Invest

How to capitalise on a heating market

As Australian consumers continue their sea change shift, investors looking to capitalise are being advised they may have a limited window, with a deeper analysis of the area required before purchasing.

How to capitalise on a heating market

As Australian consumers continue their sea change shift, investors looking to capitalise are being advised they may have a limited window, with a deeper analysis of the area required before purchasing.

In a conversation with Smart Property Investment, InvestorKit’s head of research, Arjun Paliwal, explained the driving forces behind a push towards a sea change.

“The sea change is definitely happening. The rental market is the first to show this because people do not need large liquidity changes,” Mr Paliwal said.

However, investors are being advised that they might not be able to get the bargain they were hoping for when purchasing in a coastal area.

“The clear theme we are seeing is the rental market is displaying a tremendous shift towards houses.

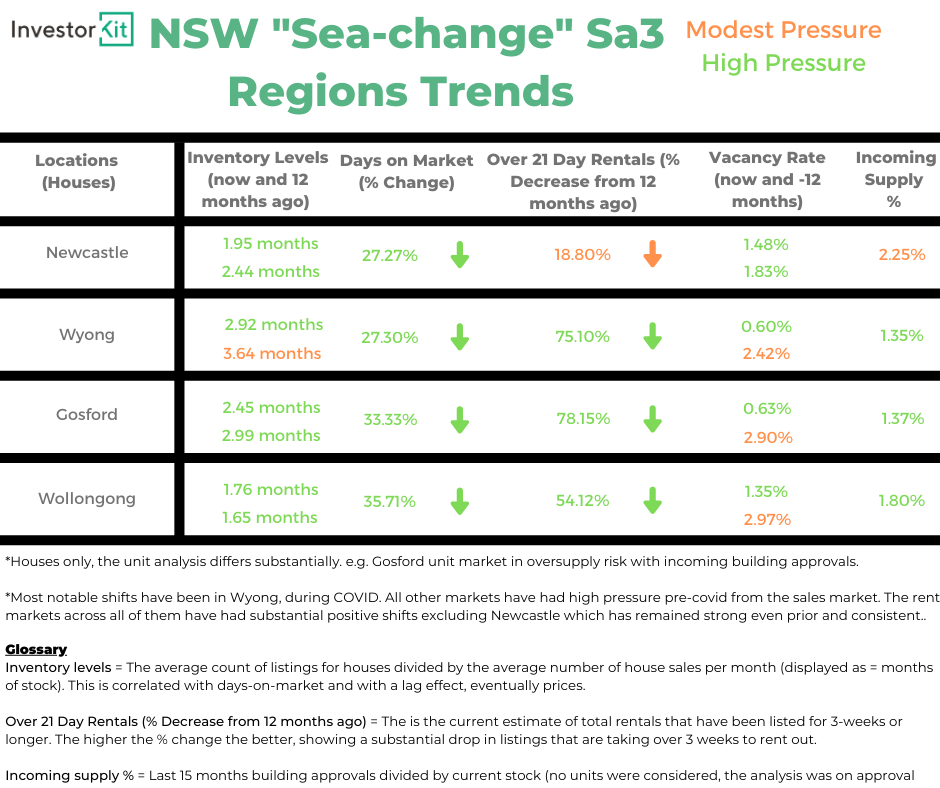

“With regards to stock levels, all four regions display extreme lows in stocks, with high pressure likely.

“From the last census, all of these regions have a high outright ownership, so many people in these regions do not need to sell,” Mr Paliwal told investors.

While pointing out it might be difficult to enter the market, Mr Paliwal explained to purchasers that it is important they look at the property from an investment perspective and do not simply fall in love with a beachside property.

“Investors are going to find it difficult to buy in these four regions in pockets where there is not a large supply of new builds and supply coming towards the middle.

“In areas that are built out, investors will find it difficult to compete with owner-occupiers.

“On the ground, we are seeing many open homes being sold in the first weekend, as well as the first open homes having 30 to 50 people attending, with many owner-occupiers pushing prices to a higher range,” Mr Paliwal said.

Due to such high demand, Mr Paliwal noted that investors looking to get into a sea change market might consider not having a hard number.

“I think, in these areas, you need to have a deeper dive on your comparable analysis than ever before.

“It goes beyond it looks nice or has a nice feeling. Instead, investors need to consider room sizes, dining and lounge room finishes, bathroom situations, backyard situations, car park spacing, neighbourhoods, and is it walking distance to shops.

“In these areas, rather than coming up to a straight price, they need to break down the comparables more than ever before. Only because what might look nicer from a house might not be in the right neighbourhood or have the right bells and whistles,” Mr Paliwal said.

He also pointed out that in markets where they haven’t seen the percentage rise but have seen an increase in interest, those who miss out on the first property will all be competing for the next one.

“If 30 people miss out, they will join you for the next. A sales agent will say a comparable sell in two days at or above the price range.

“They are going to take that comparable to their next vendor listing presentation. This is when the start of market upticks occur and new listings rise in prices.

“This is where people need to be mindful that by setting hard limits and not doing a deep-dive comparable analysis, they might miss out on properties, and when they find the right one, they might pay a little too much,” Mr Paliwal concluded.

About the author

About the author

Property

Multigenerational living is moving mainstream: how agents, developers and lenders can monetise the shift

Australia’s quiet housing revolution is no longer a niche lifestyle choice; it’s a structural shift in demand that will reward property businesses prepared to redesign product, pricing and ...Read more

Property

Prestige property, precision choice: a case study in selecting the right agent when millions are at stake

In Australia’s top-tier housing market, the wrong agent choice can quietly erase six figures from a sale. Privacy protocols, discreet buyer networks and data-savvy marketing have become the new ...Read more

Property

From ‘ugly’ to alpha: Turning outdated Australian homes into high‑yield assets

In a tight listings market, outdated properties aren’t dead weight—they’re mispriced optionality. Agencies and vendors that industrialise light‑touch refurbishment, behavioural marketing and ...Read more

Property

The 2026 Investor Playbook: Rental Tailwinds, City Divergence and the Tech-Led Operations Advantage

Rental income looks set to do the heavy lifting for investors in 2026, but not every capital city will move in lockstep. Industry veteran John McGrath tips a stronger rental year and a Melbourne ...Read more

Property

Prestige property, precision choice: Data, discretion and regulation now decide million‑dollar outcomes

In Australia’s prestige housing market, the selling agent is no longer a mere intermediary but a strategic supplier whose choices can shift outcomes by seven figures. The differentiators are no longer ...Read more

Property

The new battleground in housing: how first-home buyer policy is reshaping Australia’s entry-level market

Government-backed guarantees and stamp duty concessions have pushed fresh demand into the bottom of Australia’s price ladder, lifting values and compressing selling times in entry-level segmentsRead more

Property

Property 2026: Why measured moves will beat the market

In 2026, Australian property success will be won by investors who privilege resilience over velocity. The market is fragmenting by suburb and asset type, financing conditions remain tight, and ...Read more

Property

Entry-level property is winning: How first home buyer programs are reshaping demand, pricing power and strategy

Lower-priced homes are appreciating faster as government support channels demand into the entry tier. For developers, lenders and marketers, this is not a blip—it’s a structural reweighting of demand ...Read more

Property

Multigenerational living is moving mainstream: how agents, developers and lenders can monetise the shift

Australia’s quiet housing revolution is no longer a niche lifestyle choice; it’s a structural shift in demand that will reward property businesses prepared to redesign product, pricing and ...Read more

Property

Prestige property, precision choice: a case study in selecting the right agent when millions are at stake

In Australia’s top-tier housing market, the wrong agent choice can quietly erase six figures from a sale. Privacy protocols, discreet buyer networks and data-savvy marketing have become the new ...Read more

Property

From ‘ugly’ to alpha: Turning outdated Australian homes into high‑yield assets

In a tight listings market, outdated properties aren’t dead weight—they’re mispriced optionality. Agencies and vendors that industrialise light‑touch refurbishment, behavioural marketing and ...Read more

Property

The 2026 Investor Playbook: Rental Tailwinds, City Divergence and the Tech-Led Operations Advantage

Rental income looks set to do the heavy lifting for investors in 2026, but not every capital city will move in lockstep. Industry veteran John McGrath tips a stronger rental year and a Melbourne ...Read more

Property

Prestige property, precision choice: Data, discretion and regulation now decide million‑dollar outcomes

In Australia’s prestige housing market, the selling agent is no longer a mere intermediary but a strategic supplier whose choices can shift outcomes by seven figures. The differentiators are no longer ...Read more

Property

The new battleground in housing: how first-home buyer policy is reshaping Australia’s entry-level market

Government-backed guarantees and stamp duty concessions have pushed fresh demand into the bottom of Australia’s price ladder, lifting values and compressing selling times in entry-level segmentsRead more

Property

Property 2026: Why measured moves will beat the market

In 2026, Australian property success will be won by investors who privilege resilience over velocity. The market is fragmenting by suburb and asset type, financing conditions remain tight, and ...Read more

Property

Entry-level property is winning: How first home buyer programs are reshaping demand, pricing power and strategy

Lower-priced homes are appreciating faster as government support channels demand into the entry tier. For developers, lenders and marketers, this is not a blip—it’s a structural reweighting of demand ...Read more