Save

Which ATO publications can be relied on?

While the ATO produces a mountain of guidance material, only certain publications are binding, while others may be easily changed.

Which ATO publications can be relied on?

While the ATO produces a mountain of guidance material, only certain publications are binding, while others may be easily changed.

The tax office is a large bureaucracy and produces plenty of guidance material. Generally, the ATO feels bound by its published material from an administrative viewpoint. However, only certain publications bind the ATO.

Thus, it is important that taxpayers understand the range of material, or products, published by the ATO and the level of protection that each provides. For example, a tax ruling is generally binding on the ATO. As discussed, the ATO’s general administrative practice is that it feels bound to follow its own written materials but in the event the ATO is wrong, the tax still remains payable but penalties may be remitted.

In particular, only certain documents provide a ‘precedential ATO view’. This is the ATO’s documented view about the application of any of the law administered by the ATO in relation to a particular interpretative issue. The ATO has precedential views to ensure its decisions on interpretative issues are accurate and consistent. Precedential ATO views are set out in the following documents:

• Public rulings (including draft public rulings);

• ATO interpretative decisions (ATO IDs);

• Decision impact statements; and

• Documents listed in the Schedule of Documents containing Precedential ATO Views (attached to PS LA 2003/3).

We discuss the main types of ATO publications below and also provide a handy summary at the end of this article.

Public rulings

Public rulings are binding advice that express the ATO’s interpretation of the law. The ATO publish different types of public rulings including:

TR – Taxation ruling;

TD – Taxation determination (short-form ruling);

GSTR – GST ruling;

MT – Miscellaneous taxation ruling;

SGR – Superannuation guarantee ruling;

CR – Class ruling; and

PR – Product ruling.

Where a taxpayer follows a public, private or oral ruling that applies to them, the ATO is bound to assess them as set out in the ruling. If the correct application of the law is less favourable to a taxpayer than the ruling provides, the ruling protects the taxpayer from the law being applied by the ATO in that less favourable way.

A public ruling usually applies to both past and future years and protects a taxpayer from the date of its application, which is usually the date of effect of the relevant legislative provision. In addition, a public ruling that is withdrawn continues to apply to schemes that had begun to be carried out before the withdrawal.

Private binding rulings

A private binding ruling (PBR) on a tax query is binding on the ATO. Note that this is the information provided at the start of most PBRs:

You cannot rely on the rulings in the register of private binding rulings in your tax affairs. You can only rely on a private ruling that we have given to you or to someone acting on your behalf.

The register of private binding rulings is a public record of private rulings issued by the ATO. The register is a historical record of rulings and we do not update it to reflect changes in the law or our policies.

The rulings in the register have been edited and may not contain all the factual details relevant to each decision. Do not use the register to predict ATO policy or decisions.

As you will note, PBRs only provide protection to the particular taxpayer that the PBR is issued to. Thus, those who seek to rely on information in the register of PBRs do so at their own risk.

An example where this may prove risky for SMSFs is if they relied on a favourable PBR issued to another taxpayer on a nil interest LRBA from a related party since there would be no protection from that PBR (as it only protects the taxpayer covered by that PBR).

Note that following several PBRs issued by the ATO in FY2014, numerous other SMSFs entered into LRBAs without a PBR. The ATO issued PCG 2016/5 in April 2016 that stated that SMSFs with non-arm’s length LRBAs that did not bring them in compliance with arm’s length terms prior to 31 January 2017 would be subject to NALI. Fortunately, these SMSFs did not suffer additional tax or penalties for relying on a strategy that had been covered in another taxpayer’s PBR. In contrast, there have been other situations where taxpayers have suffered extra tax and penalties for relying on another taxpayer’s PBR which did not provide protection to them.

Tax determinations

A tax determination (TD) provides similar protection to a public ruling. By way of example, the protection provided by a TD, as described in TD 2013/22 follows:

• This publication provides you with the following level of protection;

• This publication (excluding appendixes) is a public ruling for the purposes of the Taxation Administration Act 1953;

• A public ruling is an expression of the commissioner’s opinion about the way in which a relevant provision applies, or would apply, to entities generally or to a class of entities in relation to a particular scheme or a class of schemes; and

• If you rely on this ruling, the commissioner must apply the law to you in the way set out in the ruling (unless the commissioner is satisfied that the ruling is incorrect and disadvantages you, in which case the law may be applied to you in a way that is more favourable for you, provided the commissioner is not prevented from doing so by a time limit imposed by the law). You will be protected from having to pay any underpaid tax, penalty or interest in respect of the matters covered by this ruling if it turns out that it does not correctly state how the relevant provision applies to you

ATO IDs

An ATO ID is a summary of a decision on an interpretative issue and is indicative of the ATO’s view on the interpretation of the law on that particular issue. ATO IDs are produced to assist ATO officers to apply the law consistently and accurately to particular factual situations.

This ATO ID provides you with the following level of protection:

If you reasonably apply this decision in good faith to your own circumstances (which are not materially different from those described in the decision) and the decision is later found to be incorrect, you will not be liable to pay any penalty or interest. However, you will be required to pay any underpaid tax (or repay any over-claimed credit, grant or benefit), provided the time limits under the law allow it. If you do intend to apply this decision to your own circumstances, you will need to ensure that the relevant provisions referred to in the decision have not been amended or repealed. You may wish to obtain further advice from the tax office or from a professional adviser.

Law administration practice statement

This provides direction and assistance to ATO staff on the approaches to be taken in performing duties involving the application of the laws administered by the commissioner.

Although public statements are published in the interests of open administration, their intended audience is ATO staff and they have a main purpose of providing instructions to ATO staff on the manner of performing law administration duties.

Practical compliance guidelines

From 2016, public statements will align more closely with their main purpose and Practical Compliance Guidelines (PCG) will be the appropriate communication product providing broad law administration guidance to taxpayers.

Provided a taxpayer follows a PCG, the ATO will administer the law in accordance with the approach reflected in that guideline. PCGs are not binding on the ATO and are used as safe harbours to provide an indication of how the ATO will apply its compliance resources. For example, PCG 2006/5 provide safe harbour terms for related party LRBAs that if satisfied, will not result in the ATO applying resources to review and audit LRBAs prior to FY2016.

Law companion guideline

A law companion guideline (LCG) provides the ATO view on how recently enacted law applies and is usually developed at the same time as the drafting of the bill.

An LCG will normally:

• Be published in draft form for comment when the bill is introduced into Parliament and will be finalised soon after the bill receives royal assent. It provides early certainty in relation to the application of the new law; or

• Where taxpayers need to take additional action to comply with the law, to provide certainty about what needs to be done.

An LCG will not usually be issued where the new law is straightforward, is limited in its application or does not relate to an obligation to pay tax, penalties or interest.

A range of draft LCGs have issued in relation to the super reforms that commence from 1 July 2017 including LCG 2016/D8 on superannuation reform: transfer balance cap and transition-to retirement reforms: transitional CGT relief for superannuation funds.

An LCG will usually be finalised as a public ruling at the time the bill receives royal assent and becomes law, unless issues arise during consultation or the bill is significantly amended in the bill’s passage through Parliament.

Because LCGs are prepared at such an early time, an LCG will not be informed by experience of the new law operating in practice. Therefore, while they offer the same protection in relation to underpaid tax, penalties or interest as a normal public ruling, this will only apply if a taxpayer relies on an LCG in good faith.

SMSF specific advice

An SMSF specific advice on a SISA or SISR SMSF question is not binding on the ATO. Typically, ATO advice can be sought in relation to the following topics:

Investment rules including:

• Acquisition of assets from related parties;

• Borrowing and charges;

• In-house assets;

• Business real property;

• In specie contributions/payments; and

• Payment of benefits under a condition of release.

In certain cases, if taxpayers request a PBR and SMSF specific advice, the ATO generally ask that these be separated into different requests. However, we have noticed a number of PBRs issued where the ATO has combined these two forms of guidance but have been very clear in their letter that this is where the PBR starts and finishes and similarly, this is where the SMSF specific advice starts and finishes so there is no confusion as to what part is binding and what is not binding on the ATO.

Taxpayer alerts

Taxpayer alerts (TA) are intended to be an early warning of the ATO’s concerns about significant and emerging potential aggressive tax planning issues or arrangements that it has under risk assessment. Moreover, the ATO usually develops its views more comprehensively following the issue of a TA on a topic and prior TAs can be superseded shortly after being issued.

TAs are intended to be an early warning of our concerns about significant or emerging higher risk planning issues or arrangements that the ATO has under risk assessment, or where there are recurrences of arrangements that have been previously risk assessed.

Decision impact statements

Decision impact statements (DIS) are succinct statements of the ATO’s response to significant cases decided by the courts or tribunals. They provide the details of the case including the implications of the decision and whether any ATO rulings, ATO IDs, etc need to be amended.

Superannuation circulars

Superannuation circulars explain the various legislative requirements which apply to the operation of SMSFs under SISA and SISR.

ATO web page and fact sheets

The ATO web page and fact sheets can be useful but cannot be relied on. The general administrative practice is that the ATO feels bound to follow its own written materials but in the event that the ATO is wrong, the tax is still generally payable but penalties may not be imposed.

In the interests of sound administration, the ATO’s practice has been to provide administratively binding advice in a limited range of circumstances.

For example, the ATO provides administratively binding advice on matters under the SGAA. There is no legislative framework for the provision of public, private or oral advice in relation to matters under the SGAA.

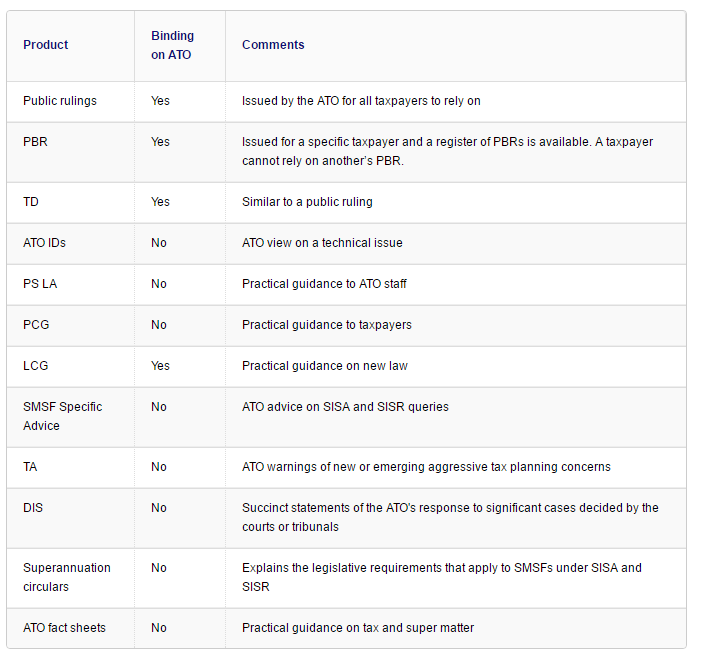

Summary of ATO materials

There is a vast array of information issued by the ATO. Advisers should be aware of each type of product and understand how it applies to taxpayers. In particular, different levels of protection apply to taxpayers relying on ATO materials. A summary of numerous ATO products follows.

Daniel Butler, director, DBA Lawyers

Tax saving

$20,000 instant asset write-off extension welcomed, but calls for broader support grow

The Australian government's decision to extend the $20,000 instant asset write-off into the next financial year has been met with approval from business leaders. However, there are growing calls for ...Read more

Tax saving

The downsizer dividend: How targeted tax levers could unlock housing supply in Australia

A call by Raine & Horne to incentivise seniors to move to smaller homes has kicked off a wider policy conversation that reaches well beyond real estate. If designed well, a targeted package could ...Read more

Tax saving

Raine & Horne's bold move could unlock housing supply but what are the hidden risks

Raine & Horne’s call for targeted tax incentives to encourage empty nesters to ‘rightsize’ isn’t just another sector wish list; it’s a potential lever to free up family homes, ease rental ...Read more

Tax saving

From annual check-ups to always‑on: how modern portfolio reviews unlock after‑tax alpha

The era of once‑a‑year portfolio check‑ins is over. Continuous, tech‑enabled reviews now drive returns through tax efficiency, risk control and behavioural discipline—especially in a high‑rate ...Read more

Tax saving

Navigating tax laws for capital gains in 2023

The landscape of Australian tax laws surrounding capital gains is ever-changing, with 2023 being no exception. Read more

Tax saving

What you need to know about the tax implications of crypto

One million Aussies are now invested in crypto, but many have not thought about how these investments will affect them at tax time. Read more

Tax saving

Welfare overhaul could give recipients a leg-up

Australia’s Centrelink recipients who’ve been doing it tough are in for a potentially easier time if the federal government pursues ambitious reforms that could provide sturdier safety nets. Read more

Tax saving

Students should think twice before tapping into their super

Former students might want to think carefully before they look to take advantage of the federal government’s biggest first home buyer incentive. Read more

Tax saving

$20,000 instant asset write-off extension welcomed, but calls for broader support grow

The Australian government's decision to extend the $20,000 instant asset write-off into the next financial year has been met with approval from business leaders. However, there are growing calls for ...Read more

Tax saving

The downsizer dividend: How targeted tax levers could unlock housing supply in Australia

A call by Raine & Horne to incentivise seniors to move to smaller homes has kicked off a wider policy conversation that reaches well beyond real estate. If designed well, a targeted package could ...Read more

Tax saving

Raine & Horne's bold move could unlock housing supply but what are the hidden risks

Raine & Horne’s call for targeted tax incentives to encourage empty nesters to ‘rightsize’ isn’t just another sector wish list; it’s a potential lever to free up family homes, ease rental ...Read more

Tax saving

From annual check-ups to always‑on: how modern portfolio reviews unlock after‑tax alpha

The era of once‑a‑year portfolio check‑ins is over. Continuous, tech‑enabled reviews now drive returns through tax efficiency, risk control and behavioural discipline—especially in a high‑rate ...Read more

Tax saving

Navigating tax laws for capital gains in 2023

The landscape of Australian tax laws surrounding capital gains is ever-changing, with 2023 being no exception. Read more

Tax saving

What you need to know about the tax implications of crypto

One million Aussies are now invested in crypto, but many have not thought about how these investments will affect them at tax time. Read more

Tax saving

Welfare overhaul could give recipients a leg-up

Australia’s Centrelink recipients who’ve been doing it tough are in for a potentially easier time if the federal government pursues ambitious reforms that could provide sturdier safety nets. Read more

Tax saving

Students should think twice before tapping into their super

Former students might want to think carefully before they look to take advantage of the federal government’s biggest first home buyer incentive. Read more