Resources

With volatility picking up, why don’t you consider owning gold?

Promoted by ETF Securities

There are 3 reasons why you should own gold; volatility has returned to the markets, downside risks have increased, gold has been consistently one of the best portfolio hedges against geopolitical risk and inflation.

With volatility picking up, why don’t you consider owning gold?

Promoted by ETF Securities

There are 3 reasons why you should own gold; volatility has returned to the markets, downside risks have increased, gold has been consistently one of the best portfolio hedges against geopolitical risk and inflation.

Trade idea – ETFS Physical Gold (GOLD)/ETFS Physical Singapore Gold ETF (ZGOL)/

- Volatility has returned to the markets

- Downside risks have increased dramatically

- Gold has been consistently one of the best portfolio hedges against geopolitical risk and inflation

- Below we take a further look at why you should be holding gold

There are three reasons why you should own gold.

- Portfolio protection against volatility

- Inflation hedging

- Event risk hedging

Points 1 and 2 have recently increased from “no concern” or “neutral” in investors’ minds to “serious concerns” so we believe that all advisers and planners should be considering including gold in their client portfolios, as it’s one of the most historically reliable hedges in such circumstances.

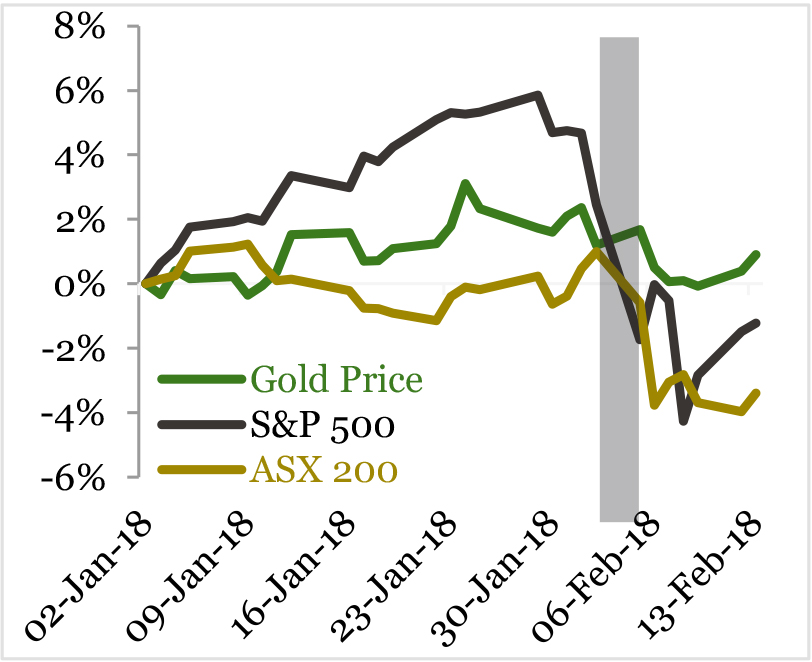

Gold protects portfolios against negative equity volatility

Just last week we had an example of gold performing as an event risk hedge when equity markets plummeted and the gold price surged upwards. On 5th February, we saw global equity markets fall with the S&P 500 down 4.1% and the ASX 200 down 1.6%, meanwhile the gold price was up 0.5% in USD terms as investors were turning risk averse. The year-to-date performance chart on the right highlights the price actions of the day. (Source: Bloomberg, data as of 13th February 2018)

Historical performance is not an indication of future performance and any investments may go down in value.

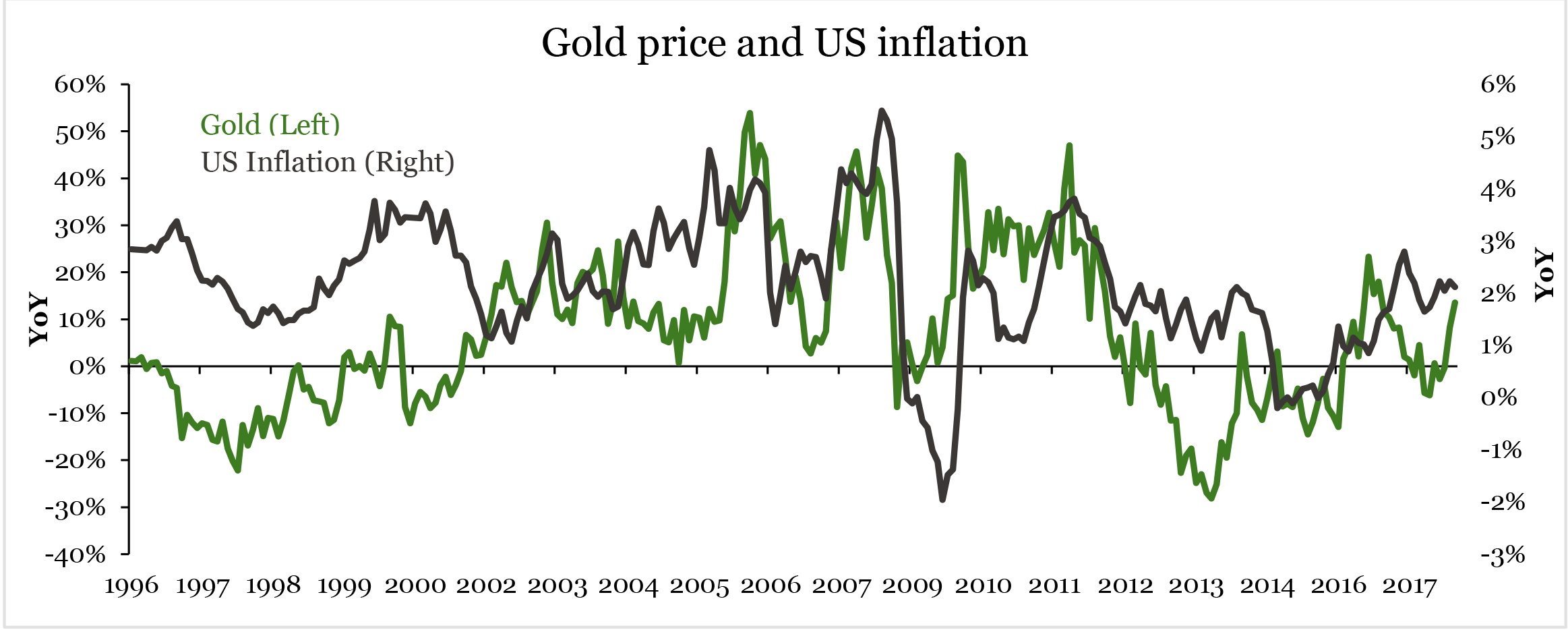

Gold against inflation

Gold is also widely viewed as a tool against inflation. Historically, the gold price tends to appreciate when inflation and interest rates are on the rise. The chart below shows how the gold price moves largely in-line with the inflation (CPI) of the United States.

Source: Bloomberg, ETF Securities as of close 31th December 2018

Source: Bloomberg, ETF Securities as of close 31th December 2018

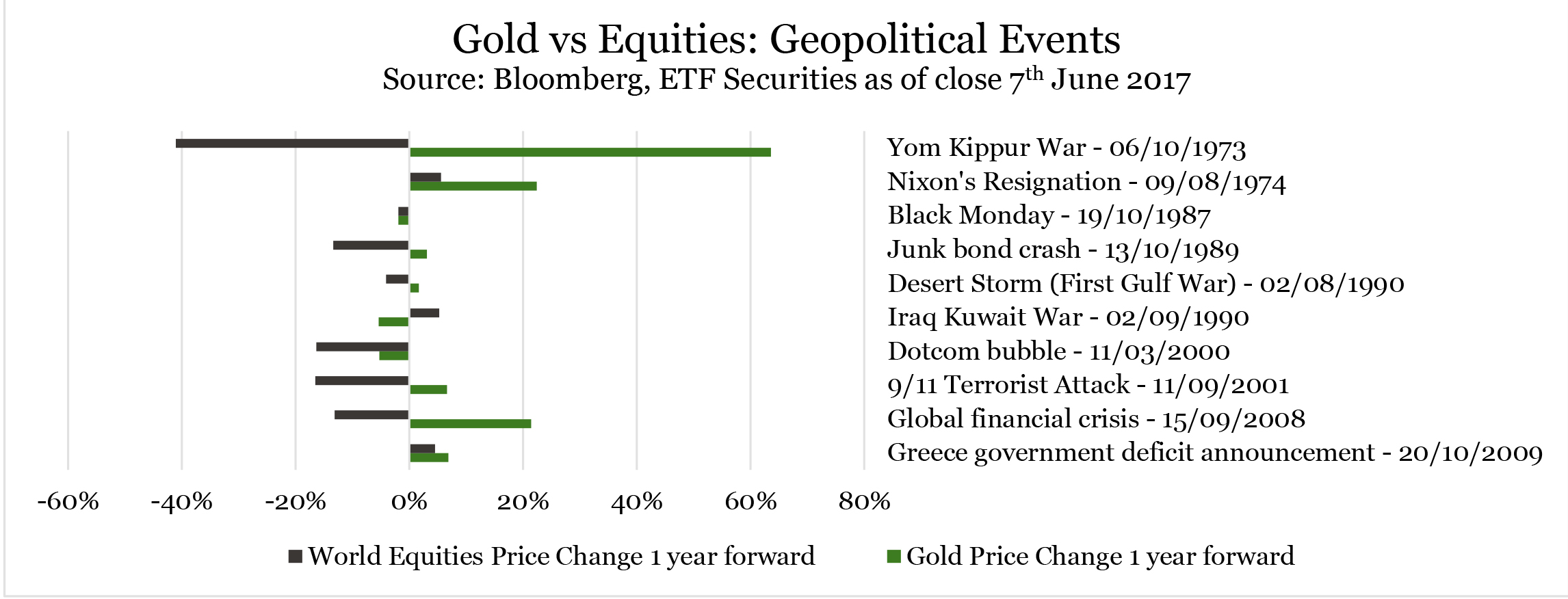

Event Risk Hedge

Lastly, although there have been no significant geopolitical events this year so far, it only takes one to roil the markets. As the table below shows, being in gold in nine out of ten of the events below was a positive when held within an investor portfolio.

Summary

There are three reasons why investors should own gold and two of them have dramatically spiked in terms of relevance. We believe all advisers should at least consider owning gold through this late economic cycle, where the probability of inflation and volatility is heightened.

Sponsored features

Dissecting the Complexities of Cash Indices Regulations: An In-Depth Analysis

Introduction In recent years, the world of finance has seen a surge of interest in cash indices trading as investors seek potential returns in various markets. This development has brought increased ...Read more

Sponsored features

The Best Ways to Find the Right Trading Platform

Promoted by Animus Webs Read more

Sponsored features

How the increase in SMSF members benefits business owners

Promoted by ThinkTank Read more

Sponsored features

Thinktank’s evolution in residential lending and inaugural RMBS transaction

Promoted by Thinktank When Thinktank, a specialist commercial and residential property lender, recently closed its first residential mortgage-backed securitisation (RMBS) issue for $500 million, it ...Read more

Sponsored features

Investors tap into cyber space to grow their wealth

Promoted by Citi Group Combined, our daily spending adds up to opportunities for investors on a global scale. Read more

Sponsored features

Ecommerce boom as world adjusts to pandemic driven trends

Promoted by Citi Group COVID-19 has accelerated the use of technologies that help keep us connected, creating a virtual supply chain and expanded digital universe for investors. Read more

Sponsored features

Industrial property – the silver lining in the retail cloud

Promoted by ThinkTank Read more

Sponsored features

Why the non-bank sector appeals to SMSFs

Promoted by Think Tank Read more

Sponsored features

Dissecting the Complexities of Cash Indices Regulations: An In-Depth Analysis

Introduction In recent years, the world of finance has seen a surge of interest in cash indices trading as investors seek potential returns in various markets. This development has brought increased ...Read more

Sponsored features

The Best Ways to Find the Right Trading Platform

Promoted by Animus Webs Read more

Sponsored features

How the increase in SMSF members benefits business owners

Promoted by ThinkTank Read more

Sponsored features

Thinktank’s evolution in residential lending and inaugural RMBS transaction

Promoted by Thinktank When Thinktank, a specialist commercial and residential property lender, recently closed its first residential mortgage-backed securitisation (RMBS) issue for $500 million, it ...Read more

Sponsored features

Investors tap into cyber space to grow their wealth

Promoted by Citi Group Combined, our daily spending adds up to opportunities for investors on a global scale. Read more

Sponsored features

Ecommerce boom as world adjusts to pandemic driven trends

Promoted by Citi Group COVID-19 has accelerated the use of technologies that help keep us connected, creating a virtual supply chain and expanded digital universe for investors. Read more

Sponsored features

Industrial property – the silver lining in the retail cloud

Promoted by ThinkTank Read more

Sponsored features

Why the non-bank sector appeals to SMSFs

Promoted by Think Tank Read more