Invest

Why global monetary policy is holding back investors and savers

Global monetary policy has a massive impact on the potential for investors to achieve the returns they want. In this piece, Clime Asset Management's John Abernethy breaks down the ways current monetary policy is hurting investors and savers. Brought to you by Clime Asset Management.

Why global monetary policy is holding back investors and savers

Global monetary policy has a massive impact on the potential for investors to achieve the returns they want. In this piece, Clime Asset Management's John Abernethy breaks down the ways current monetary policy is hurting investors and savers. Brought to you by Clime Asset Management.

The recently held Economic Policy Symposium in Jackson Hole, Wyoming, could have been a meeting where the co-ordinated normalisation of monetary policy across the world was announced.

It looked like being a special symposium and expectations were high because both Janet Yellen (the current chair of the US Federal Reserve) and Mario Draghi (the president of the European Central Bank) were down to speak.

Further, Japanese Central Bank governor Haruhiko Kuroda, was in the audience and so there was hope that something substantive would be said.

The anticipation was also heightened because at Mario Draghi’s last appearance in 2014, he used the symposium to strongly hint that Europe would follow the US Federal Reserve and commence with its own quantitative easing policy (where a central bank uses its own government bonds to keep interest rates low and money available).

Three years later, his reappearance suggested that he may give an indication of when European quantitative easing (QE) might end.

With these big three in the same place and the eyes of the world’s financial system watching, it was hoped that an honest appraisal of the world’s monetary policy outlook and agreed strategies would be outlined — alas, the only co-ordination was a walk in the park for coffee and photos.

By way of background, the symposium is hosted each year in August by the Federal Reserve of Kansas.

According to Wikipedia, the location at Jackson Lake Lodge was originally chosen as the inaugural meeting place because trout fishing was required to induce the then US Federal Reserve chairman, Paul Volcker, to attend in 1982. It has stayed there ever since.

This year, the central bankers that spoke claimed some success as the developed world pushes through a “cyclical and synchronised growth phase”.

However, we should not get too excited because the synchronised growth is not occurring at a strong enough rate to justify a pull-back in the extraordinarily supportive monetary policies — things are good, but not that good.

Interest rates need to stay negative or near zero to keep the world’s economy ticking; emergency life support is still required, and will be for the forseeable future.

It is interesting to note that the big three central bankers have become the world’s largest asset managers, and importantly, they do not have to generate a return on their portfolios — and are doing their darndest to achieve this feat.

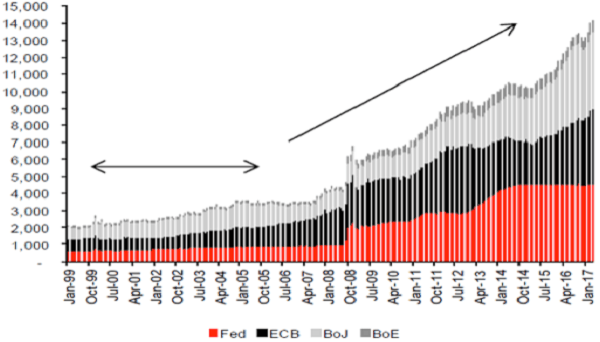

Together, their central banks have amassed US$14 trillion of assets, which is about $10 trillion more than the amount held leading into the GFC. The 10-year monetary expansion experiment has maintained the solvency of governments, some of which cannot pay market rates of interest on their massive debt – most notably Japan.

Figure 1. Growth of G4 central bank balance sheets — now exceeds $US14 trillion

Source. CEIC; Macquarie Research, June 2017

In retrospect, we may have expected too much from Jackson Hole. Mario Draghi may have had little to gain from pre-empting the September European Central Bank (ECB) policy meeting.

Further, neither he nor Governor Kuroda are in a position to opine with any authority as to when simultaneous monetary policy normalisation might occur.

The three bankers present as co-pilots of a jet going nowhere. The only pressing issue for each of them seems to be whether they will retire before the monetary fuel runs out.

Notable comments

While policy pronouncements were not forthcoming, there were a few interesting observations that deserve acknowledgement and reflection.

The following observation was made by Janet Yellen when reviewing the US financial system leading into the GFC. Reading it carefully, it could well describe the Australian financial system and economy of today.

“The vulnerabilities within the financial system in the mid-2000s were numerous and, in hindsight, familiar from past financial panics. Financial institutions had assumed too much risk, especially related to the housing market, through mortgage lending standards that were far too lax and contributed to substantial over borrowing.

“Repeating a familiar pattern, the ‘madness of crowds’ had contributed to a bubble in which investors and households expected rapid appreciation in house prices.

“The long period of economic stability beginning in the 1980s had led to complacency about potential risks, and the build-up of risk was not widely recognised. As a result, market and supervisory discipline was lacking, and financial institutions were allowed to take on high levels of leverage.”

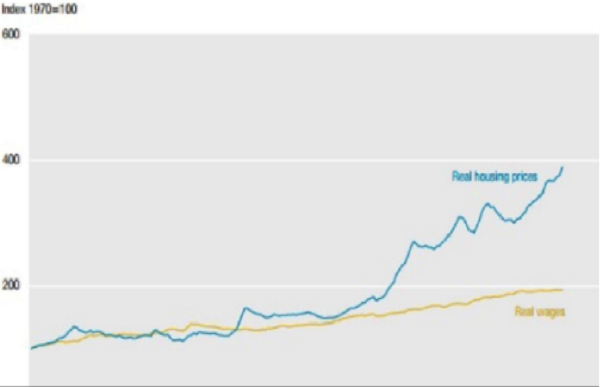

Figure 2. Real housing price and wage indexes: Australia, 1970-2016

Source. ABS

Given the above chart, and with this week’s announcement by APRA of its intended investigation into Commonwealth Bank’s governance, culture and accountability, Yellen’s reflections of the US in 2007 should ring alarm bells.

After 26 years of continuous growth, can anybody claim that complacency does not abound across our financial system?

Further, that market and supervisory discipline has not been lacking?

Indeed, the extraordinary blow-out in Australian household debt and the associated Sydney and Melbourne house price bubbles suggest that today’s Australian financial regulators must have been still at school in 2007.

Other key themes and commentary covered by both Yellen and Draghi in their speeches dealt with financial regulation, financial capital adequacy, ageing demographics and the requirement for free trade to be the key driver for growth and productivity.

Remarkably, it was Mario Draghi that homed in on the challenges emerging for “free trade” across the world.

In our view, his analysis was somewhat hypocritical because money printing and the maintenance of negative interest rates by the ECB is clearly anti-competitive.

By undertaking these policies, the ECB has debased the Euro and created an unfair trade playing field for Europe’s benefit.

It appeared that Draghi hadn’t pre-read his own speech when he declared that —

“…there is the concern about whether openness is fair – i.e. whether all are playing by the same rules and applying the same standards. This manifests itself in fears about currency manipulation by trading partners, dumping practices and lack of reciprocal market access.”

We agree that open trade and the sharing of technological advancements are crucial for world growth, so too is the proper cost of both capital and debt such that risk is fairly compensated.

Without proper compensation, capital will be squandered and returns on invested capital will fall.

Draghi noted that the western world is stalling, and policies need to be developed to openly trade technological advancements.

“To inject more dynamism into the global economy we need to raise potential output growth, and to do so with ageing societies we need to lift productivity growth. For advanced economies that are close to the technological frontier, this depends crucially on openness to trade.”

At another point, Draghi observed that the ageing dynamics of the western world is now threatening to permanently stall world economic growth. He declared:

“Old-age dependency ratios are rising, putting more pressure on public finances. By 2025 there will be 35 people aged 65 and over for every 100 persons of working age in OECD countries, compared with 14 in 1950. At the same time, public debt levels have surged in those countries from 56 per cent of GDP in 2007 to around 87 per cent today.

“Only higher potential growth can provide a lasting solution… At the centre of this debate is the question of how to raise potential output growth, which has slowed from around 2 per cent in OECD countries in 2000 to around 1 per cent today…

“Without stronger potential growth, the cyclical recovery we are now seeing globally will ultimately converge downwards to those slower growth rates. Slower growth will in turn make it harder to work through the debt and demographic challenges facing many advanced economies.”

The problem with this analysis is that it assumes that growth can now pay back accumulated debt. However, for that to happen, the cost of that debt must stay permanently low — dooming savers and pension funds to sub-optimal returns for decades to come. Their only recourse is to chase returns by taking excessive risk.

Frankly, the world’s central bankers either have no idea of the mess they have created, or are content to let others deal with the problems ‘down the road’.

Draghi’s commentary ignored the obvious solution for debt: it should be bought by the central banks with printed money and written off.

It should be obvious that the massive amounts of government debt across Europe, Japan and probably the US cannot be repaid, therefore it is foolish to carry on with interest rate policies that are crippling low risk investing whilst rewarding high risk speculation.

Draghi’s dream of debt repayment from growth assumes the emergence of a massive deflationary growth phase where wages across the world fall as productivity sharply lifts.

Interest rates stay low, there is no inflation, and people are convinced that they can consume more with less. It simply is not credible.

Both Yellen and Draghi used their speeches to argue against dismantling financial regulation. In reviewing Yellen’s case, some commentators suggested that she was rebuffing President Trump’s push for deregulation of US financial institutions and his desire to free up credit.

Others suggested she was merely signalling her retirement as Federal Reserve chair in early 2018.

Whatever her intentions, Yellen was quite clear in stating that today’s financial system is safer than 2007 —

“The evidence shows that reforms since the crisis have made the financial system substantially safer. Loss-absorbing capacity among the largest banks is significantly higher; with Tier 1 common equity capital more than doubling from early 2009 to now… reforms have boosted the resilience of the financial system. Banks are safer”.

Let’s not forget the Bank of Japan (BOJ)

While BOJ Governor Kuroda was not saying anything publicly at Jackson Hole, he had already taken precautions before he arrived. In early July (and in case either Mario Draghi or Janet Yellen said something about policy) the BOJ once again put in place a massive manipulation strategy that secured their long-term bond yields.

Readers might recall the scare in world bond markets in early July when the Federal Reserve began talking about the reduction of its balance sheet.

That is, it signalled the intention to reduce its bond holdings by not reinvesting its cash maturities. So what did the Bank of Japan do to fight off the risk that long-term bond yields might sharply rise in a worldwide bond market rout?

It offered to buy unlimited amounts of 10-year Japanese bonds at a yield of just 0.11 per cent, thereby putting a floor underneath Japanese 10-year bond prices, and the market since has actually not traded at this yield and appears headed below 0.10 per cent.

A residual effect of this massive manipulation was the market yields on even longer dated Japanese bonds. As you can see from our final graph below, Japanese 20-year bonds yield 0.5 per cent, 30-year bonds yield 0.8 per cent and 40-year bonds now yield the magical 1.0 per cent.

Today, the Bank of Japan owns over 40 per cent of all Japanese government bonds on issue.

Figure 3. Yield premium to 10-year bonds for 20-, 30- and 40-year JGB's

Source. Bloomberg, Japan Bond Trading Co.

It’s no wonder that governor Kuroda was not invited to say anything at Jackson Hole. The above chart is quite simply inexplicable, and his policies are grossly anti-free trade.

John Abernethy is chief investment officer at Clime Asset Management. To access John’s exclusive Letter to investors, click here.

Investment insights

APAC deal activity down by 3% in 2025 as China and India offset broader decline

The Asia-Pacific (APAC) region witnessed a moderation in deal activity in 2025, with a 3% decline in the total number of deals announced compared to the previous year. This downturn, encompassing ...Read more

Investment insights

Risk seeking among the noise: institutional investors shift strategies amid market fluctuations

In a landscape marked by evolving market dynamics, institutional investors are demonstrating a cautious yet strategic shift in their investment patterns. The latest State Street Institutional Investor ...Read more

Investment insights

2026 Portfolio Growth: Why Australia’s Savviest Investors Are Pausing Deals and Doubling Down on Operations

After a two-year sugar hit for property returns, multiple signals suggest 2026 is a danger year for buying sprees. Australian investors are being urged to slow acquisitions, protect balance sheets, ...Read more

Investment insights

Investors warn: AI hype is fuelling a bubble in humanoid robotics

The burgeoning field of humanoid robotics, powered by artificial intelligence (AI), is drawing significant investor interest, but experts warn that the hype might be creating a bubble. A recent report ...Read more

Investment insights

Australia emerges as key player in 2025 APAC private equity market

Australia has solidified its position as a significant player in the Asia-Pacific (APAC) private equity market, according to a new analysis by global private markets firm HarbourVest PartnersRead more

Investment insights

Global deal activity declines by 6% amid challenging market conditions, reports GlobalData

In a year marked by economic uncertainty and geopolitical tensions, global deal activity has experienced a notable decline, according to recent findings by GlobalData, a prominent data and analytics ...Read more

Investment insights

Furious five trends set to reshape the investment landscape in 2026

The investment landscape of 2026 is poised for transformation as five key trends, dubbed the "Furious Five" by CMC Markets, are set to dominate and disrupt markets. These trends encompass artificial ...Read more

Investment insights

Investors maintain cautious stance amid data uncertainty

Amidst the backdrop of a US government shutdown and lingering economic uncertainties, investors have adopted a neutral stance, as revealed by the latest State Street Institutional Investor IndicatorsRead more

Investment insights

APAC deal activity down by 3% in 2025 as China and India offset broader decline

The Asia-Pacific (APAC) region witnessed a moderation in deal activity in 2025, with a 3% decline in the total number of deals announced compared to the previous year. This downturn, encompassing ...Read more

Investment insights

Risk seeking among the noise: institutional investors shift strategies amid market fluctuations

In a landscape marked by evolving market dynamics, institutional investors are demonstrating a cautious yet strategic shift in their investment patterns. The latest State Street Institutional Investor ...Read more

Investment insights

2026 Portfolio Growth: Why Australia’s Savviest Investors Are Pausing Deals and Doubling Down on Operations

After a two-year sugar hit for property returns, multiple signals suggest 2026 is a danger year for buying sprees. Australian investors are being urged to slow acquisitions, protect balance sheets, ...Read more

Investment insights

Investors warn: AI hype is fuelling a bubble in humanoid robotics

The burgeoning field of humanoid robotics, powered by artificial intelligence (AI), is drawing significant investor interest, but experts warn that the hype might be creating a bubble. A recent report ...Read more

Investment insights

Australia emerges as key player in 2025 APAC private equity market

Australia has solidified its position as a significant player in the Asia-Pacific (APAC) private equity market, according to a new analysis by global private markets firm HarbourVest PartnersRead more

Investment insights

Global deal activity declines by 6% amid challenging market conditions, reports GlobalData

In a year marked by economic uncertainty and geopolitical tensions, global deal activity has experienced a notable decline, according to recent findings by GlobalData, a prominent data and analytics ...Read more

Investment insights

Furious five trends set to reshape the investment landscape in 2026

The investment landscape of 2026 is poised for transformation as five key trends, dubbed the "Furious Five" by CMC Markets, are set to dominate and disrupt markets. These trends encompass artificial ...Read more

Investment insights

Investors maintain cautious stance amid data uncertainty

Amidst the backdrop of a US government shutdown and lingering economic uncertainties, investors have adopted a neutral stance, as revealed by the latest State Street Institutional Investor IndicatorsRead more