Invest

10 years on, here’s where you should have bought

According to new figures, one Melbourne suburb has seen property values increase by 130 per cent in 10 years. In other news, hindsight is a beautiful thing.

10 years on, here’s where you should have bought

According to new figures, one Melbourne suburb has seen property values increase by 130 per cent in 10 years. In other news, hindsight is a beautiful thing.

The latest CoreLogic Home Value Index data has shone a light on the Australian regions that have seen the greatest increase in dwelling values in the decade to October 2017.

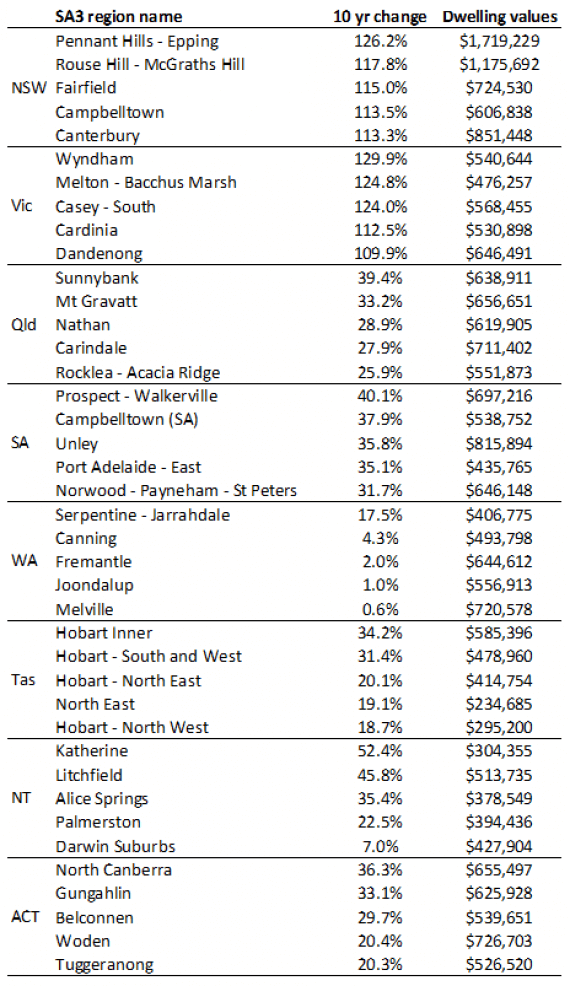

The number one suburb was Wyndham in Victoria where the current $540,644 value reflects a whopping 129.9 per cent increase.

The outer south-western Melbourne region has seen “substantial new housing development” occur in the past 10 years.

Close behind Wyndham is the Pennant Hills – Epping region in Sydney. A 126.2 per cent increase has seen the average dwelling value shoot to $1.7 million.

The figures also provide insight into the relative strength of the housing markets in different states.

With the strongest suburb in Western Australia (Serpentine-Jarrahdale) recording an increase of just 17.5 per cent and the fifth strongest (Melville) up just 0.6 per cent, the numbers highlight “just how weak the housing market in Perth has been over the past decade, despite the mining boom supporting strong capital gains over the first half of the decade”, CoreLogic analyst Cameron Kusher said.

“When analysing the regions with the greatest value increases, the top 10 regions nationally are all located in either Sydney or Melbourne while Katherine in the Northern Territory is the only region outside of NSW or Victoria to have recorded value growth in excess of 50 per cent (52.4 per cent) over the past decade.

“This highlights how much stronger value growth has been in Sydney and Melbourne relative to other capital cities over the past decade.”

The number one suburb in Queensland, Sunnybank saw an increase of 39.4 per cent to $638,911, while the top South Australia region (Prospect – Walkerville) jumped 40.1 per cent to $697,216.

Hobart Inner in Tasmania saw prices increase by 34.2 per cent to $585,396 and dwelling values in North Canberra in the ACT grew by 36.3 per cent to $655,497.

Mr Kusher continued: “The top five list for each state and territory shows a significant slant towards capital city regions rather than regional housing markets. In fact, only Katherine and Alice Springs make the list for the top five in each state and territory outside of a capital city.

“Overall the data highlights the strength of value growth in Sydney and Melbourne over recent years. Furthermore, it details just how moderate growth has generally been outside of these two cities.”

However, he noted that Sydney and Melbourne together account for about 40.3 per cent of the national population and 58.3 per cent of the total value of dwellings across the country.

“Given this, it really highlights the extent to which the performance of the Sydney and Melbourne housing markets will drive the national headline growth figures.”

Here's the full list:

Regions in each state with the greatest increase in dwelling values, decade to October 2017

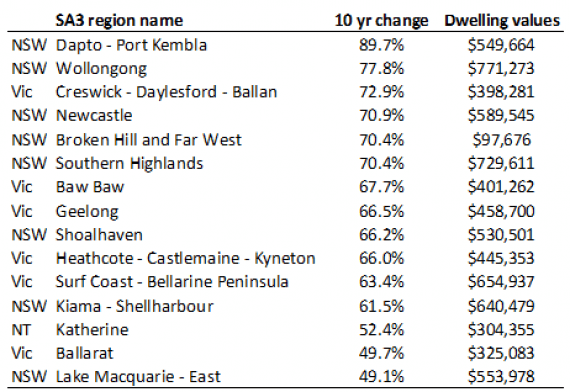

Non-capital city regions with the greatest increase in dwelling values, decade to October 2017

Property

Multigenerational living is moving mainstream: how agents, developers and lenders can monetise the shift

Australia’s quiet housing revolution is no longer a niche lifestyle choice; it’s a structural shift in demand that will reward property businesses prepared to redesign product, pricing and ...Read more

Property

Prestige property, precision choice: a case study in selecting the right agent when millions are at stake

In Australia’s top-tier housing market, the wrong agent choice can quietly erase six figures from a sale. Privacy protocols, discreet buyer networks and data-savvy marketing have become the new ...Read more

Property

From ‘ugly’ to alpha: Turning outdated Australian homes into high‑yield assets

In a tight listings market, outdated properties aren’t dead weight—they’re mispriced optionality. Agencies and vendors that industrialise light‑touch refurbishment, behavioural marketing and ...Read more

Property

The 2026 Investor Playbook: Rental Tailwinds, City Divergence and the Tech-Led Operations Advantage

Rental income looks set to do the heavy lifting for investors in 2026, but not every capital city will move in lockstep. Industry veteran John McGrath tips a stronger rental year and a Melbourne ...Read more

Property

Prestige property, precision choice: Data, discretion and regulation now decide million‑dollar outcomes

In Australia’s prestige housing market, the selling agent is no longer a mere intermediary but a strategic supplier whose choices can shift outcomes by seven figures. The differentiators are no longer ...Read more

Property

The new battleground in housing: how first-home buyer policy is reshaping Australia’s entry-level market

Government-backed guarantees and stamp duty concessions have pushed fresh demand into the bottom of Australia’s price ladder, lifting values and compressing selling times in entry-level segmentsRead more

Property

Property 2026: Why measured moves will beat the market

In 2026, Australian property success will be won by investors who privilege resilience over velocity. The market is fragmenting by suburb and asset type, financing conditions remain tight, and ...Read more

Property

Entry-level property is winning: How first home buyer programs are reshaping demand, pricing power and strategy

Lower-priced homes are appreciating faster as government support channels demand into the entry tier. For developers, lenders and marketers, this is not a blip—it’s a structural reweighting of demand ...Read more

Property

Multigenerational living is moving mainstream: how agents, developers and lenders can monetise the shift

Australia’s quiet housing revolution is no longer a niche lifestyle choice; it’s a structural shift in demand that will reward property businesses prepared to redesign product, pricing and ...Read more

Property

Prestige property, precision choice: a case study in selecting the right agent when millions are at stake

In Australia’s top-tier housing market, the wrong agent choice can quietly erase six figures from a sale. Privacy protocols, discreet buyer networks and data-savvy marketing have become the new ...Read more

Property

From ‘ugly’ to alpha: Turning outdated Australian homes into high‑yield assets

In a tight listings market, outdated properties aren’t dead weight—they’re mispriced optionality. Agencies and vendors that industrialise light‑touch refurbishment, behavioural marketing and ...Read more

Property

The 2026 Investor Playbook: Rental Tailwinds, City Divergence and the Tech-Led Operations Advantage

Rental income looks set to do the heavy lifting for investors in 2026, but not every capital city will move in lockstep. Industry veteran John McGrath tips a stronger rental year and a Melbourne ...Read more

Property

Prestige property, precision choice: Data, discretion and regulation now decide million‑dollar outcomes

In Australia’s prestige housing market, the selling agent is no longer a mere intermediary but a strategic supplier whose choices can shift outcomes by seven figures. The differentiators are no longer ...Read more

Property

The new battleground in housing: how first-home buyer policy is reshaping Australia’s entry-level market

Government-backed guarantees and stamp duty concessions have pushed fresh demand into the bottom of Australia’s price ladder, lifting values and compressing selling times in entry-level segmentsRead more

Property

Property 2026: Why measured moves will beat the market

In 2026, Australian property success will be won by investors who privilege resilience over velocity. The market is fragmenting by suburb and asset type, financing conditions remain tight, and ...Read more

Property

Entry-level property is winning: How first home buyer programs are reshaping demand, pricing power and strategy

Lower-priced homes are appreciating faster as government support channels demand into the entry tier. For developers, lenders and marketers, this is not a blip—it’s a structural reweighting of demand ...Read more