darwin and Perth driving much of the growth, CoreLogic’s new quarterly rental review revealed.

Unsurprisingly, the combined regional markets saw a stronger lift in rents than the capital cities, recording growth of 4.1 per cent in the first quarter compared with a combined increase of 2.9 per cent in the cities.

But what is surprising is that regional units recorded the highest quarterly rental growth of 4.8 per cent compared with a 4.0 per cent hike in house rents, despite a growing preference for larger spaces. In the cities the figures were on par with trends, with unit rents up 2.0 per cent compared with houses, which gained 3.3 per cent in the three months to March.

But while housing rents are rising at the fastest pace since 2007, the headline reading hides the sheer diversity of rental conditions around the country, CoreLogic research director Tim Lawless cautioned.

“At one end of the spectrum, we have Perth and Darwin where annual rental growth is well into double digits and accelerating. At the other end is Melbourne and Sydney where rents are down over the year,” Mr Lawless said.

In fact, houses and units in Darwin showed the strongest growth in rental rates over the quarter, up 8.2 per cent and 7.0 per cent, respectively. In Perth, quarterly growth stood at 5.9 per cent for houses and 6.0 per cent for units.

In Australia’s two largest cities, Sydney and Melbourne, growth stalled as closed international borders exasperated a demand shock already challenged by high supply.

Melbourne unit rents dropped 8.2 per cent over the year, while Sydney unit rents contracted 4.9 per cent.

“Some inner-city precincts of Melbourne have seen unit rents fall by more than 20 per cent over the past 12 months,” Mr Lawless said.

The expert noted that prospects for a material improvement in rental conditions across these inner-city high-density precincts are largely dependent on a return of tenancy demand from international students and visitors.

Canberra, on the other hand, was not only the most expensive market to rent a house across the capital cities, but also the most expensive capital city unit rental market in the quarter at $513 per week.

But Mr Lawless pointed to another discrepancy, noting that although rents are generally rising, housing values have been rising at a faster rate, which has seen rental yields compress across most of the capital cities.

“The exceptions are Perth and Darwin where rents have risen at a faster pace than housing values, driving a rise in yields. The opposite is true in Sydney and Melbourne where rental yields are plumbing new record lows.

“Outside of Sydney and Melbourne, with mortgage rates so low, yields are generally high enough to provide investors with positive cash flow opportunities from the outset,” Mr Lawless concluded.

About the author

About the author

Property

Multigenerational living is moving mainstream: how agents, developers and lenders can monetise the shift

Australia’s quiet housing revolution is no longer a niche lifestyle choice; it’s a structural shift in demand that will reward property businesses prepared to redesign product, pricing and ...Read more

Property

Prestige property, precision choice: a case study in selecting the right agent when millions are at stake

In Australia’s top-tier housing market, the wrong agent choice can quietly erase six figures from a sale. Privacy protocols, discreet buyer networks and data-savvy marketing have become the new ...Read more

Property

From ‘ugly’ to alpha: Turning outdated Australian homes into high‑yield assets

In a tight listings market, outdated properties aren’t dead weight—they’re mispriced optionality. Agencies and vendors that industrialise light‑touch refurbishment, behavioural marketing and ...Read more

Property

The 2026 Investor Playbook: Rental Tailwinds, City Divergence and the Tech-Led Operations Advantage

Rental income looks set to do the heavy lifting for investors in 2026, but not every capital city will move in lockstep. Industry veteran John McGrath tips a stronger rental year and a Melbourne ...Read more

Property

Prestige property, precision choice: Data, discretion and regulation now decide million‑dollar outcomes

In Australia’s prestige housing market, the selling agent is no longer a mere intermediary but a strategic supplier whose choices can shift outcomes by seven figures. The differentiators are no longer ...Read more

Property

The new battleground in housing: how first-home buyer policy is reshaping Australia’s entry-level market

Government-backed guarantees and stamp duty concessions have pushed fresh demand into the bottom of Australia’s price ladder, lifting values and compressing selling times in entry-level segmentsRead more

Property

Property 2026: Why measured moves will beat the market

In 2026, Australian property success will be won by investors who privilege resilience over velocity. The market is fragmenting by suburb and asset type, financing conditions remain tight, and ...Read more

Property

Entry-level property is winning: How first home buyer programs are reshaping demand, pricing power and strategy

Lower-priced homes are appreciating faster as government support channels demand into the entry tier. For developers, lenders and marketers, this is not a blip—it’s a structural reweighting of demand ...Read more

Property

Multigenerational living is moving mainstream: how agents, developers and lenders can monetise the shift

Australia’s quiet housing revolution is no longer a niche lifestyle choice; it’s a structural shift in demand that will reward property businesses prepared to redesign product, pricing and ...Read more

Property

Prestige property, precision choice: a case study in selecting the right agent when millions are at stake

In Australia’s top-tier housing market, the wrong agent choice can quietly erase six figures from a sale. Privacy protocols, discreet buyer networks and data-savvy marketing have become the new ...Read more

Property

From ‘ugly’ to alpha: Turning outdated Australian homes into high‑yield assets

In a tight listings market, outdated properties aren’t dead weight—they’re mispriced optionality. Agencies and vendors that industrialise light‑touch refurbishment, behavioural marketing and ...Read more

Property

The 2026 Investor Playbook: Rental Tailwinds, City Divergence and the Tech-Led Operations Advantage

Rental income looks set to do the heavy lifting for investors in 2026, but not every capital city will move in lockstep. Industry veteran John McGrath tips a stronger rental year and a Melbourne ...Read more

Property

Prestige property, precision choice: Data, discretion and regulation now decide million‑dollar outcomes

In Australia’s prestige housing market, the selling agent is no longer a mere intermediary but a strategic supplier whose choices can shift outcomes by seven figures. The differentiators are no longer ...Read more

Property

The new battleground in housing: how first-home buyer policy is reshaping Australia’s entry-level market

Government-backed guarantees and stamp duty concessions have pushed fresh demand into the bottom of Australia’s price ladder, lifting values and compressing selling times in entry-level segmentsRead more

Property

Property 2026: Why measured moves will beat the market

In 2026, Australian property success will be won by investors who privilege resilience over velocity. The market is fragmenting by suburb and asset type, financing conditions remain tight, and ...Read more

Property

Entry-level property is winning: How first home buyer programs are reshaping demand, pricing power and strategy

Lower-priced homes are appreciating faster as government support channels demand into the entry tier. For developers, lenders and marketers, this is not a blip—it’s a structural reweighting of demand ...Read more