How can I maximise my super?

It is likely for most of us that our retirement will be the largest financial event of our life and superannuation, therefore, is an essential element of our retirement savings plan. The logic is simple – the more you contribute now into your fund, the more comfortable your retirement is likely to be, enabling you to do the things you want to do when you have all of the time in the world to do them.

This simple strategy will pay dividends over time. You’ll begin to enjoy the benefit of compounding returns as your savings grow, and even a little extra contribution can add a lot to your balance at retirement.

By law, your employer must pay 9.5 per cent of your ordinary time earnings into your superannuation account. If, for example, your salary is $50,000, your employer must pay an additional employer contribution of $4,750 per annum into your superannuation, as long as you earn $450 or more in a month.

It’s important to remember that ordinary time earnings are what employees earn for their ordinary hours of work including over-award payments, bonuses, commissions, allowances and certain paid leave. Make sure this is included in your super payments.

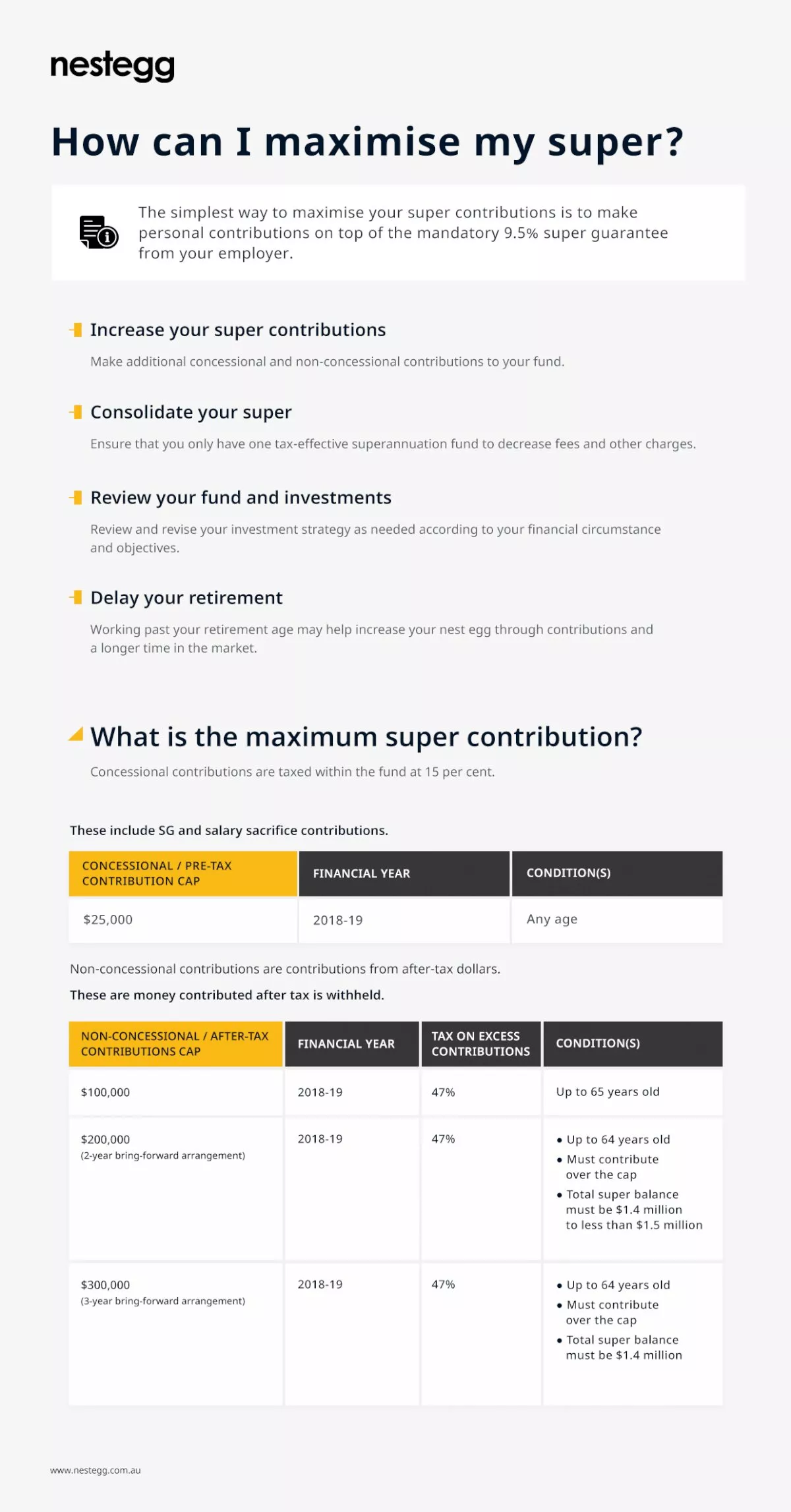

There are a range of things you can consider doing now to maximise your superannuation. Here are a few ideas worth considering to help start building your retirement funds.

1. Sacrifice some of your salary

There are several ways you can boost your super savings over and above your employer contributions.

Salary sacrificing or salary packaging can be a great way to grow your superannuation balance and save on tax. This simply involves directing an amount of your pay into superannuation from your pre-tax income (also known as concessional contributions). This can be via a self-managed superannuation fund, industry or private sector fund.

Salary sacrificed contributions into superannuation are taxed at a concessional rate of 15 per cent, which is much lower than most employees’ marginal tax rate plus the 2 per cent Medicare levy. Your employer must agree to pay some of your pre-tax salary into your superannuation account, but the reality is most are happy to do this on your behalf.

There are, however, the caps on concessional contributions which includes salary-sacrificed contributions, as well as any personal contributions claimed as a tax deduction by a self-employed person.

In the 2016-17 years, those caps sit at $30,000 for someone aged less than 49 years and $35,000 to someone who is aged 49 or more. If you make contributions over and above those levels, your superannuation contributions will be included as taxable income, which will be subject to being taxed at marginal tax rate, plus an excess concessional contributions charge will apply. In other words, you’ll be penalised for making additional contributions, so it’s worth keeping that in mind.

2. Make after-tax super contributions

Simply depositing additional money into your superannuation account can help you increase your savings. These are called after-tax superannuation contributions or non-concessional contributions. This is different from salary-sacrificed payments, which are made before your income is taxed.

In addition to the tax on concessional contributions, there are also limits to how much you can put into your superannuation as after-tax contributions. These are commonly referred to as non-concessional limits. The federal government has announced that it has removed the $500,000 cap on non-concessional contributions and replaced it with a new measure that reduces the annual non-concessional cap from $180,000 to $100,000 but allows it up to a superannuation balance of $1.6 million.

3. Low-income super contribution

If you earn less than $51,021 per year (before tax) and make after-tax superannuation contributions, you might be eligible to get matching super contributions from the government. This is called the government co-contribution.

If you earn less than $36,021, the maximum government co-contribution is $500, based on 50 cents from the government for every $1 you contribute. Unfortunately, the amount of government co-contribution reduces as your earnings increase. However, it is still worth the effort for lower income earners as it’s a tax-free payment focused on increasing your retirement savings.

4. Self-employed super contributions

If you are self-employed, you can claim a tax deduction when you contribute to your superannuation from your pre-tax income, up to the corresponding concessional cap limits.

If you’re self-employed, the danger is that you don’t make any payments at all into your superannuation because by law you don’t have to make contributions for yourself. But refraining from making the necessary contributions could leave you with very little to live on when you retire. It’s a good idea to do what you can now to take advantage of government incentives, like tax concessions on superannuation contributions, to boost your nest egg for your retirement.

5. Optimise your superannuation account

The size of your superannuation balance will depend greatly on how you invest your money and the type of funds into which you contribute. Many employees are placed into default superannuation funds when they join a fund. These funds usually target a lower level of risk/return investment approach. You will need to make sure your superannuation fund is targeting a rate of return or risk that suits you and this may require a higher growth fund to be selected to achieve your goals. It’s a good idea to talk to a financial adviser about the sort of funds in which you should invest, depending on your age and risk profile.

6. Consolidate any super accounts

Simplifying your investments as much as possible by putting all your small super into one account can help to save costs through reducing account fees and additional insurance premiums that you may be paying for, making it easier to keep track of your super savings in one account rather than having scattered investments.

7. Funding your own retirement

With the recent round of changes to superannuation by the government, it is becoming increasingly difficult for all Australians to access to the Centrelink age pension with the eligibility age being raised.

The reality is you need to be prepared to provide for our own retirement. ABS statistics show Australian women now live to an average age of 84.5 and men 80.4. We are living for much longer into retirement than we have ever before. Although most people don’t consider it, starting to prepare for a healthy, active retirement should start as soon as we enter the workforce.

Superannuation is fast becoming increasingly complicated, with new rules and a myriad of products on the market to choose from. Preparing for an adequately funded retirement can be easier said than done. Taking professional guidance and a strategic approach to meeting your goals can help to make a huge difference in the long term and this is where speaking with a financial adviser can deliver additional benefit, ensuring you retire with confidence.

Jason Dunn, strategy & distribution general manager, Anne Street Partners Financial Services

Superannuation

Rest posts healthy returns following a positive end to 2025

Rest, one of Australia's largest profit-to-member superannuation funds, has reported impressive returns in its flagship MySuper Growth investment option for the year 2025. The fund is optimistic about...Read more

Superannuation

Rest marks milestone with first private equity co-investment exit

In a significant development for Rest, one of Australia’s largest profit-to-member superannuation funds, the organisation has announced the successful completion of its first private equity co-inves...Read more

Superannuation

Expanding super for under-18s could help close the gender super gap, says Rest

In a push to address the gender disparity in superannuation savings, Rest, one of Australia's largest profit-to-member superannuation funds, has called for a significant policy change that would allow...Read more

Superannuation

Employment Hero pioneers real-time super payments with HeroClear integration

In a significant leap forward for Australia's payroll and superannuation systems, Employment Hero, in collaboration with Zepto and OZEDI, has successfully processed the country's first payroll-embedde...Read more

Superannuation

Rest launches Rest Pay to streamline superannuation payments and boost member outcomes

In a significant move aimed at enhancing compliance with upcoming superannuation regulations, Rest, one of Australia’s largest profit-to-member superannuation funds, has unveiled an innovative clear...Read more

Superannuation

Rest appoints experienced governance expert to bolster superannuation fund

Rest, one of Australia's largest profit-to-member superannuation funds, has announced the appointment of Ed Waters as the new Company Secretary. Waters, who brings with him over 15 years of extensive ...Read more

Superannuation

Small businesses brace for cash flow challenges as Payday Super becomes law

With the new Payday Super legislation now enacted, small businesses across Australia are preparing for a significant shift in how they manage superannuation contributions. The law, which mandates a tr...Read more

Superannuation

Rest launches Innovate RAP to support fairer super outcomes for First Nations members

In a significant move towards reconciliation and inclusivity, Rest, one of Australia's largest profit-to-member superannuation funds, has unveiled its Innovate Reconciliation Action Plan (RAP). This i...Read more

Superannuation

Rest posts healthy returns following a positive end to 2025

Rest, one of Australia's largest profit-to-member superannuation funds, has reported impressive returns in its flagship MySuper Growth investment option for the year 2025. The fund is optimistic about...Read more

Superannuation

Rest marks milestone with first private equity co-investment exit

In a significant development for Rest, one of Australia’s largest profit-to-member superannuation funds, the organisation has announced the successful completion of its first private equity co-inves...Read more

Superannuation

Expanding super for under-18s could help close the gender super gap, says Rest

In a push to address the gender disparity in superannuation savings, Rest, one of Australia's largest profit-to-member superannuation funds, has called for a significant policy change that would allow...Read more

Superannuation

Employment Hero pioneers real-time super payments with HeroClear integration

In a significant leap forward for Australia's payroll and superannuation systems, Employment Hero, in collaboration with Zepto and OZEDI, has successfully processed the country's first payroll-embedde...Read more

Superannuation

Rest launches Rest Pay to streamline superannuation payments and boost member outcomes

In a significant move aimed at enhancing compliance with upcoming superannuation regulations, Rest, one of Australia’s largest profit-to-member superannuation funds, has unveiled an innovative clear...Read more

Superannuation

Rest appoints experienced governance expert to bolster superannuation fund

Rest, one of Australia's largest profit-to-member superannuation funds, has announced the appointment of Ed Waters as the new Company Secretary. Waters, who brings with him over 15 years of extensive ...Read more

Superannuation

Small businesses brace for cash flow challenges as Payday Super becomes law

With the new Payday Super legislation now enacted, small businesses across Australia are preparing for a significant shift in how they manage superannuation contributions. The law, which mandates a tr...Read more

Superannuation

Rest launches Innovate RAP to support fairer super outcomes for First Nations members

In a significant move towards reconciliation and inclusivity, Rest, one of Australia's largest profit-to-member superannuation funds, has unveiled its Innovate Reconciliation Action Plan (RAP). This i...Read more