Invest

Why is Sydney a popular place to live in?

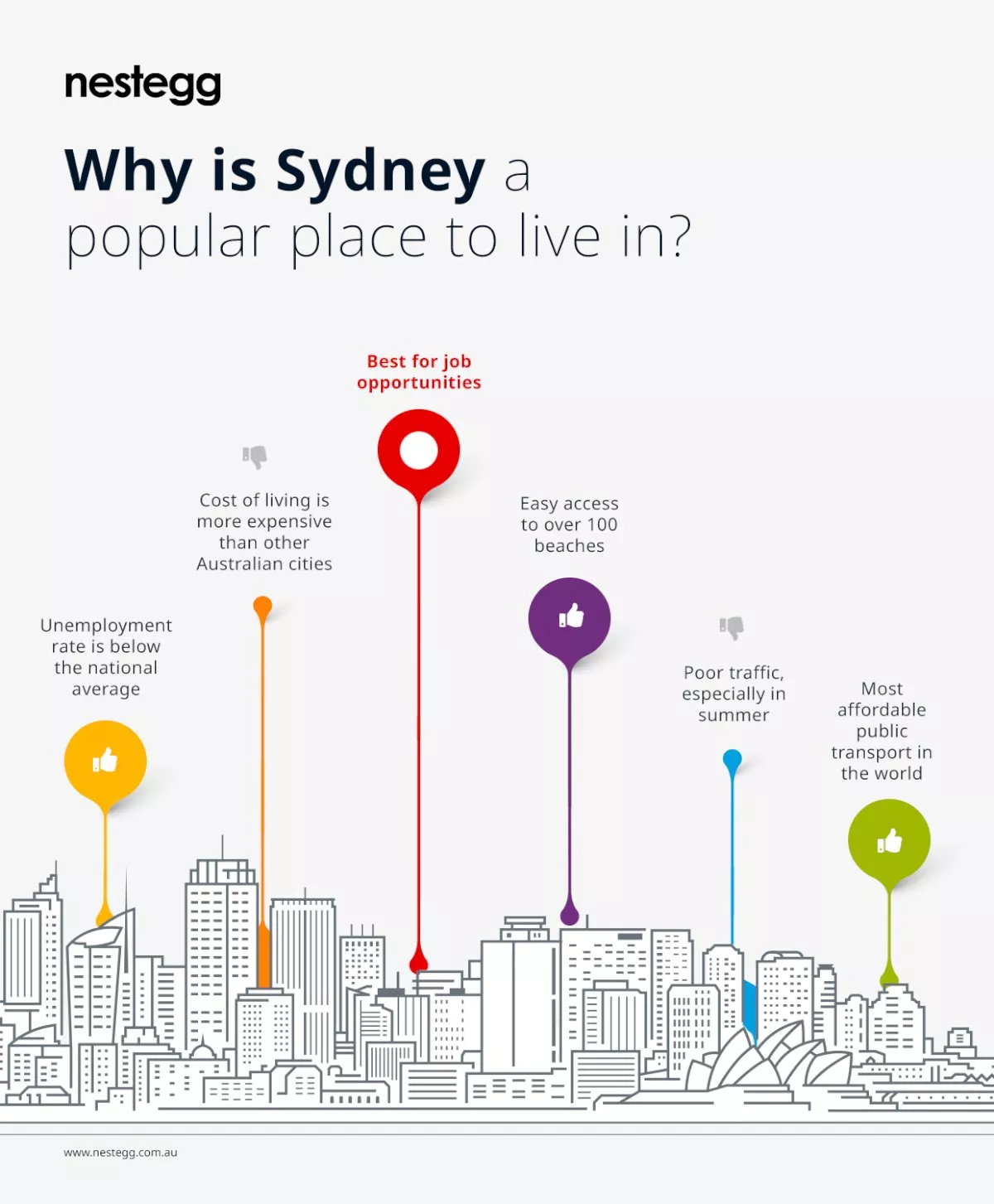

INFOGRAPHIC: There’s no denying that Sydney is home to one of the most picturesque harbours in the world. In fact, millions of tourists find their way to the Sydney Harbour and the Sydney Opera House each year to enjoy the view and culturally diverse activities.

Why is Sydney a popular place to live in?

INFOGRAPHIC: There’s no denying that Sydney is home to one of the most picturesque harbours in the world. In fact, millions of tourists find their way to the Sydney Harbour and the Sydney Opera House each year to enjoy the view and culturally diverse activities.

But Sydney isn’t only popular for its beauty — the sprawling state capital of NSW boasts great things when it comes to improving its population’s livelihood.

Here are some of the reasons that has allowed Sydney to maintain its status as one of the best cities in the world to live in.

Affordable public transport

According to the Australian Bureau of Statistics (ABS), Sydney is Australia’s most populated city, with an estimated population density of 400 people per square kilometre.

Naturally, moving this large population around is crucial to keeping the city’s economy thriving – and this is where Sydney’s comprehensive public transport network comes in.

Sydney’s public transport in the world is among the most affordable in the world.

Poor traffic

The downside for Sydneysiders is that the city usually suffers from poor traffic, with volumes typically reaching its peak during the summer season.

Low unemployment rate

According to the ABS labour force survey and Centrelink data, Sydney’s unemployment rate is at 2.46 per cent for the March 2019 quarter. This is well below the national average, which is at 5.1 per cent.

The 2019 census reveals that among the 171,427 local resident workers, 47.8 per cent are professionals and managerial-level workers. The remaining 52 per cent include clerical, administrative, community and personal service, sales, technicians trade and other skilled labourers.

Best for job opportunities

Sydney’s low unemployment rate is most likely influenced by the host of job opportunities that workers may choose from – and it’s not just Sydneysiders. The city’s sprawling economy paves the way for businesses to succeed and expand and opens more employment opportunities for Sydneysiders and migrants.

High cost of living

Sydney’s sprawling economy also has its downsides, particularly in the cost of living.

Despite high income-earning opportunities, Sydney’s cost of living is one of the highest among other Australian cities – and it doesn’t help that property values are just as high.

Best for beach lovers

When it comes to leisure activities, especially of the beach variety, Sydneysiders have easy access to over 100 beaches.

About the author

About the author

Property

Multigenerational living is moving mainstream: how agents, developers and lenders can monetise the shift

Australia’s quiet housing revolution is no longer a niche lifestyle choice; it’s a structural shift in demand that will reward property businesses prepared to redesign product, pricing and go‑to...Read more

Property

Prestige property, precision choice: a case study in selecting the right agent when millions are at stake

In Australia’s top-tier housing market, the wrong agent choice can quietly erase six figures from a sale. Privacy protocols, discreet buyer networks and data-savvy marketing have become the new curr...Read more

Property

From ‘ugly’ to alpha: Turning outdated Australian homes into high‑yield assets

In a tight listings market, outdated properties aren’t dead weight—they’re mispriced optionality. Agencies and vendors that industrialise light‑touch refurbishment, behavioural marketing and A...Read more

Property

The 2026 Investor Playbook: Rental Tailwinds, City Divergence and the Tech-Led Operations Advantage

Rental income looks set to do the heavy lifting for investors in 2026, but not every capital city will move in lockstep. Industry veteran John McGrath tips a stronger rental year and a Melbourne rebou...Read more

Property

Prestige property, precision choice: Data, discretion and regulation now decide million‑dollar outcomes

In Australia’s prestige housing market, the selling agent is no longer a mere intermediary but a strategic supplier whose choices can shift outcomes by seven figures. The differentiators are no long...Read more

Property

The new battleground in housing: how first-home buyer policy is reshaping Australia’s entry-level market

Government-backed guarantees and stamp duty concessions have pushed fresh demand into the bottom of Australia’s price ladder, lifting values and compressing selling times in entry-level segments. Th...Read more

Property

Property 2026: Why measured moves will beat the market

In 2026, Australian property success will be won by investors who privilege resilience over velocity. The market is fragmenting by suburb and asset type, financing conditions remain tight, and regulat...Read more

Property

Entry-level property is winning: How first home buyer programs are reshaping demand, pricing power and strategy

Lower-priced homes are appreciating faster as government support channels demand into the entry tier. For developers, lenders and marketers, this is not a blip—it’s a structural reweighting of dem...Read more

Property

Multigenerational living is moving mainstream: how agents, developers and lenders can monetise the shift

Australia’s quiet housing revolution is no longer a niche lifestyle choice; it’s a structural shift in demand that will reward property businesses prepared to redesign product, pricing and go‑to...Read more

Property

Prestige property, precision choice: a case study in selecting the right agent when millions are at stake

In Australia’s top-tier housing market, the wrong agent choice can quietly erase six figures from a sale. Privacy protocols, discreet buyer networks and data-savvy marketing have become the new curr...Read more

Property

From ‘ugly’ to alpha: Turning outdated Australian homes into high‑yield assets

In a tight listings market, outdated properties aren’t dead weight—they’re mispriced optionality. Agencies and vendors that industrialise light‑touch refurbishment, behavioural marketing and A...Read more

Property

The 2026 Investor Playbook: Rental Tailwinds, City Divergence and the Tech-Led Operations Advantage

Rental income looks set to do the heavy lifting for investors in 2026, but not every capital city will move in lockstep. Industry veteran John McGrath tips a stronger rental year and a Melbourne rebou...Read more

Property

Prestige property, precision choice: Data, discretion and regulation now decide million‑dollar outcomes

In Australia’s prestige housing market, the selling agent is no longer a mere intermediary but a strategic supplier whose choices can shift outcomes by seven figures. The differentiators are no long...Read more

Property

The new battleground in housing: how first-home buyer policy is reshaping Australia’s entry-level market

Government-backed guarantees and stamp duty concessions have pushed fresh demand into the bottom of Australia’s price ladder, lifting values and compressing selling times in entry-level segments. Th...Read more

Property

Property 2026: Why measured moves will beat the market

In 2026, Australian property success will be won by investors who privilege resilience over velocity. The market is fragmenting by suburb and asset type, financing conditions remain tight, and regulat...Read more

Property

Entry-level property is winning: How first home buyer programs are reshaping demand, pricing power and strategy

Lower-priced homes are appreciating faster as government support channels demand into the entry tier. For developers, lenders and marketers, this is not a blip—it’s a structural reweighting of dem...Read more