Invest

Dividends in Australian shares – is the COVID lockdown lifting?

What happened during reporting season? Andrew Zenonos asks.

Dividends in Australian shares – is the COVID lockdown lifting?

In many ways, FY20 reporting season was one of the most closely watched in recent memory as investors attempted to understand the true impact of the COVID-19 pandemic on company fundamentals. Going into the end of the financial year, expectations for earnings had been slashed significantly due to the level of uncertainty that remained in the outlook for the economy. While there was stock level volatility and divergence (as always), reporting season for FY20 was largely better than expected though FY21 earnings expectations were downgraded; the ASX 300 returned 3.05 per cent for the month of August.

Although results were better than expected at the aggregate level, many companies did not give guidance for FY21 due to the uncertainty that still looms over the next 12 months in the economy. Companies may provide updates during AGMs in Q4; however, it is difficult to know if additional clarity will be available at that point in time.

There were some notable themes at the sector level. The consumer discretionary sector was a notable space for earnings upgrades as the “work from home” theme drove strong increases in sales. JB Hi-Fi and Harvey Norman were beneficiaries of this, outperforming by 9.5 per cent and 15.8 per cent, respectively, through August. While bank results were mostly in line with expectations, FY21 earnings for the sector was downgraded on the back of net interest margin pressures, as well as uncertainty for the economy once fiscal stimulus has ended or is tapered significantly. Resources companies remain resilient and reported earnings upgrades in aggregate; iron ore miners remain well bid as the commodity market dynamics remain favourable.

What happened to dividend expectations?

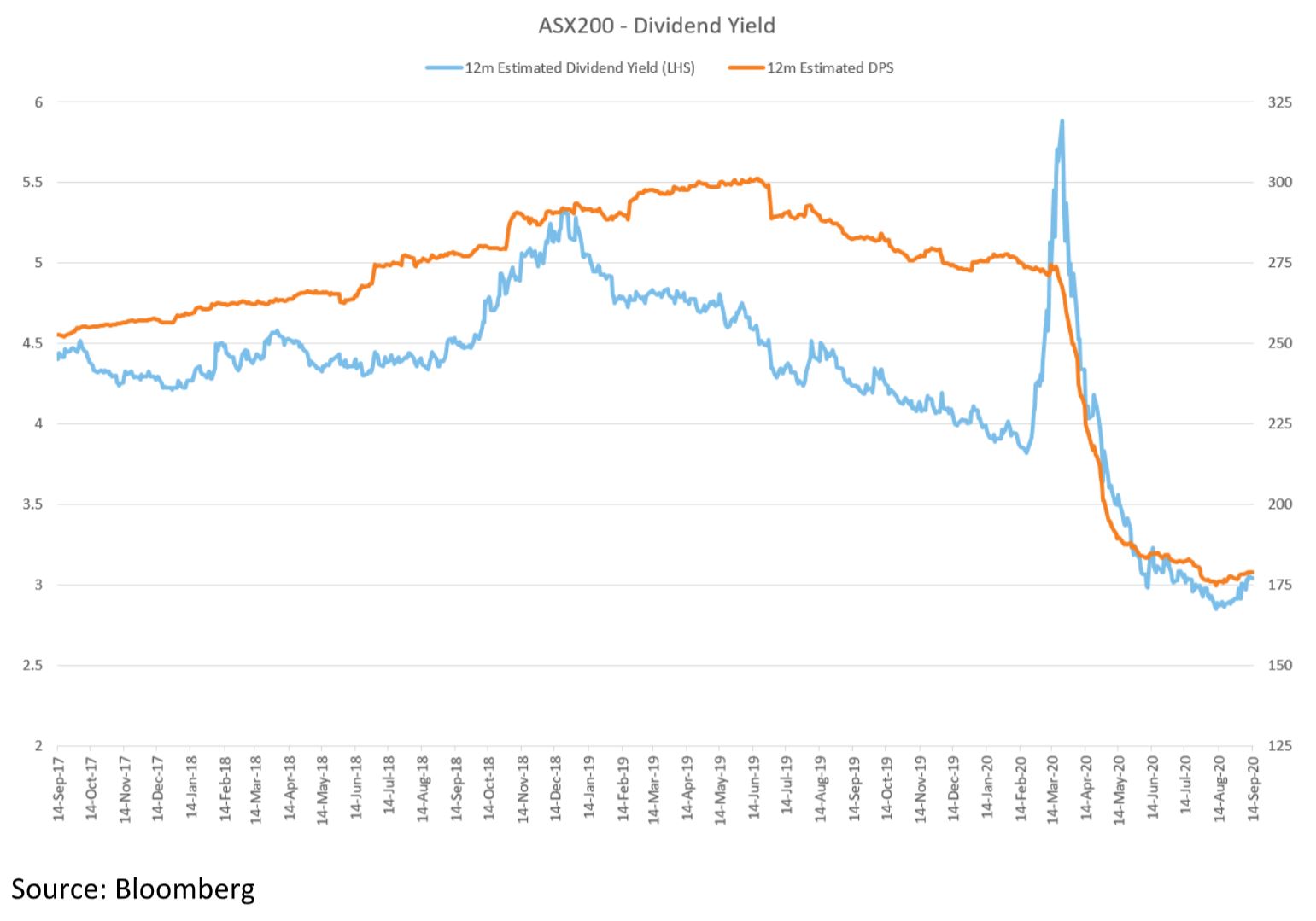

Due to the level of uncertainty that remains for the coming 12 months and the hesitation from companies to give guidance, it is not surprising that we did not see much in terms of news flow around dividends relative to expectations. At the end of July, APRA eased restrictions around paying dividends for banks however payout ratios for authorised deposit-taking institutions (ADIs) will be maintained below 50 per cent for this year. While this is a small positive, the outlook for bank dividends remains significantly below what investors have come to expect. ANZ, CBA and NAB announced dividends; however, Westpac confirmed that an interim dividend will not be paid. Once factoring in reporting season, approximately 35 per cent of companies in the ASX 200 have deferred, cancelled, suspended or declared no final dividend. The outlook for dividends at the aggregate market level remains subdued and shrouded in uncertainty, i.e. not dissimilar to the environment before reporting season. In saying that, however, alongside the thematic that earnings were better than feared, it appears that the outlook for dividends has potentially seen a bottom – at least for now.

The expected dividend yield for the Australian market, which has historically been viewed as a high dividend yield market, is now around 3 per cent. This is significantly lower than the 20-year average dividend yield of 4.3 per cent.

How did our ETFs perform?

Through August, both our Russell Investments High Dividend Australian Shares ETF (RDV) and our Russell Investments Responsible Investment ETF (RARI) outperformed relative to the broad market.

RDV benefitted from exposure to retail and the “work from home” theme noted above via overweight positions in Harvey Norman and JB Hi-Fi. Exposure to a number of companies that reported “better than feared results also added value, particularly in tourism-related parts of the market. Star Entertainment and Flight Centre outperformed the broad market on the back of their results.

RARI also benefitted from exposure to strong retail names such as Super Retail group and Premier Investments, as well as “better than feared” results in Qantas and Stockland Group. Rio Tinto is excluded from RARI’s holdings due to its involvement in, and risk attributable to, mining activities. This benefited performance over the month of August, as controversy related to the company’s blasting of indigenous sites weighed on the share price. This caused significant shareholder backlash, and exposed some questionable, if not poor, governance practices within the company. Subsequently, the CEO and a number of senior executives have departed. We continue to see strong demand for ESG-related products and growing concern around active ownership and governance.

Andrew Zenonos is an associate portfolio manager, equity, at Russell Investments.

Investment insights

APAC deal activity down by 3% in 2025 as China and India offset broader decline

The Asia-Pacific (APAC) region witnessed a moderation in deal activity in 2025, with a 3% decline in the total number of deals announced compared to the previous year. This downturn, encompassing ...Read more

Investment insights

Risk seeking among the noise: institutional investors shift strategies amid market fluctuations

In a landscape marked by evolving market dynamics, institutional investors are demonstrating a cautious yet strategic shift in their investment patterns. The latest State Street Institutional Investor ...Read more

Investment insights

2026 Portfolio Growth: Why Australia’s Savviest Investors Are Pausing Deals and Doubling Down on Operations

After a two-year sugar hit for property returns, multiple signals suggest 2026 is a danger year for buying sprees. Australian investors are being urged to slow acquisitions, protect balance sheets, ...Read more

Investment insights

Investors warn: AI hype is fuelling a bubble in humanoid robotics

The burgeoning field of humanoid robotics, powered by artificial intelligence (AI), is drawing significant investor interest, but experts warn that the hype might be creating a bubble. A recent report ...Read more

Investment insights

Australia emerges as key player in 2025 APAC private equity market

Australia has solidified its position as a significant player in the Asia-Pacific (APAC) private equity market, according to a new analysis by global private markets firm HarbourVest PartnersRead more

Investment insights

Global deal activity declines by 6% amid challenging market conditions, reports GlobalData

In a year marked by economic uncertainty and geopolitical tensions, global deal activity has experienced a notable decline, according to recent findings by GlobalData, a prominent data and analytics ...Read more

Investment insights

Furious five trends set to reshape the investment landscape in 2026

The investment landscape of 2026 is poised for transformation as five key trends, dubbed the "Furious Five" by CMC Markets, are set to dominate and disrupt markets. These trends encompass artificial ...Read more

Investment insights

Investors maintain cautious stance amid data uncertainty

Amidst the backdrop of a US government shutdown and lingering economic uncertainties, investors have adopted a neutral stance, as revealed by the latest State Street Institutional Investor IndicatorsRead more

Investment insights

APAC deal activity down by 3% in 2025 as China and India offset broader decline

The Asia-Pacific (APAC) region witnessed a moderation in deal activity in 2025, with a 3% decline in the total number of deals announced compared to the previous year. This downturn, encompassing ...Read more

Investment insights

Risk seeking among the noise: institutional investors shift strategies amid market fluctuations

In a landscape marked by evolving market dynamics, institutional investors are demonstrating a cautious yet strategic shift in their investment patterns. The latest State Street Institutional Investor ...Read more

Investment insights

2026 Portfolio Growth: Why Australia’s Savviest Investors Are Pausing Deals and Doubling Down on Operations

After a two-year sugar hit for property returns, multiple signals suggest 2026 is a danger year for buying sprees. Australian investors are being urged to slow acquisitions, protect balance sheets, ...Read more

Investment insights

Investors warn: AI hype is fuelling a bubble in humanoid robotics

The burgeoning field of humanoid robotics, powered by artificial intelligence (AI), is drawing significant investor interest, but experts warn that the hype might be creating a bubble. A recent report ...Read more

Investment insights

Australia emerges as key player in 2025 APAC private equity market

Australia has solidified its position as a significant player in the Asia-Pacific (APAC) private equity market, according to a new analysis by global private markets firm HarbourVest PartnersRead more

Investment insights

Global deal activity declines by 6% amid challenging market conditions, reports GlobalData

In a year marked by economic uncertainty and geopolitical tensions, global deal activity has experienced a notable decline, according to recent findings by GlobalData, a prominent data and analytics ...Read more

Investment insights

Furious five trends set to reshape the investment landscape in 2026

The investment landscape of 2026 is poised for transformation as five key trends, dubbed the "Furious Five" by CMC Markets, are set to dominate and disrupt markets. These trends encompass artificial ...Read more

Investment insights

Investors maintain cautious stance amid data uncertainty

Amidst the backdrop of a US government shutdown and lingering economic uncertainties, investors have adopted a neutral stance, as revealed by the latest State Street Institutional Investor IndicatorsRead more