Invest

Funding the gap year

The gap year is fast becoming a rite of passage for many young Australians, as they seek a break between the rigours of their final year of school and commencing further studies at tertiary level.

Funding the gap year

The gap year is fast becoming a rite of passage for many young Australians, as they seek a break between the rigours of their final year of school and commencing further studies at tertiary level.

Some students take a break to work and earn money to help them through uni, while others seek experiences – some for fun, others related to their tertiary studies and career goals. In this article, Centuria looks at the opportunities a gap year can provide to young adults and provides some strategies to help your clients provide for an exciting and relevant gap year experience for their children or grandchildren.

More than 220,000 students completed year 12 Australia-wide in 2017. From secondary school there are many pathways, including apprenticeship, employment or tertiary education. In 2009, university places were changed from fixed to demand-driven and, as a result, by 2015 the number of (local) students going to university had grown by nearly 30 per cent. While numbers vary from year to year, it seems more than three-quarters of the class of 2017 is expected to apply for further education.

What is a gap year?

While common in the US, the UK and Europe, for many years the notion of taking a gap year had negative connotations in Australia. A ‘gap year’ is time taken out of formal education; mostly it occurs between finishing school and taking up tertiary study, although some students take a gap during a course or between completing a qualification and seeking work.

According to research undertaken by the National Centre for Vocational Education Research (NCVER)[1], the incidence of gap-taking by Australian students has increased – it is estimated that approximately 25 per cent of Australian students who complete high school will take a gap year before they go on to further education.

Interestingly, the research found that the most common activities of Australian gap students were part-time (28 per cent) or full-time work (23 per cent), or training (10 per cent) – only 6 per cent reported travel as their main activity. This is significantly lower than the incidence of travel reported for students taking gap years in the UK or US.

The benefits of a gap year

Because there are so many opportunities and experiences available to gap-takers, there are, likewise, a range of benefits. These might include:

- Time to identify and explore their education and career goals;

- Development of organisational and work skills;

- Undertaking non-university courses or training to support tertiary studies;

- Development of a broader world view, particularly among those students who go abroad for travel or volunteer work; and

- Deferring and working is the only way that many students can qualify for Youth Allowance; students from regional areas who earn a designated sum during their gap year may qualify as independent and receive Youth Allowance during their studies.

A study by the University of Sydney found that Australian students who had taken a gap year as a result of lower academic performance and motivation in secondary school were more motivated during their tertiary education than those who had not taken a gap year.

The findings of this and other research suggest gap-takers are often more motivated and successful in their courses, have wider interests and are more easily able to socialise with a diverse range of people. If the gap year experience is valued by prospective employers, they may gain employment advantages – for example, where students gain relevant work experience, or combine travel and voluntary work, this can add to their skillset and increase their employability after university. Given the competition for jobs, this can only be a positive thing!

Some gap year opportunities

Interestingly, fewer Australian students travel or undertake voluntary work, despite the benefits it can deliver. In many cases, this will come down to financial reasons – either the student needs to work to save money for their university years, or simply does not have the savings to head overseas. For those with the means to travel, there’s a variety of opportunities they can take up, such as volunteering for projects across a range of countries and ‘themes’. These might include:

- Teaching English to children and adults in developing nations;

- Working on an African game reserve to help conserve wildlife;

- Contributing to the lives of young Buddhist monks in Nepal;

- Building homes and schools in developing nations;

- Coaching sport; and

- Working in childcare or undertaking medical internships.

While most volunteer positions are available in developing nations, there are also opportunities in other parts of the world. This can be a boon for students wanting to learn or develop a second language.

These are great opportunities for those who can afford it – how can you help your clients provide a positive gap year experience for their children or grandchildren?

Funding the gap year

One strategy to fund a gap year experience is a regular investment plan using an investment bond. As detailed in our last article published by Adviser Voice – Resolutions for a new year – regular investment of savings harnesses the benefits of compound interest and dollar cost averaging, and enables clients to build up a nest egg over time. While many managed investments have savings plans attached to them, investment bonds have a range of features that make them especially attractive to regular savers with a longer-term savings goal.

#1 Start small and add regularly

An investment bond can be initiated with as little as $500, and regular investments of up to a total of 125 per cent of the initial investment can be made each year.

#2 A tax effective investment

An investment bond is a tax effective structure; tax is paid within the investment bond rather than personally by the investor. The maximum tax paid on the earnings and capital gains within an investment bond is 30 per cent, although franking credits and tax deductions can reduce this effective tax rate.

There is no tax liability on maturation after 10 years, and no capital gains tax liability when switching between investment options.

However, if necessary, the investment is accessible earlier; if redeemed within the first 10 years, the investor will pay tax on the assessable portion of growth as shown in figure one.

Figure one: Tax payable on returns from investment bonds

| Withdrawal occurs | Taxable portion (of growth redrawn) |

| Within the first 8 years | 100 per cent |

| In year 9 | Two-thirds |

| In year 10 | One-third |

| After 10 years | Nil |

#3 No annual tax reporting

No one likes paperwork and while the client’s money remains invested, the manager of the investment bond will pay tax on investment earnings; there is no requirement for your client to declare those earnings in their annual tax reporting.

#4 Investment choice

Centuria’s investment bonds offer a choice of investment options:

- Australian shares

- Balanced

- Cash

- Growth

- Guaranteed

- Imputation

Earnings are automatically reinvested in the bond and, because investors have no capital gains tax liability, reinvestment dates do not need to be tracked for capital gains tax purposes. Investors can also switch between investment options without triggering personal capital gains tax.

#5 Beneficiaries

Investment bonds provide investors with freedom to nominate anyone as a beneficiary in the event of their death. As an investment bond falls outside of the estate, it is not distributed according to the will, nor is it affected if the owner dies intestate.

Once the 10-year investment period ends, or in the event of the death of the investor, the investment bond is paid tax-free to the nominated beneficiary/ies.

Illustrative Case study

Kerrie and Sam have two children in primary school and want each of them to have the opportunity to take a gap year, to see the world and make a contribution through voluntary work. They invest $1,000 to start a regular investment plan using an investment bond.

Each month, Kerrie and Sam add $100 through a regular investment plan, and each year the regular savings amount is increased by 25 per cent.

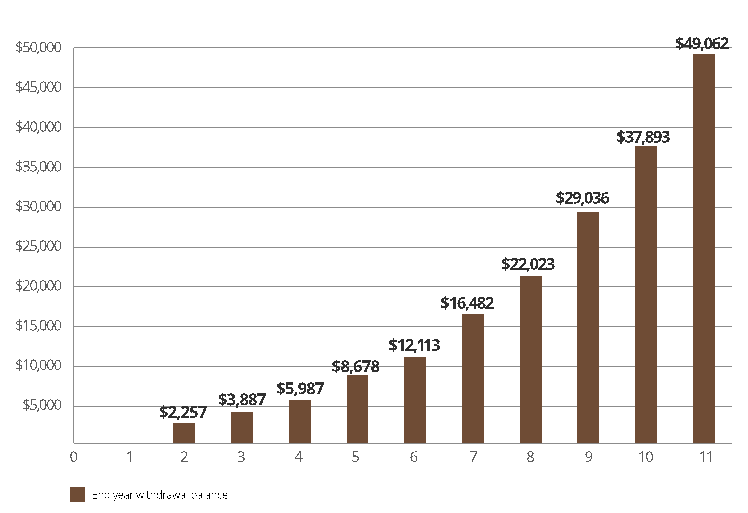

Figure one: Growth in investment balance over 10 years

Source: Centuria – figures assume investment returns of 4 per cent income (70 per cent franked) and 3 per cent growth, and that the investment is held for 10 years. This example is for illustration purposed only and does not purport to represent the return achievable in any particular investment bond. Investments are subject to risk, including the risk of negative return. Changes to the assumptions given in the illustrative example will alter the outcome.

If the outcome in this illustrative example is achieved, Kerrie and Sam’s investment will have grown to a little over $49,000, tax paid, by the time their first child finishes school. That way, both of their children will have a funded gap year to explore the world and take up opportunities that will help them develop skills to benefit their future employment.

Saving and investing regularly over the medium to long term can translate into a growing nest egg. Your clients’ children and grandchildren can benefit from the power of compounding returns and have a fund to support them during a gap year between school and university – or between university and starting work. After all, everyone wants the best for their children – this way, your clients can be sure that their children can make the most of every opportunity available to them.

[1] Who takes a gap year and why? – NCVER, 2015

Neil Rogan is the general manager of investment bonds at Centuria Investment Bonds.

Investment insights

APAC deal activity down by 3% in 2025 as China and India offset broader decline

The Asia-Pacific (APAC) region witnessed a moderation in deal activity in 2025, with a 3% decline in the total number of deals announced compared to the previous year. This downturn, encompassing ...Read more

Investment insights

Risk seeking among the noise: institutional investors shift strategies amid market fluctuations

In a landscape marked by evolving market dynamics, institutional investors are demonstrating a cautious yet strategic shift in their investment patterns. The latest State Street Institutional Investor ...Read more

Investment insights

2026 Portfolio Growth: Why Australia’s Savviest Investors Are Pausing Deals and Doubling Down on Operations

After a two-year sugar hit for property returns, multiple signals suggest 2026 is a danger year for buying sprees. Australian investors are being urged to slow acquisitions, protect balance sheets, ...Read more

Investment insights

Investors warn: AI hype is fuelling a bubble in humanoid robotics

The burgeoning field of humanoid robotics, powered by artificial intelligence (AI), is drawing significant investor interest, but experts warn that the hype might be creating a bubble. A recent report ...Read more

Investment insights

Australia emerges as key player in 2025 APAC private equity market

Australia has solidified its position as a significant player in the Asia-Pacific (APAC) private equity market, according to a new analysis by global private markets firm HarbourVest PartnersRead more

Investment insights

Global deal activity declines by 6% amid challenging market conditions, reports GlobalData

In a year marked by economic uncertainty and geopolitical tensions, global deal activity has experienced a notable decline, according to recent findings by GlobalData, a prominent data and analytics ...Read more

Investment insights

Furious five trends set to reshape the investment landscape in 2026

The investment landscape of 2026 is poised for transformation as five key trends, dubbed the "Furious Five" by CMC Markets, are set to dominate and disrupt markets. These trends encompass artificial ...Read more

Investment insights

Investors maintain cautious stance amid data uncertainty

Amidst the backdrop of a US government shutdown and lingering economic uncertainties, investors have adopted a neutral stance, as revealed by the latest State Street Institutional Investor IndicatorsRead more

Investment insights

APAC deal activity down by 3% in 2025 as China and India offset broader decline

The Asia-Pacific (APAC) region witnessed a moderation in deal activity in 2025, with a 3% decline in the total number of deals announced compared to the previous year. This downturn, encompassing ...Read more

Investment insights

Risk seeking among the noise: institutional investors shift strategies amid market fluctuations

In a landscape marked by evolving market dynamics, institutional investors are demonstrating a cautious yet strategic shift in their investment patterns. The latest State Street Institutional Investor ...Read more

Investment insights

2026 Portfolio Growth: Why Australia’s Savviest Investors Are Pausing Deals and Doubling Down on Operations

After a two-year sugar hit for property returns, multiple signals suggest 2026 is a danger year for buying sprees. Australian investors are being urged to slow acquisitions, protect balance sheets, ...Read more

Investment insights

Investors warn: AI hype is fuelling a bubble in humanoid robotics

The burgeoning field of humanoid robotics, powered by artificial intelligence (AI), is drawing significant investor interest, but experts warn that the hype might be creating a bubble. A recent report ...Read more

Investment insights

Australia emerges as key player in 2025 APAC private equity market

Australia has solidified its position as a significant player in the Asia-Pacific (APAC) private equity market, according to a new analysis by global private markets firm HarbourVest PartnersRead more

Investment insights

Global deal activity declines by 6% amid challenging market conditions, reports GlobalData

In a year marked by economic uncertainty and geopolitical tensions, global deal activity has experienced a notable decline, according to recent findings by GlobalData, a prominent data and analytics ...Read more

Investment insights

Furious five trends set to reshape the investment landscape in 2026

The investment landscape of 2026 is poised for transformation as five key trends, dubbed the "Furious Five" by CMC Markets, are set to dominate and disrupt markets. These trends encompass artificial ...Read more

Investment insights

Investors maintain cautious stance amid data uncertainty

Amidst the backdrop of a US government shutdown and lingering economic uncertainties, investors have adopted a neutral stance, as revealed by the latest State Street Institutional Investor IndicatorsRead more