Resources

The Eurozone is in Expansion Territory

Promoted by

Economic growth in the eurozone is at the highest level in a decade and the outlook is positive for 2018. This article looks at potential opportunities as well as some challenges on the horizon.

The Eurozone is in Expansion Territory

Promoted by

Economic growth in the eurozone is at the highest level in a decade and the outlook is positive for 2018. This article looks at potential opportunities as well as some challenges on the horizon.

In this week’s ETFS Trade idea, we look to the European economic and political outlook for 2018 and highlight potential opportunities as well as some challenges on the horizon.

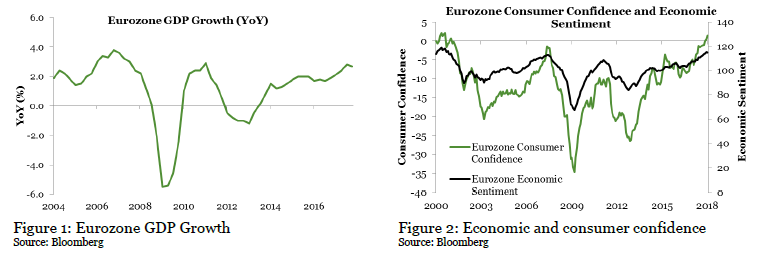

Eurozone economy growing at fastest pace in a decade

European data continues to paint a picture of an economy on the up, with positive momentum predicted to carry into 2018. Eurozone GDP grew at a rate of 2.7% in 2017 and the outlook remains positive, with the IMF forecasting growth to remain above 2% for at least the next two years. Moreover, while much of the initial impetus had come from the powerhouses of Germany and France, the periphery has now started to follow suit.

Labour markets are looking strong, with unemployment across the region continuing to plummet and wage growth picking up. Despite slipping slightly in February, sentiment remains high, with economic and consumer confidence both at levels last seen in 2001. PMI data remains positive and there are signs that excess capacity is shrinking as economic growth gathers pace.

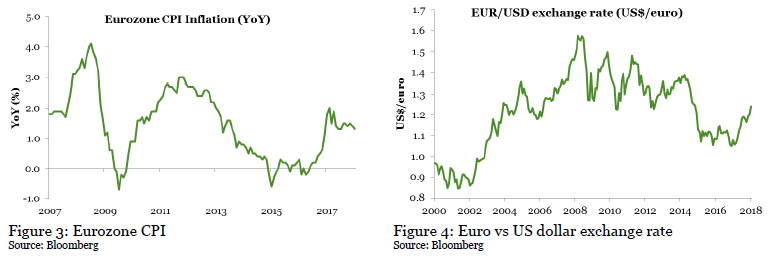

Monetary policy outlook remains stable

In the face of an expanding economy, the monetary policy outlook is surprisingly stable. Monetary stimulus in the form of the ECB’s unprecedented asset-buying programme is likely to remain. Inflationary pressures appear subdued, with CPI falling from 1.5% in November to 1.4% in December, well below the ECB’s target level of 2%.

The strength of the euro is also aiding the stimulus impact by reducing inflationary pressure from imported goods. In US dollar terms, the euro has appreciated by over 17% since the start of 2017. In historical terms, the currency is currently sitting close to its long-term average level, and many analysts are predicting further appreciation in 2018.

Political risks remain on the horizon

Political risks, so prominent in the European dialogue over the past decade, took a back seat to the improving economy in the second half of 2017. French, Dutch and German elections took place without major incident as the anti-EU populist threat appeared to dissipate.

Italian elections on 4th March are the next major event to face the region. Former President Silvio Berlusconi’s Forza Italia party are, according to polls, looking likely to be the largest in a right-leaning coalition campaigning on an anti-immigration platform. With Italy widely viewed as the most anti-EU of the major nations, observers will be watching developments with interest.

Other risk events likely to have a bearing on the shape of Europe this year include the ongoing Brexit negotiations, the final wash-up for Germany’s coalition government and developments in the Catalan push for independence.

How to invest in the eurozone?

ETFS EURO STOXX 50 ETF (ESTX) is well positioned for investors for the following reasons:

- ESTX captures the performance of the 50 largest corporations in the eurozone – all significant global players in their fields.

- ESTX tracks the world’s most widely traded European benchmark index – the EURO STOXX 50 Index.

- ESTX is unhedged with respect to currency movements; meaning that investors benefit from a strengthening euro or weakening Australian dollar and vice-versa.

- No UK companies are included in ESTX, making it somewhat Brexit remote compared to other pan-European funds.

- ESTX is the joint lowest cost Europe-focused ETF on the ASX with an MER of 0.35% p.a.

- ESTX is domiciled in Australia so there are no W8-BEN tax forms for investors to complete and US estate tax is not applicable

- ESTX has Recommended rating by Lonsec.

ETFS EURO STOXX 50® ETF factsheet

GET MORE INFORMATION

To sign up for future ETFS Trade ideas, email

To find out more about ETF Securities products, visit www.etfsecurities.com.au

Sponsored features

Dissecting the Complexities of Cash Indices Regulations: An In-Depth Analysis

Introduction In recent years, the world of finance has seen a surge of interest in cash indices trading as investors seek potential returns in various markets. This development has brought increased ...Read more

Sponsored features

The Best Ways to Find the Right Trading Platform

Promoted by Animus Webs Read more

Sponsored features

How the increase in SMSF members benefits business owners

Promoted by ThinkTank Read more

Sponsored features

Thinktank’s evolution in residential lending and inaugural RMBS transaction

Promoted by Thinktank When Thinktank, a specialist commercial and residential property lender, recently closed its first residential mortgage-backed securitisation (RMBS) issue for $500 million, it ...Read more

Sponsored features

Investors tap into cyber space to grow their wealth

Promoted by Citi Group Combined, our daily spending adds up to opportunities for investors on a global scale. Read more

Sponsored features

Ecommerce boom as world adjusts to pandemic driven trends

Promoted by Citi Group COVID-19 has accelerated the use of technologies that help keep us connected, creating a virtual supply chain and expanded digital universe for investors. Read more

Sponsored features

Industrial property – the silver lining in the retail cloud

Promoted by ThinkTank Read more

Sponsored features

Why the non-bank sector appeals to SMSFs

Promoted by Think Tank Read more

Sponsored features

Dissecting the Complexities of Cash Indices Regulations: An In-Depth Analysis

Introduction In recent years, the world of finance has seen a surge of interest in cash indices trading as investors seek potential returns in various markets. This development has brought increased ...Read more

Sponsored features

The Best Ways to Find the Right Trading Platform

Promoted by Animus Webs Read more

Sponsored features

How the increase in SMSF members benefits business owners

Promoted by ThinkTank Read more

Sponsored features

Thinktank’s evolution in residential lending and inaugural RMBS transaction

Promoted by Thinktank When Thinktank, a specialist commercial and residential property lender, recently closed its first residential mortgage-backed securitisation (RMBS) issue for $500 million, it ...Read more

Sponsored features

Investors tap into cyber space to grow their wealth

Promoted by Citi Group Combined, our daily spending adds up to opportunities for investors on a global scale. Read more

Sponsored features

Ecommerce boom as world adjusts to pandemic driven trends

Promoted by Citi Group COVID-19 has accelerated the use of technologies that help keep us connected, creating a virtual supply chain and expanded digital universe for investors. Read more

Sponsored features

Industrial property – the silver lining in the retail cloud

Promoted by ThinkTank Read more

Sponsored features

Why the non-bank sector appeals to SMSFs

Promoted by Think Tank Read more