Invest

What's next for Chinese tech?

The entrepreneurial vision in China along with state-backed funding has led to one of the fastest growing and vibrant start up scenes in the world, rivaled only by that of Silicon Valley.

What's next for Chinese tech?

The entrepreneurial vision in China along with state-backed funding has led to one of the fastest growing and vibrant start up scenes in the world, rivaled only by that of Silicon Valley.

China's tech sector, under the government initiatives of “Internet Plus”, “Made in China 2025”, and “Outline on the National Information Technology Development Strategy”, is emerging as an innovation and technology powerhouse.

Year-to-date, however, the Chinese tech sector has significantly underperformed its US counterpart. At the beginning of the year, the biggest issue weighing on Chinese equities was the government’s financial de-risking campaign and quasi fiscal moderation. In order to try and de-risk its economy, China has been on strict path to deleverage, with stricter financial regulation and rules to curb shadow banking and misallocation of capital to non-productive areas of the economy. Add to this trade frictions, slowing economic growth, tightening US monetary policy, and a stronger dollar, and we see a perfect storm in Chinese equity markets that has sent them into a tailspin since the beginning of the year.

As economic data began to cool off and miss estimates, the Chinese government pre-empted a growth slowdown and stepped in in to ensure economic growth was not compromised. A double-barreled fiscal and monetary easing campaign has been enacted. There have already been three reserve ratio requirement cuts this year (with more expected), record medium-term lending facility liquidity injections, and a fiscal stimulus package including 65 billion yuan in tax cuts, expanding the preferential policy for small firms to all firms plus an infrastructure spending package all aimed at boosting domestic demand.

All this signals a policy shift towards easing, which is likely to support growth momentum in China for the time being – something that markets may be underestimating at the moment. Although the policy efforts introduced so far do not amount to broad-based easing as seen in 2009, these measures should not be underestimated.

The valuation of Chinese tech has been extreme relative to the US. As the graph below shows, historically a basket of Chinese tech companies trade at a valuation premium to US tech when comparing P/E ratios due to stellar growth. Now that actual growth is no longer meeting expectations, we are seeing a repricing across the sector as a whole. The market is revaluing Chinese tech stocks based on a slowing growth trajectory rather than a structural problem within the sector. For example, Tencent shares fell 6.67 per cent in the US after reporting weaker than expected numbers but it is still one of the fastest-growing technology companies in the world, as Saxo Bank head of equity strategy Peter Garnry recently pointed out.

Valuations have corrected significantly within the Chinese tech sector and the A-shares market. The valuation premium for Chinese tech is now the lowest since 2012 (see above graph), which may present an opportunity for long-term investors. As Mr Garnry notes, it’s often when others hesitate that one should act. When China’s stimulus begins to halt the weakness, the market will likely reprice the A-shares market as there remains attractive opportunities and even more so now at the current low valuation compared to developed markets.

Overall, the Chinese technology sector remains exciting in the longer term. The ecosystem contains a variety of interesting businesses with significant opportunities with the ability to drive growth and increase profitability for investors. Demographic shifts, with the rapid rise of the Chinese middle class and a burgeoning economy, have unleashed a wave of consumer engagement in China resulting in a decade of hyper-digitisation from which the tech sector can benefit from.

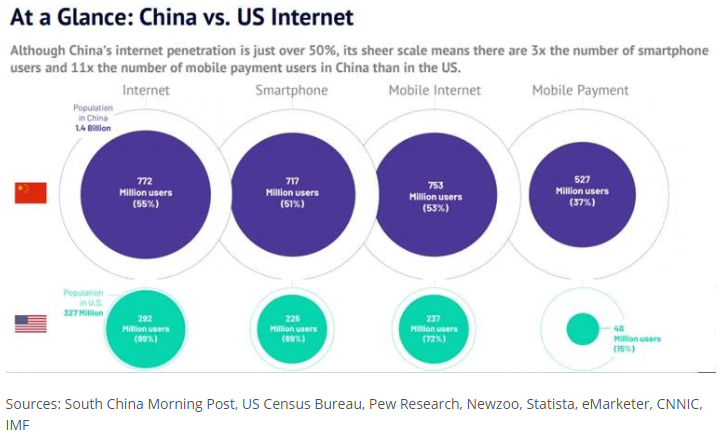

According to the China Internet Network Information Center, China’s online user base has increased to 800 million as at August 2018, double the population of the US – and it still has room to grow. According to Internet World Stats, only 54.6 per cent of the population in China is online compared with 89 per cent in the US.

We expect internet penetration and sector revenues to continue rising in the coming years due to the following:

1. China has a similar proportion of city dwellers as the US did in 1940 with a population approximately five times the size of the US, illustrating that there are still decades of above-average growth and urbanisation to come.

2. According to McKinsey & Company, China’s mobile payments ecosystem is already 11 times larger than the US; as these trends continue to emerge it will be critical for Chinese consumers to be online.

Besides the three tech gaints – Baidu, Alibaba, and Tencent – there is an abundance of technology companies listed on Chinese, Hong Kong and US exchanges who benefit from state support due to Beijing's plans for the Chinese economy as well as demographic trends in the country. But despite government support, these firms operate with entrepreneurial drive in what Baidu's chief scientist described as a “permanent state of war”, driving consistent growth within China’s tech sector.

Top Chinese tech stocks by market capitalisation

Alibaba Group Holding

Tencent Holdings

Baidu Inc.

Hangzhou Hikvision Digital Tec

Netease Inc.

360 Security technology Inc.

Iqiyi Inc.

Hanergy Thin Film Power Group

Focus Media Information technology

Weibo Corp

Eleanor Creagh is Australian markets strategist at Saxo Bank.

Investment insights

APAC deal activity down by 3% in 2025 as China and India offset broader decline

The Asia-Pacific (APAC) region witnessed a moderation in deal activity in 2025, with a 3% decline in the total number of deals announced compared to the previous year. This downturn, encompassing ...Read more

Investment insights

Risk seeking among the noise: institutional investors shift strategies amid market fluctuations

In a landscape marked by evolving market dynamics, institutional investors are demonstrating a cautious yet strategic shift in their investment patterns. The latest State Street Institutional Investor ...Read more

Investment insights

2026 Portfolio Growth: Why Australia’s Savviest Investors Are Pausing Deals and Doubling Down on Operations

After a two-year sugar hit for property returns, multiple signals suggest 2026 is a danger year for buying sprees. Australian investors are being urged to slow acquisitions, protect balance sheets, ...Read more

Investment insights

Investors warn: AI hype is fuelling a bubble in humanoid robotics

The burgeoning field of humanoid robotics, powered by artificial intelligence (AI), is drawing significant investor interest, but experts warn that the hype might be creating a bubble. A recent report ...Read more

Investment insights

Australia emerges as key player in 2025 APAC private equity market

Australia has solidified its position as a significant player in the Asia-Pacific (APAC) private equity market, according to a new analysis by global private markets firm HarbourVest PartnersRead more

Investment insights

Global deal activity declines by 6% amid challenging market conditions, reports GlobalData

In a year marked by economic uncertainty and geopolitical tensions, global deal activity has experienced a notable decline, according to recent findings by GlobalData, a prominent data and analytics ...Read more

Investment insights

Furious five trends set to reshape the investment landscape in 2026

The investment landscape of 2026 is poised for transformation as five key trends, dubbed the "Furious Five" by CMC Markets, are set to dominate and disrupt markets. These trends encompass artificial ...Read more

Investment insights

Investors maintain cautious stance amid data uncertainty

Amidst the backdrop of a US government shutdown and lingering economic uncertainties, investors have adopted a neutral stance, as revealed by the latest State Street Institutional Investor IndicatorsRead more

Investment insights

APAC deal activity down by 3% in 2025 as China and India offset broader decline

The Asia-Pacific (APAC) region witnessed a moderation in deal activity in 2025, with a 3% decline in the total number of deals announced compared to the previous year. This downturn, encompassing ...Read more

Investment insights

Risk seeking among the noise: institutional investors shift strategies amid market fluctuations

In a landscape marked by evolving market dynamics, institutional investors are demonstrating a cautious yet strategic shift in their investment patterns. The latest State Street Institutional Investor ...Read more

Investment insights

2026 Portfolio Growth: Why Australia’s Savviest Investors Are Pausing Deals and Doubling Down on Operations

After a two-year sugar hit for property returns, multiple signals suggest 2026 is a danger year for buying sprees. Australian investors are being urged to slow acquisitions, protect balance sheets, ...Read more

Investment insights

Investors warn: AI hype is fuelling a bubble in humanoid robotics

The burgeoning field of humanoid robotics, powered by artificial intelligence (AI), is drawing significant investor interest, but experts warn that the hype might be creating a bubble. A recent report ...Read more

Investment insights

Australia emerges as key player in 2025 APAC private equity market

Australia has solidified its position as a significant player in the Asia-Pacific (APAC) private equity market, according to a new analysis by global private markets firm HarbourVest PartnersRead more

Investment insights

Global deal activity declines by 6% amid challenging market conditions, reports GlobalData

In a year marked by economic uncertainty and geopolitical tensions, global deal activity has experienced a notable decline, according to recent findings by GlobalData, a prominent data and analytics ...Read more

Investment insights

Furious five trends set to reshape the investment landscape in 2026

The investment landscape of 2026 is poised for transformation as five key trends, dubbed the "Furious Five" by CMC Markets, are set to dominate and disrupt markets. These trends encompass artificial ...Read more

Investment insights

Investors maintain cautious stance amid data uncertainty

Amidst the backdrop of a US government shutdown and lingering economic uncertainties, investors have adopted a neutral stance, as revealed by the latest State Street Institutional Investor IndicatorsRead more