Invest

Are apartments a good investment?

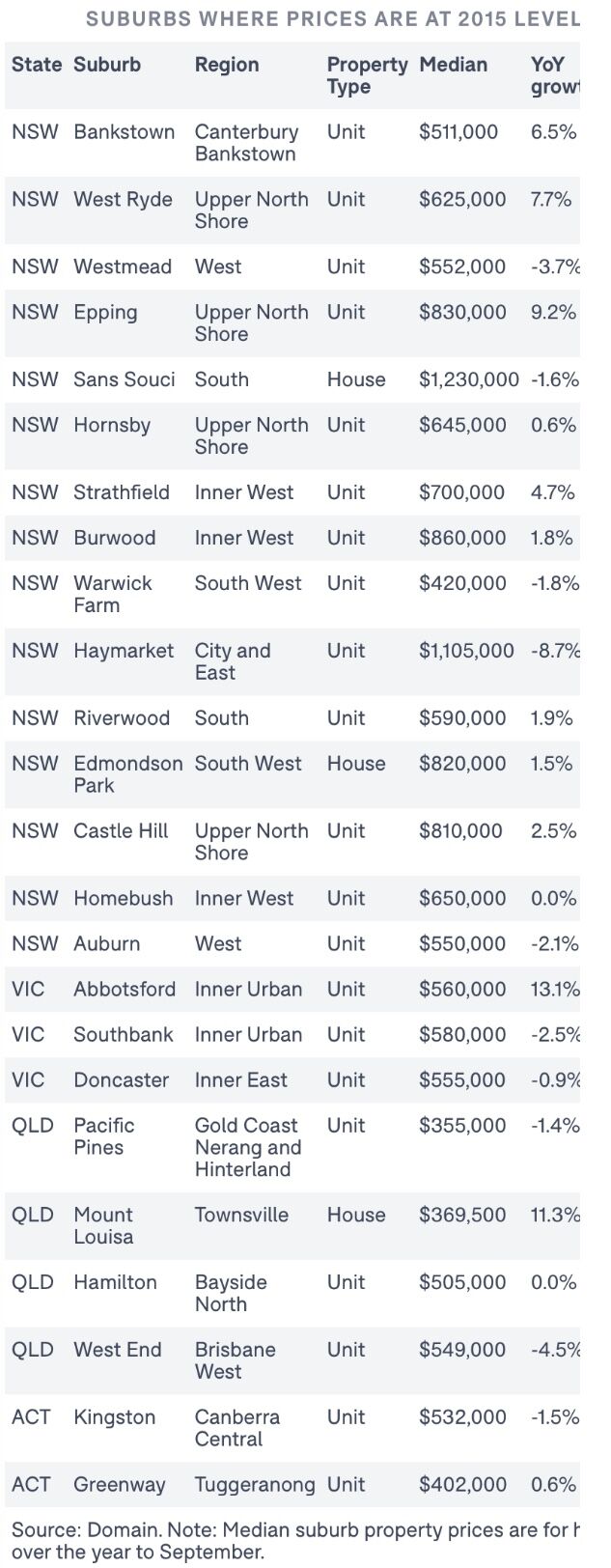

As the property market surges towards 2017 highs, investors might be wondering if it is time to buy cheaper apartments closer to the city.

Are apartments a good investment?

As the property market surges towards 2017 highs, investors might be wondering if it is time to buy cheaper apartments closer to the city.

In a conversation with nestegg, InvestorKit’s head of research, Arjun Paliwal, advised investors to look beyond apartments, with freestanding properties outperforming apartments regardless of location.

“Most investors who purchase apartments are usually doing it because of a lack of knowledge or a lack of support in order to purchase in markets that are outside of areas that are familiar to the investor,” Mr Paliwal said.

He noted that recent CoreLogic stats have shown that the strength in the housing market has not translated into strong growth for apartments.

House values have driven gains in the combined capitals index over the past three months, rising 1.1 per cent. While the rate of decline has eased, capital city unit values fell by -0.6 per cent over the same period.

“This trend towards stronger conditions in detached housing markets is evident across most of the capital cities. Relative weakness in the unit market can be attributed to factors including low investment activity, higher supply levels in some regions and weaker rental market conditions across key inner-city unit precincts,” Corelogic head of research Tim Lawless said.

What to look for when buying an apartment

While highlighting the investors should look into freestanding properties, the researcher explained what investors in apartments should be looking for.

“Investors should look for a point of difference,” Mr Paliwal said.

“Now a point of difference can be room sizes, bells and whistles as part of the complex or the overall appeal of the dwelling.

“The greater differentiators are likely to happen in boutique blocks,” he said.

The researcher said investors who are going to purchase an apartment might need to purchase an entire block to protect themselves against downside risks.

“Investors could look for areas where they can purchase a block of units rather than the singular apartment,” he said.

“With the whole block, it takes away the downside of apartments, which is supply. If an investor owns the entire block, if there are zoning changes, you can use it to your advantage.

“The second advantage is when sales in a block have distress or deceased estate or any types of sales that impact comparables – you can’t control that. However, when you own the block, it’s unlikely the investor will distress sale one of two apartments,” Mr Paliwal explained.

He also pointed out the investor can control the rents, with other investors unable to impact rental returns through changing prices.

About the author

About the author

Property

Multigenerational living is moving mainstream: how agents, developers and lenders can monetise the shift

Australia’s quiet housing revolution is no longer a niche lifestyle choice; it’s a structural shift in demand that will reward property businesses prepared to redesign product, pricing and ...Read more

Property

Prestige property, precision choice: a case study in selecting the right agent when millions are at stake

In Australia’s top-tier housing market, the wrong agent choice can quietly erase six figures from a sale. Privacy protocols, discreet buyer networks and data-savvy marketing have become the new ...Read more

Property

From ‘ugly’ to alpha: Turning outdated Australian homes into high‑yield assets

In a tight listings market, outdated properties aren’t dead weight—they’re mispriced optionality. Agencies and vendors that industrialise light‑touch refurbishment, behavioural marketing and ...Read more

Property

The 2026 Investor Playbook: Rental Tailwinds, City Divergence and the Tech-Led Operations Advantage

Rental income looks set to do the heavy lifting for investors in 2026, but not every capital city will move in lockstep. Industry veteran John McGrath tips a stronger rental year and a Melbourne ...Read more

Property

Prestige property, precision choice: Data, discretion and regulation now decide million‑dollar outcomes

In Australia’s prestige housing market, the selling agent is no longer a mere intermediary but a strategic supplier whose choices can shift outcomes by seven figures. The differentiators are no longer ...Read more

Property

The new battleground in housing: how first-home buyer policy is reshaping Australia’s entry-level market

Government-backed guarantees and stamp duty concessions have pushed fresh demand into the bottom of Australia’s price ladder, lifting values and compressing selling times in entry-level segmentsRead more

Property

Property 2026: Why measured moves will beat the market

In 2026, Australian property success will be won by investors who privilege resilience over velocity. The market is fragmenting by suburb and asset type, financing conditions remain tight, and ...Read more

Property

Entry-level property is winning: How first home buyer programs are reshaping demand, pricing power and strategy

Lower-priced homes are appreciating faster as government support channels demand into the entry tier. For developers, lenders and marketers, this is not a blip—it’s a structural reweighting of demand ...Read more

Property

Multigenerational living is moving mainstream: how agents, developers and lenders can monetise the shift

Australia’s quiet housing revolution is no longer a niche lifestyle choice; it’s a structural shift in demand that will reward property businesses prepared to redesign product, pricing and ...Read more

Property

Prestige property, precision choice: a case study in selecting the right agent when millions are at stake

In Australia’s top-tier housing market, the wrong agent choice can quietly erase six figures from a sale. Privacy protocols, discreet buyer networks and data-savvy marketing have become the new ...Read more

Property

From ‘ugly’ to alpha: Turning outdated Australian homes into high‑yield assets

In a tight listings market, outdated properties aren’t dead weight—they’re mispriced optionality. Agencies and vendors that industrialise light‑touch refurbishment, behavioural marketing and ...Read more

Property

The 2026 Investor Playbook: Rental Tailwinds, City Divergence and the Tech-Led Operations Advantage

Rental income looks set to do the heavy lifting for investors in 2026, but not every capital city will move in lockstep. Industry veteran John McGrath tips a stronger rental year and a Melbourne ...Read more

Property

Prestige property, precision choice: Data, discretion and regulation now decide million‑dollar outcomes

In Australia’s prestige housing market, the selling agent is no longer a mere intermediary but a strategic supplier whose choices can shift outcomes by seven figures. The differentiators are no longer ...Read more

Property

The new battleground in housing: how first-home buyer policy is reshaping Australia’s entry-level market

Government-backed guarantees and stamp duty concessions have pushed fresh demand into the bottom of Australia’s price ladder, lifting values and compressing selling times in entry-level segmentsRead more

Property

Property 2026: Why measured moves will beat the market

In 2026, Australian property success will be won by investors who privilege resilience over velocity. The market is fragmenting by suburb and asset type, financing conditions remain tight, and ...Read more

Property

Entry-level property is winning: How first home buyer programs are reshaping demand, pricing power and strategy

Lower-priced homes are appreciating faster as government support channels demand into the entry tier. For developers, lenders and marketers, this is not a blip—it’s a structural reweighting of demand ...Read more