Invest

Hot Property: Biggest headlines from the week that was

JobKeeper and JobSeeker may look different, but they will stick around past September, allowing the property market to breathe a sigh of relief: Here are the biggest property stories from this week.

Hot Property: Biggest headlines from the week that was

JobKeeper and JobSeeker may look different, but they will stick around past September, allowing the property market to breathe a sigh of relief: Here are the biggest property stories from this week.

Welcome to nestegg’s weekly round-up of the bricks-and-mortar stories that we think will be most relevant to you, whether as a first home buyer, a seasoned investor or anyone in between!

To compile this list, not only are we taking a look at the week’s most-read stories and the news that matters, but we are also curating it to include stories from our sister platforms that could have an impact on your buying, selling or investment journey, no matter where you find yourself on the property ladder.

Unemployment is expected to reach 9 per cent by Christmas while the budget deficit returns to World War II-era levels, the Treasurer has forecast in an economic update.

Steve Dick, director of Raine & Horne Commercial Newcastle, said the knock-on effects of COVID-19 will change the commercial property landscape moving forward.

Continued impact on corporate travel, WFH options gaining popularity, and the continued pick-up of online shopping are three trends to look out for.

3. Property peril: Why Sydney housing market has fallen more than official figures

According to Macquarie University’s professor of business analytics, Stefan Trueck, property prices in May 2020 sold on average 8 per cent below their valuation. This means that in May, houses were being offered at a significant discount to those before the COVID-19 crisis.

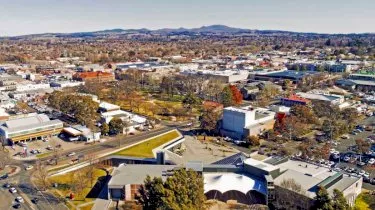

4. Central West hotspot revealed

Orange, NSW, is the property market-keen investors should be keeping a close eye on, according to Propertyology head of research Simon Pressley.

“For (both) capital growth and rental income growth, the property market in Orange, NSW, has already been one of the best in the country over the last five years,” Mr Pressley said.

5. $250k in taxes on a $500k property: The real cost of investing

The $13.1 billion in negative gearing benefits dished out to investors in 2017-18 was nothing compared with the staggering surge in taxes being paid by those same property holders.

The president of Property Club, Kevin Young, said that “during the five years from 2013-2014 to 2018-2019, overall government taxes on property in Australia surged by 38.5 per cent to $32.6 billion during 2018-2019.”

6. How this investor got on the property ladder making $5.10 an hour

Australians looking to get onto the property ladder but lack the financial resources to do so are being encouraged to get creative and use other means at their disposal.

Real estate agent and property investor Alex Lumsden did not enter the market initially by himself: “I bought into our family home, and I bought another property with some family. Why? I guess I always thought that it was the way to make money,” he said.

7. Lender ramps up home lending scrutiny

COVID-induced crackdowns on home loan serviceability have continued with yet another lender reducing its risk appetite.

BOQ Group (includes Virgin Money) has revised its credit policy for home loan applications as part of its “ongoing commitment to responsible lending”.

The COVID-19 pandemic has seen a reduction in the demand for property, while an oversupply of properties in Melbourne and Sydney could see cheaper rent, new research has revealed.

About the author

About the author

Property

Multigenerational living is moving mainstream: how agents, developers and lenders can monetise the shift

Australia’s quiet housing revolution is no longer a niche lifestyle choice; it’s a structural shift in demand that will reward property businesses prepared to redesign product, pricing and ...Read more

Property

Prestige property, precision choice: a case study in selecting the right agent when millions are at stake

In Australia’s top-tier housing market, the wrong agent choice can quietly erase six figures from a sale. Privacy protocols, discreet buyer networks and data-savvy marketing have become the new ...Read more

Property

From ‘ugly’ to alpha: Turning outdated Australian homes into high‑yield assets

In a tight listings market, outdated properties aren’t dead weight—they’re mispriced optionality. Agencies and vendors that industrialise light‑touch refurbishment, behavioural marketing and ...Read more

Property

The 2026 Investor Playbook: Rental Tailwinds, City Divergence and the Tech-Led Operations Advantage

Rental income looks set to do the heavy lifting for investors in 2026, but not every capital city will move in lockstep. Industry veteran John McGrath tips a stronger rental year and a Melbourne ...Read more

Property

Prestige property, precision choice: Data, discretion and regulation now decide million‑dollar outcomes

In Australia’s prestige housing market, the selling agent is no longer a mere intermediary but a strategic supplier whose choices can shift outcomes by seven figures. The differentiators are no longer ...Read more

Property

The new battleground in housing: how first-home buyer policy is reshaping Australia’s entry-level market

Government-backed guarantees and stamp duty concessions have pushed fresh demand into the bottom of Australia’s price ladder, lifting values and compressing selling times in entry-level segmentsRead more

Property

Property 2026: Why measured moves will beat the market

In 2026, Australian property success will be won by investors who privilege resilience over velocity. The market is fragmenting by suburb and asset type, financing conditions remain tight, and ...Read more

Property

Entry-level property is winning: How first home buyer programs are reshaping demand, pricing power and strategy

Lower-priced homes are appreciating faster as government support channels demand into the entry tier. For developers, lenders and marketers, this is not a blip—it’s a structural reweighting of demand ...Read more

Property

Multigenerational living is moving mainstream: how agents, developers and lenders can monetise the shift

Australia’s quiet housing revolution is no longer a niche lifestyle choice; it’s a structural shift in demand that will reward property businesses prepared to redesign product, pricing and ...Read more

Property

Prestige property, precision choice: a case study in selecting the right agent when millions are at stake

In Australia’s top-tier housing market, the wrong agent choice can quietly erase six figures from a sale. Privacy protocols, discreet buyer networks and data-savvy marketing have become the new ...Read more

Property

From ‘ugly’ to alpha: Turning outdated Australian homes into high‑yield assets

In a tight listings market, outdated properties aren’t dead weight—they’re mispriced optionality. Agencies and vendors that industrialise light‑touch refurbishment, behavioural marketing and ...Read more

Property

The 2026 Investor Playbook: Rental Tailwinds, City Divergence and the Tech-Led Operations Advantage

Rental income looks set to do the heavy lifting for investors in 2026, but not every capital city will move in lockstep. Industry veteran John McGrath tips a stronger rental year and a Melbourne ...Read more

Property

Prestige property, precision choice: Data, discretion and regulation now decide million‑dollar outcomes

In Australia’s prestige housing market, the selling agent is no longer a mere intermediary but a strategic supplier whose choices can shift outcomes by seven figures. The differentiators are no longer ...Read more

Property

The new battleground in housing: how first-home buyer policy is reshaping Australia’s entry-level market

Government-backed guarantees and stamp duty concessions have pushed fresh demand into the bottom of Australia’s price ladder, lifting values and compressing selling times in entry-level segmentsRead more

Property

Property 2026: Why measured moves will beat the market

In 2026, Australian property success will be won by investors who privilege resilience over velocity. The market is fragmenting by suburb and asset type, financing conditions remain tight, and ...Read more

Property

Entry-level property is winning: How first home buyer programs are reshaping demand, pricing power and strategy

Lower-priced homes are appreciating faster as government support channels demand into the entry tier. For developers, lenders and marketers, this is not a blip—it’s a structural reweighting of demand ...Read more