Invest

Fintech startup okoora unlocks over $3 billion in forex savings for businesses

Invest

Fintech startup okoora unlocks over $3 billion in forex savings for businesses

Fintech innovator okoora has announced it has saved customers a monumental amount over $3 billion through international foreign exchange transactions.

Fintech startup okoora unlocks over $3 billion in forex savings for businesses

Fintech innovator okoora has announced it has saved customers a monumental amount over $3 billion through international foreign exchange transactions.

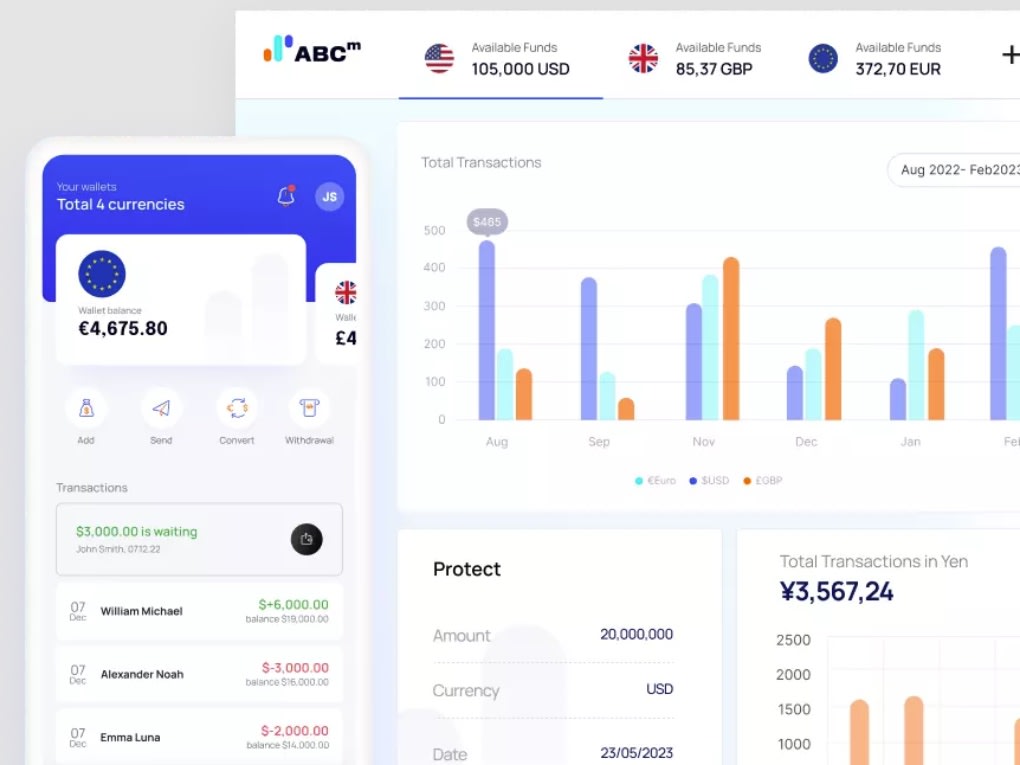

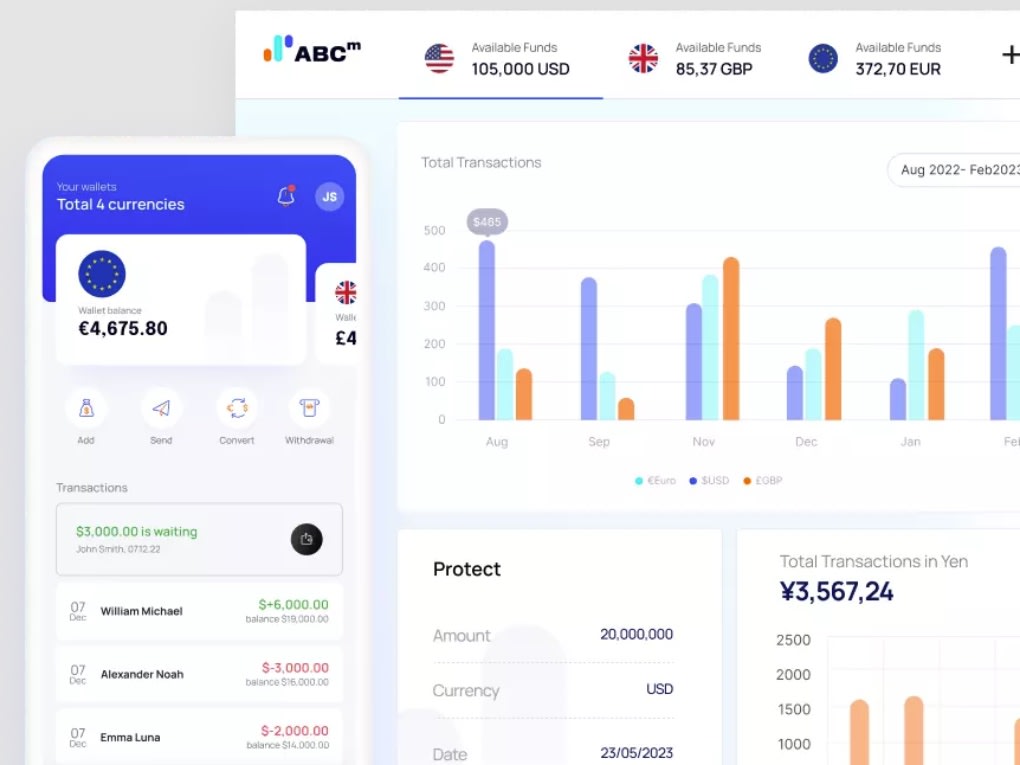

The substantial savings, mainly garnered in 2023, were facilitated by the company's Automated Business Currency Management (ABCM™) integrated cloud platform. This technology manages global payments, transactional banking, and risk management operations.

Established in 2021, the Swiss-Israeli startup reported profitability last year, demonstrating the strong market demand for its AI-powered platform that offers real-time insights into global currency markets. The post-Covid era, marked by increased volatility and complexity in international financial markets, saw okoora's customer base grow by 83% in 2023. Presently, the ABCM platform serves 13,000 registered clients and recorded a 465% rise in payment transactions and a 161% increase in protection transactions in the last year.

In a significant move to establish its presence in the European market, okoora opened a new branch in Limassol, Cyprus, at the end of last year. The company has ambitious plans to expand into two more European countries within the year, with the aim of obtaining licenses for full-scale commercial operations across the 27 EU countries, aiming to assist millions of businesses within this area.

Provided as a cloud-based subscription software-as-a-service solution, the ABCM platform integrates several operational tools, a foreign exchange risk management system, and access to a global network of banks and trading rooms. Okoora has distinguished itself as the first company globally to offer an API in the field of currency risk management.

Recently, okoora introduced new ABCM features including one-click foreign account opening (Payments Account), Payment on Behalf, and Fast Payment in response to customer demands for more effective ways to navigate volatile currency markets. The platform's subscription plans allow customers to open foreign accounts without charge for the initial accounts, with the number of free accounts determined by the subscription plan.

Benjamin Avraham, CEO and founder of okoora, expressed, “The surge in the use of okoora reflects the confidence that businesses have in the platform we’ve developed. Its user-friendly interface and powerful foreign exchange risk management capabilities have saved numerous businesses substantial amounts of money.” He added, “In essence we’ve created a cloud-based solution that enhances the currency exchange and risk management field, simplifying and empowering cross-border operations for businesses across the world. We plan to continue expanding into the European market as the value proposition provided by ABCM ensures our customers can benefit from significant savings and the peace of mind that their foreign currency transactions are optimized.”

Driven by a committed team of 100 professionals across Israel, Switzerland, Germany, Cyprus, and India, okoora is eyeing further expansion into the European market. The company is set to increase its workforce to boost its operational capacity and continue providing exceptional service to its growing list of clients.

Stock market

6K Additive secures A$48 million through initial public offering on the Australian Stock Exchange

6K Additive, a prominent player in the advanced metal powders and alloy additions market, has made a significant stride by successfully completing its Initial Public Offering (IPO) on the Australian ...Read more

Stock market

Institutional investors increase stock allocations to 18-year high amid cautious market shifts

In a recent development, State Street Markets unveiled the findings of its latest State Street Institutional Investor Indicators, revealing intriguing shifts in institutional investor behaviourRead more

Stock market

FOREX.com launches in Australia to empower self-directed traders

StoneX Group Inc. (NASDAQ: SNEX) has announced the Australian launch of FOREX.com, expanding access for self-directed traders to a global suite of Contracts for Difference (CFD) products across ...Read more

Stock market

Westpac and CMC Markets strengthen partnership to enhance online trading services

In a significant move that underscores the evolving landscape of online trading in Australia, CMC Markets Stockbroking has been chosen as the preferred vendor by Westpac Banking Corporation to extend ...Read more

Stock market

Portfolio reviews as an operating discipline: turning volatility into a competitive edge

In a higher-rate, higher-volatility world, portfolio reviews are no longer an annual hygiene task; they’re a core operating rhythm that protects cash flow, unlocks tax alpha, and sharpens risk ...Read more

Stock market

Fee war on the ASX: Global X’s A300 turns up the heat on core Aussie equity ETFs

Global X has lobbed a 0.04% management fee into Australia’s core equity sandbox, launching the Australia 300 ETF (A300) to take on entrenched giants. Read more

Stock market

Challenger IM shakes up the ASX with private credit note and a side of risk

Challenger Investment Management has taken private credit mainstream with an ASX-listed note structure—LiFTs—that secured roughly $100 million in cornerstone commitments within a day of launch. Read more

Stock market

International stocks: Diversifying your portfolio beyond Australia

In an increasingly globalized market, Australian investors have the opportunity to enhance their investment portfolio by incorporating international stocks. Diversifying your investments globally can ...Read more

Stock market

6K Additive secures A$48 million through initial public offering on the Australian Stock Exchange

6K Additive, a prominent player in the advanced metal powders and alloy additions market, has made a significant stride by successfully completing its Initial Public Offering (IPO) on the Australian ...Read more

Stock market

Institutional investors increase stock allocations to 18-year high amid cautious market shifts

In a recent development, State Street Markets unveiled the findings of its latest State Street Institutional Investor Indicators, revealing intriguing shifts in institutional investor behaviourRead more

Stock market

FOREX.com launches in Australia to empower self-directed traders

StoneX Group Inc. (NASDAQ: SNEX) has announced the Australian launch of FOREX.com, expanding access for self-directed traders to a global suite of Contracts for Difference (CFD) products across ...Read more

Stock market

Westpac and CMC Markets strengthen partnership to enhance online trading services

In a significant move that underscores the evolving landscape of online trading in Australia, CMC Markets Stockbroking has been chosen as the preferred vendor by Westpac Banking Corporation to extend ...Read more

Stock market

Portfolio reviews as an operating discipline: turning volatility into a competitive edge

In a higher-rate, higher-volatility world, portfolio reviews are no longer an annual hygiene task; they’re a core operating rhythm that protects cash flow, unlocks tax alpha, and sharpens risk ...Read more

Stock market

Fee war on the ASX: Global X’s A300 turns up the heat on core Aussie equity ETFs

Global X has lobbed a 0.04% management fee into Australia’s core equity sandbox, launching the Australia 300 ETF (A300) to take on entrenched giants. Read more

Stock market

Challenger IM shakes up the ASX with private credit note and a side of risk

Challenger Investment Management has taken private credit mainstream with an ASX-listed note structure—LiFTs—that secured roughly $100 million in cornerstone commitments within a day of launch. Read more

Stock market

International stocks: Diversifying your portfolio beyond Australia

In an increasingly globalized market, Australian investors have the opportunity to enhance their investment portfolio by incorporating international stocks. Diversifying your investments globally can ...Read more