Invest

How big is the gender gap in housing?

It would take women an additional 10 months to save for a 20 per cent deposit on the median Australian dwelling value as at January 2021.

How big is the gender gap in housing?

It would take women an additional 10 months to save for a 20 per cent deposit on the median Australian dwelling value as at January 2021.

On occasion of International Women’s Day, CoreLogic has released brand-new research revealing the existence of a substantial gender gap in home ownership across Australia.

According to CoreLogic’s inaugural Women and Property: State of Play report, men get access to housing sooner, meaning they have more time in market and therefore have greater wealth accumulation.

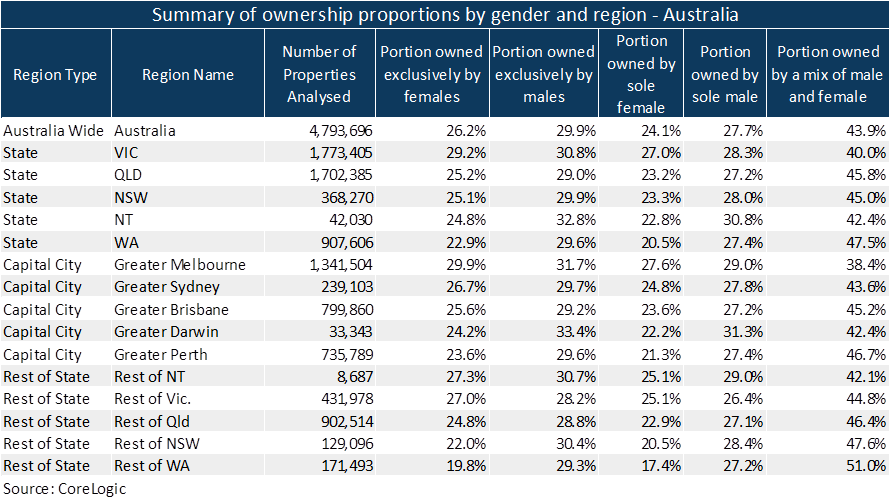

The report analysed a 2021 snapshot of property ownership by gender across the country by matching ownership gender with 41.2 per cent of Australian properties.

Unsurprisingly, there were higher rates of property ownership among men than women, with property exclusively belonging to owners identified as female representing 26.2 per cent of those analysed versus 29.9 per cent for owners identified as male.

Moreover, the research revealed higher rates of female ownership of property in major cities where dwelling values and incomes are typically higher.

“CoreLogic estimates Australia’s residential real estate to be worth over $7 trillion. Given there’s a high level of equity held in real estate, if you don’t own property, that’s a big source of household wealth and security you don’t have access to,” said Eliza Owen, CoreLogic’s head of research and author of the report.

With property ownership considered a “pillar” of retirement, Milena Malev, CoreLogic international’s GM, financial services & insurance solutions, stressed the implications women’s lower ownership could have on future living standards and healthcare access.

“This wealth gap becomes a particular challenge around retirement, and it’s well documented that if you still have rental or mortgage costs at the time you retire, then you have a much higher incidence of falling into poverty,” Ms Malev said.

How to bridge the divide

CoreLogic found a direct correlation between the gender pay gap and home ownership based on the average weekly full-time earnings for men and women, which revealed that it would take women an additional 10 months to save for a 20 per cent deposit on the median Australian dwelling value as at January 2021.

However, data has suggested that single women may be even more disadvantaged given their high part-time employment participation.

“The core of this analysis and its findings is that it’s all about wealth inequality and income inequality, and that doesn’t just span between men and women, it spans among women as well – including those that are single, sole parents or part-time workers,” Ms Owen said.

In order to ensure a boost in equality, CoreLogic has stressed the need for long-term policy changes to address the gender pay gap and gender wealth gap.

“For government, there are implications for the provision of social support. The gender pay gap appears to be creating a barrier for entry into the property market among women, and this is amplified for single or lone adult households. Women are more likely to exit property ownership after the dissolution of a marriage, and that’s where we see women over 50 among the highest growing rates of homelessness in Australia.

“Savings and investment solutions from lending institutions for those on lower and/or single incomes can help provide a leg up into the wealth accumulation that is associated with property ownership,” Ms Malev said.

About the author

About the author

Property

Multigenerational living is moving mainstream: how agents, developers and lenders can monetise the shift

Australia’s quiet housing revolution is no longer a niche lifestyle choice; it’s a structural shift in demand that will reward property businesses prepared to redesign product, pricing and ...Read more

Property

Prestige property, precision choice: a case study in selecting the right agent when millions are at stake

In Australia’s top-tier housing market, the wrong agent choice can quietly erase six figures from a sale. Privacy protocols, discreet buyer networks and data-savvy marketing have become the new ...Read more

Property

From ‘ugly’ to alpha: Turning outdated Australian homes into high‑yield assets

In a tight listings market, outdated properties aren’t dead weight—they’re mispriced optionality. Agencies and vendors that industrialise light‑touch refurbishment, behavioural marketing and ...Read more

Property

The 2026 Investor Playbook: Rental Tailwinds, City Divergence and the Tech-Led Operations Advantage

Rental income looks set to do the heavy lifting for investors in 2026, but not every capital city will move in lockstep. Industry veteran John McGrath tips a stronger rental year and a Melbourne ...Read more

Property

Prestige property, precision choice: Data, discretion and regulation now decide million‑dollar outcomes

In Australia’s prestige housing market, the selling agent is no longer a mere intermediary but a strategic supplier whose choices can shift outcomes by seven figures. The differentiators are no longer ...Read more

Property

The new battleground in housing: how first-home buyer policy is reshaping Australia’s entry-level market

Government-backed guarantees and stamp duty concessions have pushed fresh demand into the bottom of Australia’s price ladder, lifting values and compressing selling times in entry-level segmentsRead more

Property

Property 2026: Why measured moves will beat the market

In 2026, Australian property success will be won by investors who privilege resilience over velocity. The market is fragmenting by suburb and asset type, financing conditions remain tight, and ...Read more

Property

Entry-level property is winning: How first home buyer programs are reshaping demand, pricing power and strategy

Lower-priced homes are appreciating faster as government support channels demand into the entry tier. For developers, lenders and marketers, this is not a blip—it’s a structural reweighting of demand ...Read more

Property

Multigenerational living is moving mainstream: how agents, developers and lenders can monetise the shift

Australia’s quiet housing revolution is no longer a niche lifestyle choice; it’s a structural shift in demand that will reward property businesses prepared to redesign product, pricing and ...Read more

Property

Prestige property, precision choice: a case study in selecting the right agent when millions are at stake

In Australia’s top-tier housing market, the wrong agent choice can quietly erase six figures from a sale. Privacy protocols, discreet buyer networks and data-savvy marketing have become the new ...Read more

Property

From ‘ugly’ to alpha: Turning outdated Australian homes into high‑yield assets

In a tight listings market, outdated properties aren’t dead weight—they’re mispriced optionality. Agencies and vendors that industrialise light‑touch refurbishment, behavioural marketing and ...Read more

Property

The 2026 Investor Playbook: Rental Tailwinds, City Divergence and the Tech-Led Operations Advantage

Rental income looks set to do the heavy lifting for investors in 2026, but not every capital city will move in lockstep. Industry veteran John McGrath tips a stronger rental year and a Melbourne ...Read more

Property

Prestige property, precision choice: Data, discretion and regulation now decide million‑dollar outcomes

In Australia’s prestige housing market, the selling agent is no longer a mere intermediary but a strategic supplier whose choices can shift outcomes by seven figures. The differentiators are no longer ...Read more

Property

The new battleground in housing: how first-home buyer policy is reshaping Australia’s entry-level market

Government-backed guarantees and stamp duty concessions have pushed fresh demand into the bottom of Australia’s price ladder, lifting values and compressing selling times in entry-level segmentsRead more

Property

Property 2026: Why measured moves will beat the market

In 2026, Australian property success will be won by investors who privilege resilience over velocity. The market is fragmenting by suburb and asset type, financing conditions remain tight, and ...Read more

Property

Entry-level property is winning: How first home buyer programs are reshaping demand, pricing power and strategy

Lower-priced homes are appreciating faster as government support channels demand into the entry tier. For developers, lenders and marketers, this is not a blip—it’s a structural reweighting of demand ...Read more