Borrow

Responsible lending laws set to stay

The controversial axing of responsible lending laws appears all but over, as independent senators announce they will not support the legislation.

Responsible lending laws set to stay

The controversial axing of responsible lending laws appears all but over, as independent senators announce they will not support the legislation.

As part of Australia’s recovery from the COVID-19 pandemic, the government announced last year it would roll back responsible lending laws in theory, making it easier for Australians to get a loan.

Treasurer Josh Frydenberg announced the overhaul of the laws governing mortgages, personal loans, credit cards and payday loans to streamline decisions as to whether customers could afford a loan.

However, senator Pauline Hanson announced on Wednesday that she would not support the bill all but ending the Treasurer’s plans.

She said the government was telling the public to relax and “trust the big banks”.

“But I say millions of Australians should not be left vulnerable to predatory banking conduct,” Senator Hanson said in a statement.

With Labor opposed to the government’s plans, the Coalition needs support from three of five Senate crossbenchers to pass its bill.

Independent Tasmanian senator Jacqui Lambie is reportedly against the change, and South Australian independent Rex Patrick said he was unconvinced because lending data did not show the responsible lending rules had hurt borrowers.

Suburbs likely to be saved by changing laws

Critics of the amending bill including consumer group CHOICE have welcomed the independents’ move to block the bill, claiming it will hurt vulnerable Australians.

“We’re glad to see more and more senators — most recently Senator Hanson — stand up to the banks and the government,” said CHOICE CEO Alan Kirkland. “Many people are still doing it tough and need laws that protect them from the bad bank behaviour that led to the banking royal commission.”

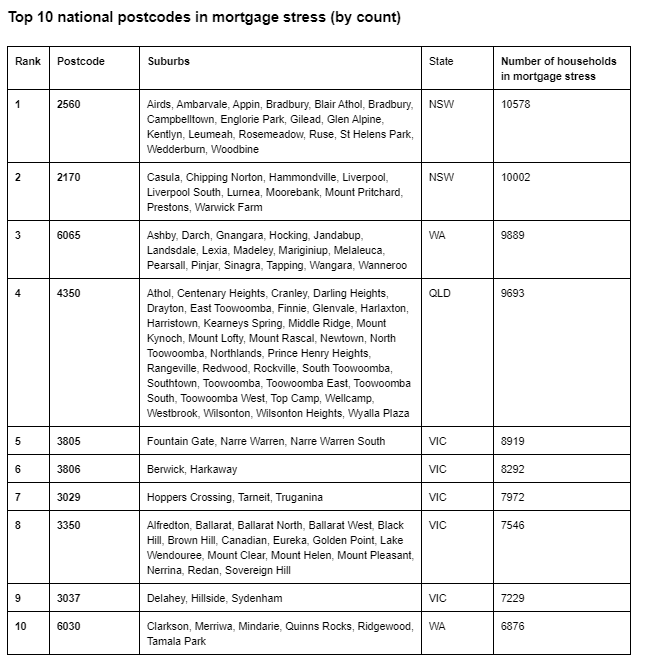

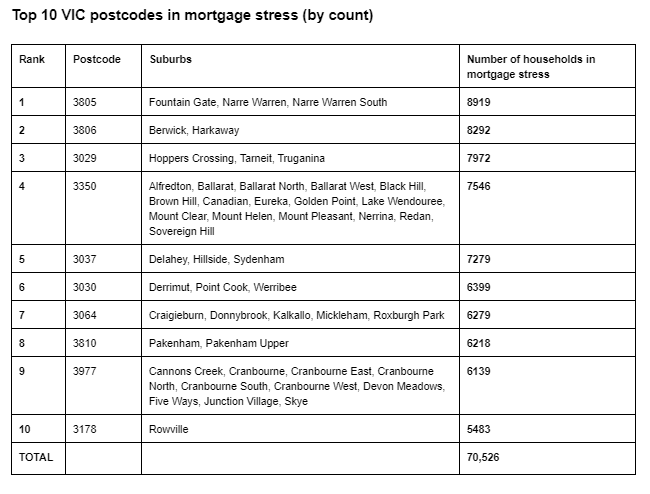

CHOICE has released postcode data showing significant parts of Western Sydney and Melbourne’s west are already in mortgage stress as the federal government tries to amend safe lending laws.

The 10 crisis suburbs for New South Wales and Victoria represent over 130,000 households on the brink.

“These are households where, from fortnight to fortnight, people are spending more than they are earning. That means that they have to make difficult choices, like whether to put food on the table or keep up with repayments. If they can’t maintain the juggling act, they risk losing their homes,” Mr Kirkland said.

The group claims removing these safe lending laws will only add to the stress of Australians.

“Safe lending laws were put in place to avoid the huge damage to families and communities caused by mortgage stress — by making banks take care to avoid giving people loans they won’t be able to afford to repay,” the CEO said.

“If the government gets away with its plan to axe safe lending laws, people who are desperate to get into a rising housing market will be at risk of overexposure and people who need to refinance won’t be adequately protected.”

About the author

About the author

Loans

Australia’s credit pivot: Mortgage enquiries hit a three‑year peak as households lean on plastic — what lenders and fintechs must do next

Australian home loan interest has rebounded even as households lean harder on cards and personal loans — a classic late‑cycle signal that demands sharper risk, pricing and AI executionRead more

Loans

Trust is the new yield: Why brokers win when credibility compounds

In a market where products look interchangeable, credibility has become the most defensible asset in mortgage broking. With broker channel share hitting record highs and AI reshaping client ...Read more

Loans

Mortgage Relief Window: How Australia’s Lenders Are Rewiring Risk and Growth at a Three‑Year Lull

Australia’s mortgage stress has eased to its lowest level since early 2023, creating a rare—likely brief—window for lenders, brokers and fintechs to reset risk and rebuild growth. This case study ...Read more

Loans

Why ANZ’s tougher stance on company-borrowed home loans matters: A case study in risk recalibration, competition, and what CFOs should do next

ANZ has tightened mortgage credit parameters for loans where a company or trust is the borrower—an apparently narrow policy tweak with wide operational consequences. It signals a broader recalibration ...Read more

Loans

Mortgage 2026: Australia’s share‑of‑wallet war will be won on switching, data rights and AI discipline

The defining feature of Australia’s 2026 mortgage market won’t be house prices; it will be switching velocity. With competition reforms sharpening the Consumer Data Right, lenders and brokers that ...Read more

Loans

Mortgage remorse reshapes the game: Australia's lending squeeze set to redefine banking and household demand

A growing cohort of Australians is rethinking recent home loan decisions as higher repayments collide with household budgets. This isn’t just consumer angst; it’s an economy-wide red flag for lenders, ...Read more

Loans

Aussie mortgage game-changer: Brokers dominate while AI sharpens the edge

Mortgage brokers now originate roughly three in four new Australian home loans, a structural shift that rewires bank economics, product strategy and customer acquisition. MFAA data shows broker market ...Read more

Loans

Fixing the future: How brokers and lenders can turn rate-hike anxiety into strategic advantage

Australian borrowers are leaning into short-term fixed loans as rate uncertainty lingers, shifting risk from households to lenders and their funding partners. That creates a narrow window for broker ...Read more

Loans

Australia’s credit pivot: Mortgage enquiries hit a three‑year peak as households lean on plastic — what lenders and fintechs must do next

Australian home loan interest has rebounded even as households lean harder on cards and personal loans — a classic late‑cycle signal that demands sharper risk, pricing and AI executionRead more

Loans

Trust is the new yield: Why brokers win when credibility compounds

In a market where products look interchangeable, credibility has become the most defensible asset in mortgage broking. With broker channel share hitting record highs and AI reshaping client ...Read more

Loans

Mortgage Relief Window: How Australia’s Lenders Are Rewiring Risk and Growth at a Three‑Year Lull

Australia’s mortgage stress has eased to its lowest level since early 2023, creating a rare—likely brief—window for lenders, brokers and fintechs to reset risk and rebuild growth. This case study ...Read more

Loans

Why ANZ’s tougher stance on company-borrowed home loans matters: A case study in risk recalibration, competition, and what CFOs should do next

ANZ has tightened mortgage credit parameters for loans where a company or trust is the borrower—an apparently narrow policy tweak with wide operational consequences. It signals a broader recalibration ...Read more

Loans

Mortgage 2026: Australia’s share‑of‑wallet war will be won on switching, data rights and AI discipline

The defining feature of Australia’s 2026 mortgage market won’t be house prices; it will be switching velocity. With competition reforms sharpening the Consumer Data Right, lenders and brokers that ...Read more

Loans

Mortgage remorse reshapes the game: Australia's lending squeeze set to redefine banking and household demand

A growing cohort of Australians is rethinking recent home loan decisions as higher repayments collide with household budgets. This isn’t just consumer angst; it’s an economy-wide red flag for lenders, ...Read more

Loans

Aussie mortgage game-changer: Brokers dominate while AI sharpens the edge

Mortgage brokers now originate roughly three in four new Australian home loans, a structural shift that rewires bank economics, product strategy and customer acquisition. MFAA data shows broker market ...Read more

Loans

Fixing the future: How brokers and lenders can turn rate-hike anxiety into strategic advantage

Australian borrowers are leaning into short-term fixed loans as rate uncertainty lingers, shifting risk from households to lenders and their funding partners. That creates a narrow window for broker ...Read more