Invest

How Hurricane Harvey will affect investors

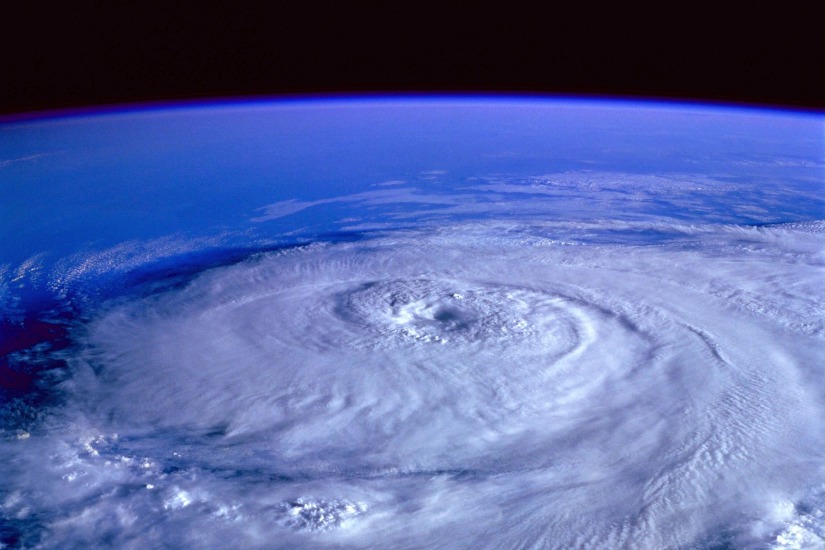

Texas is the second largest economy within the US, but the severe damage caused by Hurricane Harvey is unlikely to hit investors too heavily, according to an economist.

How Hurricane Harvey will affect investors

Texas is the second largest economy within the US, but the severe damage caused by Hurricane Harvey is unlikely to hit investors too heavily, according to an economist.

Hurricane Harvey, which made landfall in the US on 25 August, is the first major hurricane to hit the country in around 12 years, but is unlikely to have a severe or lasting effect on markets, according to Shane Oliver of AMP Capital.

Mr Oliver based his beliefs of historic data taken from August 2005, when Hurricane Katrina hit the US coastline and caused similar damage.

“As we have seen with past such disasters including Hurricane Katrina in August 2005 the negative economic impact will be [relatively] minor and temporary,” he said.

“US growth went from 3 per cent in the third quarter of 2005 to 2 per cent in the fourth quarter to 5 per cent in the first quarter of 2006 and will be followed by a boost due to rebuilding. The US Federal Reserve will look through it.”

Mr Oliver said that the hurricane will likely stifle the country’s economic data through increased jobless claims and higher inflation, driven by higher petrol prices, as 20 per cent of US oil refineries have been shut down in the midst of the storm, but other risks have now been reduced.

These risks include the possibility of a government shut down and a debt ceiling crisis, where the US government risks reaching the maximum amount of money it’s allowed to borrow.

“US federal government agencies like the Federal Emergency Management Agency will be central to the assistance and rebuild effort and Texas voted for Trump,” Mr Oliver explained.

“Given this, it's inconceivable that Trump and Congress will countenance a government shutdown and debt ceiling crisis in the immediate aftermath of a disaster.”

The US government typically avoids debt ceiling crises by raising the amount they’re allowed to borrow, and Mr Oliver said US President Donald Trump is “reportedly” looking to include a request to raise the ceiling in the request for Hurricane Harvey relief funding, thus speeding up the process.

“More broadly at the margin Harvey may help galvanise Republicans in Congress to get moving on their agenda — with tax reform high on the list and infrastructure in there as well,” Mr Oliver added.

Property

Multigenerational living is moving mainstream: how agents, developers and lenders can monetise the shift

Australia’s quiet housing revolution is no longer a niche lifestyle choice; it’s a structural shift in demand that will reward property businesses prepared to redesign product, pricing and ...Read more

Property

Prestige property, precision choice: a case study in selecting the right agent when millions are at stake

In Australia’s top-tier housing market, the wrong agent choice can quietly erase six figures from a sale. Privacy protocols, discreet buyer networks and data-savvy marketing have become the new ...Read more

Property

From ‘ugly’ to alpha: Turning outdated Australian homes into high‑yield assets

In a tight listings market, outdated properties aren’t dead weight—they’re mispriced optionality. Agencies and vendors that industrialise light‑touch refurbishment, behavioural marketing and ...Read more

Property

The 2026 Investor Playbook: Rental Tailwinds, City Divergence and the Tech-Led Operations Advantage

Rental income looks set to do the heavy lifting for investors in 2026, but not every capital city will move in lockstep. Industry veteran John McGrath tips a stronger rental year and a Melbourne ...Read more

Property

Prestige property, precision choice: Data, discretion and regulation now decide million‑dollar outcomes

In Australia’s prestige housing market, the selling agent is no longer a mere intermediary but a strategic supplier whose choices can shift outcomes by seven figures. The differentiators are no longer ...Read more

Property

The new battleground in housing: how first-home buyer policy is reshaping Australia’s entry-level market

Government-backed guarantees and stamp duty concessions have pushed fresh demand into the bottom of Australia’s price ladder, lifting values and compressing selling times in entry-level segmentsRead more

Property

Property 2026: Why measured moves will beat the market

In 2026, Australian property success will be won by investors who privilege resilience over velocity. The market is fragmenting by suburb and asset type, financing conditions remain tight, and ...Read more

Property

Entry-level property is winning: How first home buyer programs are reshaping demand, pricing power and strategy

Lower-priced homes are appreciating faster as government support channels demand into the entry tier. For developers, lenders and marketers, this is not a blip—it’s a structural reweighting of demand ...Read more

Property

Multigenerational living is moving mainstream: how agents, developers and lenders can monetise the shift

Australia’s quiet housing revolution is no longer a niche lifestyle choice; it’s a structural shift in demand that will reward property businesses prepared to redesign product, pricing and ...Read more

Property

Prestige property, precision choice: a case study in selecting the right agent when millions are at stake

In Australia’s top-tier housing market, the wrong agent choice can quietly erase six figures from a sale. Privacy protocols, discreet buyer networks and data-savvy marketing have become the new ...Read more

Property

From ‘ugly’ to alpha: Turning outdated Australian homes into high‑yield assets

In a tight listings market, outdated properties aren’t dead weight—they’re mispriced optionality. Agencies and vendors that industrialise light‑touch refurbishment, behavioural marketing and ...Read more

Property

The 2026 Investor Playbook: Rental Tailwinds, City Divergence and the Tech-Led Operations Advantage

Rental income looks set to do the heavy lifting for investors in 2026, but not every capital city will move in lockstep. Industry veteran John McGrath tips a stronger rental year and a Melbourne ...Read more

Property

Prestige property, precision choice: Data, discretion and regulation now decide million‑dollar outcomes

In Australia’s prestige housing market, the selling agent is no longer a mere intermediary but a strategic supplier whose choices can shift outcomes by seven figures. The differentiators are no longer ...Read more

Property

The new battleground in housing: how first-home buyer policy is reshaping Australia’s entry-level market

Government-backed guarantees and stamp duty concessions have pushed fresh demand into the bottom of Australia’s price ladder, lifting values and compressing selling times in entry-level segmentsRead more

Property

Property 2026: Why measured moves will beat the market

In 2026, Australian property success will be won by investors who privilege resilience over velocity. The market is fragmenting by suburb and asset type, financing conditions remain tight, and ...Read more

Property

Entry-level property is winning: How first home buyer programs are reshaping demand, pricing power and strategy

Lower-priced homes are appreciating faster as government support channels demand into the entry tier. For developers, lenders and marketers, this is not a blip—it’s a structural reweighting of demand ...Read more