Invest

Best and worst places to own property revealed

A property research house has released the median house price growth over the last 20 years, revealing the best and worst places to own property.

Best and worst places to own property revealed

A property research house has released the median house price growth over the last 20 years, revealing the best and worst places to own property.

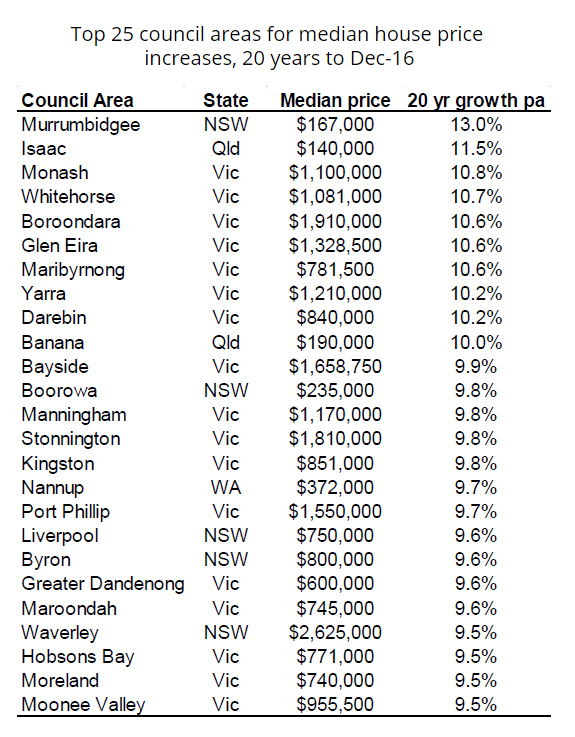

CoreLogic has revealed the top 25 winners and losers in the Australian property game over the last two decades, based on median house price growth.

The top ten, which includes Waverly and Liverpool in Sydney, have enjoyed median prices growing by double-digit annually for the last 20 years.

Inexplicably, it was Murrumbidgee in NSW’s south-west that topped the list with a whopping 13 per cent growth per annum.

“I can’t really explain why Murrumbidgee is the number one performer, although I think the main reason is that prices came off an extremely low base 20 years ago and the fact that during the late 1990s, there was a bit of a boom to that market,” CoreLogic head of research Cameron Kusher said.

Melbourne was the clear winner, claiming six of the top ten areas, including the neighbouring areas of Monash, Whitehorse and Boroondara.

“I think ultimately it’s because we haven't really seen a sustained downturn in the Melbourne housing market for the last 20 years, whereas even though Sydney is very strong at the moment, it and most other capital cities have seen a downturn for at least five years during this time,” Mr Kusher said.

“Melbourne has been the most resilient housing market for the last two decades, not having had a sustained downturn since between 1991 and 1995 when it was coming out of the last recession.”

Victoria was well-represented with 17 of the top 25 areas.

Source: CoreLogic

Meanwhile, the regions of Isaac and neighbouring Banana made up Queensland’s representation in the top 10, despite both suffering recent mining slumps.

“Issac and those kind of areas have had a big downturn in the last five years but still we’ve seen prices come from virtually nowhere and there still much higher than they were 20 years ago,” Mr Kusher said.

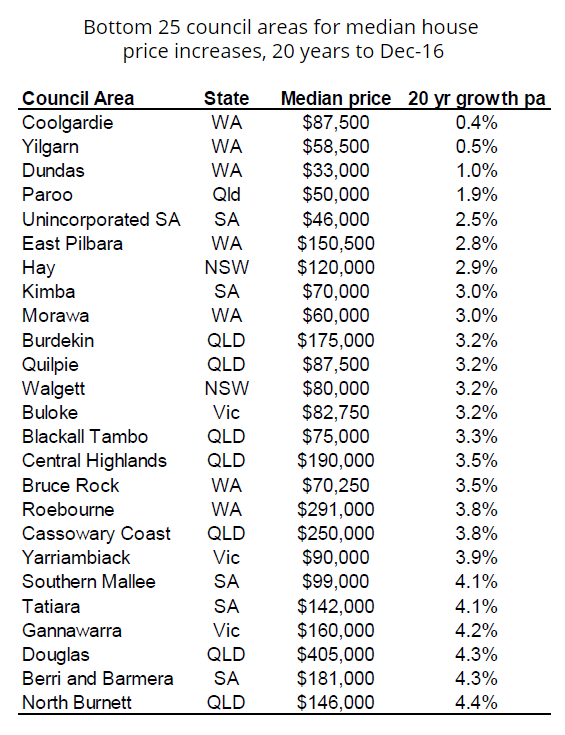

“When you look at the bottom of the list, you can see the effect of the mining boom as well, given the common theme is that most of the worst performers are mining or agricultural areas linked to one or two industries.”

It was no surprise that Western Australia, Queensland and South Australia are home to the 20 worst performers.

Source: CoreLogic

Embattled WA held the worst three performing areas, with Coolgardie, Yilgarn and Dundas scrapping 1 per cent or less annualised growth.

“It was surprising that Coolgardie’s house prices have remained unmoved given it’s next to Kargoolie which is a long-established mining area that hasn’t seen a mining boom or bust,” Mr Kusher said.

“Not one of these worst-performing council areas is situated in a capital city, highlighting that there is often a divide between the performance of capital city and regional housing markets.”

Property

Multigenerational living is moving mainstream: how agents, developers and lenders can monetise the shift

Australia’s quiet housing revolution is no longer a niche lifestyle choice; it’s a structural shift in demand that will reward property businesses prepared to redesign product, pricing and ...Read more

Property

Prestige property, precision choice: a case study in selecting the right agent when millions are at stake

In Australia’s top-tier housing market, the wrong agent choice can quietly erase six figures from a sale. Privacy protocols, discreet buyer networks and data-savvy marketing have become the new ...Read more

Property

From ‘ugly’ to alpha: Turning outdated Australian homes into high‑yield assets

In a tight listings market, outdated properties aren’t dead weight—they’re mispriced optionality. Agencies and vendors that industrialise light‑touch refurbishment, behavioural marketing and ...Read more

Property

The 2026 Investor Playbook: Rental Tailwinds, City Divergence and the Tech-Led Operations Advantage

Rental income looks set to do the heavy lifting for investors in 2026, but not every capital city will move in lockstep. Industry veteran John McGrath tips a stronger rental year and a Melbourne ...Read more

Property

Prestige property, precision choice: Data, discretion and regulation now decide million‑dollar outcomes

In Australia’s prestige housing market, the selling agent is no longer a mere intermediary but a strategic supplier whose choices can shift outcomes by seven figures. The differentiators are no longer ...Read more

Property

The new battleground in housing: how first-home buyer policy is reshaping Australia’s entry-level market

Government-backed guarantees and stamp duty concessions have pushed fresh demand into the bottom of Australia’s price ladder, lifting values and compressing selling times in entry-level segmentsRead more

Property

Property 2026: Why measured moves will beat the market

In 2026, Australian property success will be won by investors who privilege resilience over velocity. The market is fragmenting by suburb and asset type, financing conditions remain tight, and ...Read more

Property

Entry-level property is winning: How first home buyer programs are reshaping demand, pricing power and strategy

Lower-priced homes are appreciating faster as government support channels demand into the entry tier. For developers, lenders and marketers, this is not a blip—it’s a structural reweighting of demand ...Read more

Property

Multigenerational living is moving mainstream: how agents, developers and lenders can monetise the shift

Australia’s quiet housing revolution is no longer a niche lifestyle choice; it’s a structural shift in demand that will reward property businesses prepared to redesign product, pricing and ...Read more

Property

Prestige property, precision choice: a case study in selecting the right agent when millions are at stake

In Australia’s top-tier housing market, the wrong agent choice can quietly erase six figures from a sale. Privacy protocols, discreet buyer networks and data-savvy marketing have become the new ...Read more

Property

From ‘ugly’ to alpha: Turning outdated Australian homes into high‑yield assets

In a tight listings market, outdated properties aren’t dead weight—they’re mispriced optionality. Agencies and vendors that industrialise light‑touch refurbishment, behavioural marketing and ...Read more

Property

The 2026 Investor Playbook: Rental Tailwinds, City Divergence and the Tech-Led Operations Advantage

Rental income looks set to do the heavy lifting for investors in 2026, but not every capital city will move in lockstep. Industry veteran John McGrath tips a stronger rental year and a Melbourne ...Read more

Property

Prestige property, precision choice: Data, discretion and regulation now decide million‑dollar outcomes

In Australia’s prestige housing market, the selling agent is no longer a mere intermediary but a strategic supplier whose choices can shift outcomes by seven figures. The differentiators are no longer ...Read more

Property

The new battleground in housing: how first-home buyer policy is reshaping Australia’s entry-level market

Government-backed guarantees and stamp duty concessions have pushed fresh demand into the bottom of Australia’s price ladder, lifting values and compressing selling times in entry-level segmentsRead more

Property

Property 2026: Why measured moves will beat the market

In 2026, Australian property success will be won by investors who privilege resilience over velocity. The market is fragmenting by suburb and asset type, financing conditions remain tight, and ...Read more

Property

Entry-level property is winning: How first home buyer programs are reshaping demand, pricing power and strategy

Lower-priced homes are appreciating faster as government support channels demand into the entry tier. For developers, lenders and marketers, this is not a blip—it’s a structural reweighting of demand ...Read more